Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

We all think we know how important social media is, and yet social media management is a job that never seems to have enough time and resources. But managing social media is a lot easier with the right tools in hand.

Get ready for a captivating deep-dive into the world of social media management with Brandwatch. We're not just talking about the “what” and “why,” we're handing you the “how-to” on a silver platter.

From understanding its significance to mastering the art of managing your brand's online presence and campaigns, we've got you covered. So, are you ready to turn your social media game from ordinary to extraordinary? Let's ignite this digital adventure!

Continue reading or jump directly to each section.

What is social media management?

Social media management use cases

Key roles and responsibilities in social media management

What does social media management look like day-to-day?

Social media management is the practice of creating, scheduling, analyzing, and curating content across platforms like Twitter, Facebook, Instagram, TikTok, Snapchat, Pinterest, and LinkedIn. This can be done as part of a social media marketing strategy to amplify your brand, improve your online reputation, or engage with your community.

Managing your social media is an essential part of marketing today, even if your brand or business isn’t based online. Social media presence and social strategy are just as important as a physical presence for most brands. This means that tending to the content on your social media channels is the equivalent of creating an enticing window display for a retail store or networking at key events for B2B businesses.

There’s a lot more to it than just making time to post on social media. Although there is a stereotype that social media is an easy task that falls to an intern or junior team member, handling social media for a brand is a complex job involving human understanding, flawless writing, analytical thinking, and incredible organization.

Social media management offers a host of practical use cases that can help organizations use social media platforms more effectively to achieve their business goals. Below are the most common use cases – and some of the reasons why your organization may want to implement social media management. It’s worth noting that each one of these use cases has its own set of objectives and KPIs.

Content plays an important role in the marketing funnel. When content aligns with your brand's objectives and target audience, it can solidify your brand, increase your visibility (better than any other tactic), and impact the bottom line.

Content marketing in social media management involves crafting compelling and valuable content and having a distribution plan in place, ensuring the right type of content goes out to the right audience on the right social platform.

Online reputation is how your brand, products, and services are perceived and talked about by consumers online.

How important is your brand’s online reputation?

Let’s first talk about the value of online reviews. Consider the following stats:

Customer experience is the second-biggest factor impacting online reputation.

We live in a highly connected world where information can spread online quickly. That means that if a consumer has had a negative experience with your brand, other consumers are more likely to find out. So managing your online reputation is vital.

Online reputation management is the process of actively monitoring and shaping how your brand is perceived by consumers online and across social channels. Therefore, online reputation management and social media management are intrinsically connected.

We’ve already mentioned how quickly negative information can spread online. And this is a good segway to talk about the role of crisis management in social media management.

Every organization, regardless of its size or industry, can face a crisis online that can lead to long-term reputational issues and even loss of revenue.

Online crisis management refers to the practice of identifying and strategically handling crises to minimize their impact on the brand’s image and business overall. The practice involves monitoring and analyzing social media channels and conversations for sentiment, feedback, and developing negative narratives, and effectively de-escalating customer concerns.

A recent Hubspot study showed that 90% of social media marketers think that building an active online community is crucial to a successful social media strategy.

Online communities help brands build trust with their customers, and they are a free tool to increase leads and sales.

Social media community management refers to the practice of actively engaging and nurturing online communities related to your brand or organization. It includes building relationships, stimulating conversations, and providing support to your audience through social media platforms.

Online community management is closely connected to social media management, as social media platforms, especially the larger ones, often serve as the primary channels for consumer interactions.

Paid social is about utilizing advertising options on social media channels to achieve specific marketing objectives. Social media advertising helps brands reach wider audiences and different demographics, enhance brand awareness, and boost the brand’s visibility online.

Paid social ads complement organic efforts like social media posting and community engagement, and they help brands maximize the impact of their social media presence.

Brands that run ads on social media could benefit greatly from implementing social media management and paid social media analytics tools to monitor their campaigns, benchmark their efforts, and measure the return on investment.

The social media world today is highly diverse, and different roles in social media may perform completely different functions, each requiring a specific set of skills and knowledge.

Let’s go over the top four areas of focus in social media-related roles.

Content creation is a vital aspect when it comes to managing social media. It involves creating captivating and relevant social media messages that not only resonate with the target audience but also help foster meaningful connections with people.

Through thoughtful posts, brands can showcase their personality, provide valuable information, and drive audience engagement and conversions on social media platforms.

What content creation may look like for different organizations?

A business may have an in-house content manager responsible for assessing and planning what kind of content the company should be creating, publishing, and promoting.

In many companies, content managers stay behind the scenes, working with internal and external content writers, and overseeing the content strategy and all inbound and outbound communications.

Oftentimes, content managers produce a large chunk of content themselves, and in some cases, they serve as the face of the company, frequently appearing in the company’s posts on social.

Besides a content manager, you may encounter titles like “content producer,” “brand ambassador,” and “content creator” – all of whom would be heavily involved in crafting content for social media and beyond. On the latter, specialized content creators are becoming increasingly popular due to their unique expertise and focused skills.

Community management is an equally important area of focus in social media management. While community managers have a lot of cross-over with other key social media stakeholders, it's important to understand their distinct areas of focus.

Community managers are dedicated to cultivating and nurturing an organization’s online community of followers. This role becomes even more important for larger brands, as community managers often handle questions and feedback from the online audience.

Community managers’ tasks involve moderating conversations, facilitating discussions, and improving the community surrounding the brand. They engage with community members through direct messages and comments on social media as well as internal communities, ensuring the brand's voice and values are consistently represented.

At Brandwatch, we have our own Brandwatch Community, where industry professionals from within the Brandwatch network can engage in discussions about social media intelligence, share business cases, expand their network, learn from other industry peers, and find inspiration.

Social data analytics is a hugely important function in social media management that quickly evolved from “nice-to-have” to “need-to-have.”

As data volumes soar, companies are looking to deepen their understanding of their industry landscape, trends, competitors, and consumers. And they prioritize sentiment analysis, brand awareness, and customer satisfaction over vanity social media metrics such as likes, follower count, and impressions.

As a result, data science skills are in high demand among marketing and social media professionals, with many publications, including Forbes, declaring that “all marketers should be data scientists.”

Social data and insights specialists go beyond using traditional social media management tools, engaging in listening and monitoring online conversations using social listening solutions.

You’ll find more on the role of social listening later in the guide.

What does a social media manager do? The focus of social media managers lies in strategic planning. They create and implement a brand's social media strategy, aiming to increase brand awareness, drive website traffic, and generate leads.

A social media manager is also responsible for developing engaging campaigns. In smaller organizations, social media managers tend to wear many hats, from writing social posts and responding to comments online to working on paid campaigns and social ads.

Read more about the popular social media job titles and what those roles entail.

Social media management is certainly not a one-size-fits-all job, and the responsibilities may vary depending on the specifics of the role.

A social media manager’s typical duties include:

The specifics will vary depending on what the company wants from their social media presence and how many resources they have to dedicate to it. For example, an architecture company could have:

There are a number of reasons why brands should formalize how they manage their social media, from time-saving to getting messaging right. Below we’ll go through four of the big ones.

Proper social media management usually means you’ll have a steady stream of content going out on your channels. This means that your followers will find it difficult to forget you exist and will help keep your brand in their minds, even if they don’t interact with your posts every time.

There’s another set of benefits here for non-followers. When we first look up a company, we often Google them. Along with their homepage, their social pages are likely to rank highly too, and plenty of people will check these to get an idea of what the company is about.

Social media channels give you a chance to either reinforce the perception you give off with your homepage or let you focus on more specific areas (such as showing off what a great place your company is to work through Instagram posts).

Regularly updated social channels are also a good way to up your visibility and reassure your audience that you’re still up and running and reachable.

And, speaking of.

Social media allows people to contact companies at the click of a button, particularly through Facebook, Twitter, and Instagram. Whether it’s tagging the company’s handle with a complaint, or chasing up a delivery through a direct message, if these channels are open, you need to be on top of things.

Properly managing social media is essential for this if you get a lot of messages. This means logging interactions, assigning them to staff, and following up on them. This can’t be done well without any preparation, and attempting to do so risks upsetting people.

Social media customer service also means tracking and potentially handling untagged mentions relating to your brand.

Here’s an example: a potentially dissatisfied customer isn’t looking to get a response from the brand; they are simply sharing general opinions or conclusive statements about your brand on social. Keeping an eye on such conversations and jumping in where it makes sense may help brands shift consumer perceptions of the brand for the better, showing consumers that they care.

Along with knowing what customer service queries you get, social media management also means seeing what content gets the most engagement, what people say about it, and what leads to most conversions.

This is all excellent data for understanding your audience and customers. You can then feed this back into your social media strategy to get better results and fine-tune your approach. Just make sure you’re taking notes as you go, or use social analytics tools to get even better insights.

It’s entirely possible to run your social media accounts on the fly, but for companies with multiple launches, initiatives, or campaigns, this is not the best way to go.

By planning in advance, you can work with relevant co-workers to ensure social promotion hits the right marks, that you’re in the know about the launch itself, and you can spend time on creating content in advance.

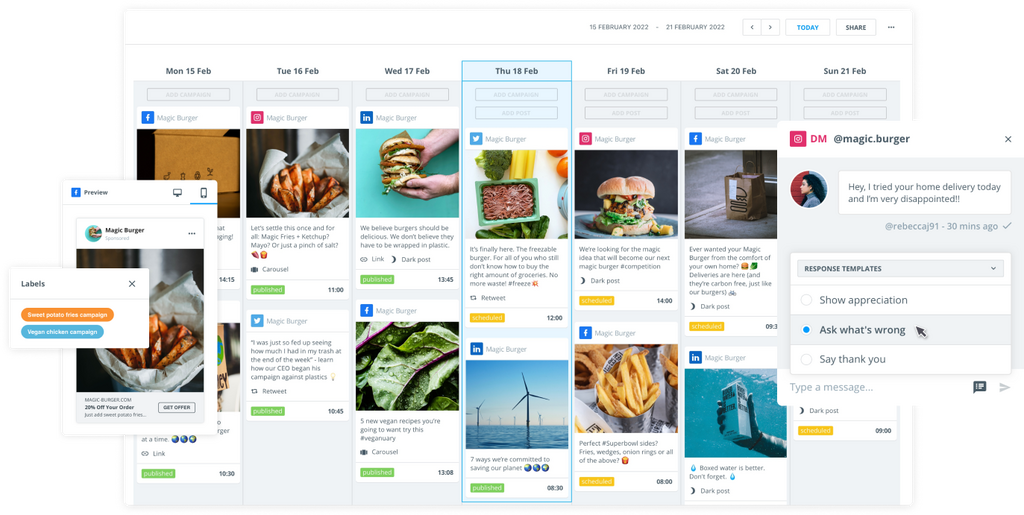

Scheduling social media content ahead of time allows marketers to create a social media calendar that helps with strategic planning, saving marketers time by avoiding last-minute scrambles.

Here are a few tips from the Brandwatch experts and some of our customers:

Your brand doesn't necessarily need to be on every channel. For instance, a design studio can let their work speak for itself on Instagram instead of spending time and resources on creating community on Facebook. Focus on the channels that are going to yield results for your brand and invest time, tools, and resources in them.

Using social media management tools to schedule posts allows social media managers to work proactively rather than reactively. Tools that offer reports on how your brand is doing are particularly useful and provide accountability and prove return on investment (ROI). These are the top social media management tools we recommend taking a look at.

The key is finding the tool that’ll make your social media management efforts more efficient.

Here are five things to consider when looking for a social media management tool:

You can’t measure the results of your work without looking at the performance of your paid and organic social media marketing initiatives. Here’s how to make sure your social media campaigns are driven by data:

Really, social media management is about understanding what your audience wants to see. This is what takes it from another duty to an active part of marketing and brand perception. Dedicating time to deep-dive into the success of your best posts and what your audience is talking about is vital to creating an effective strategy.

Social media and unprompted consumer opinions are a rich source of insights, but only if you know how to get to them.

What can social listening do for your brand? By listening to online conversations, you can:

Don’t know where to get started? Brandwatch Consumer Research can help you understand the big picture.

Creating social media content is a job in itself and needs serious consideration. Often, social media managers have little resources, so user-generated content (UGC) /think Instagram pictures from customers or buzzing hashtags on Twitter) can be a win-win. UGC not only generates engagement but helps your brand appear authentic.

There’s an increasing requirement for brands to engage with their followers on social media, rather than just broadcasting messages. Finding the right way to talk to your followers is more work than it sounds (those analytics might come in handy) but it’s one of the most fun and rewarding parts of the job once you’ve nailed it.

So there you have it, social media management is just as much about the management side as the social media side. If you want to use Brandwatch to improve your social media management, find out more about our suite.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Leverage the industry-leading, all-in-one social media management solution.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.