REPORT

Financial Services in 2020: A Cashless Future for the US?

Our new financial services report looks at how consumers in the US want to store and spend their hard earned money

Understand financial customers: Book a meetingDisruptors are moving in. Technology is expanding the ways we connect. Consumer expectations are increasingly complex. And now a global pandemic is threatening economic jeopardy. Here, we'll take a look at consumer perceptions of the financial services industry in a trying time.

We recently used Brandwatch Qriously to survey thousands of consumers across the globe to find out what they thought of some of the biggest themes in financial services, from mobile banking through to the prospect of a world without cash. We also studied social data, looking at how consumers are beginning to adapt to our new normal.

In this report, we’ll zoom in on US posts and responses to our questions to find out what expectations in the states look like across different demographic groups, and how they compare to the wider world.

We’ll cover how US consumers feel about:

Finally, we’ll be looking ahead, and specifically at the impact of Covid-19 on consumer behavior.

How do US consumers feel about mobile banking?

44% of respondents in the US said they never use mobile banking – a particularly high score compared to those in the other countries we studied.

The top reasons US respondents gave for not using mobile banking more often were down to a dislike of sharing information online or with apps, and a preference for visiting a bank in person.

Compared to other countries, US respondents over-indexed for wanting to visit their bank in person, suggesting that going ‘totally digital’ may not be the right move for banks in the US at this point in time.

The group least interested in visiting a bank in person were those aged 25-54 (18-24-year-olds and those 55+ were more likely to say they prefer to visit in person). This could be for a number of reasons, including that many of the people in this age group work full time and may have care responsibilities.

Banks should make sure to make digital or over-the-phone services well known to those in this age group, since they may be too busy to make it to a local branch.

What do US consumers want from a bank?

We presented our US respondents with a list of services a bank could provide, and asked them to indicate which they’d like most.

Top of the list was credit score advice, followed by a mobile app – interesting when many US respondents say they don’t currently use one.

Breaking preferences down by different demographics, we spotted a few anomalies:

- 18-24-year-olds were most likely to pick ‘budget advice’ as a service they’d like from a bank.

- Respondents under 55 were more likely to say they’d like their bank to have a mobile app than those aged 55+.

- Those aged over 55 were least likely (compared to other age groups) to say they’d like their bank to offer advice on debt.

- The youngest age groups (18-34) were most likely to request spend tracking (e.g. having instant access to stats around how much you spent in restaurants in a month).

- Female respondents were less likely than men to pick ‘Personal investment advice’ as a service they’d like.

Digging into the data in this way can help financial services brands identify the specific needs and preferences of particular consumer groups.

It can also uncover societal disparities in financial confidence/literacy. For example, understanding why women are less interested in personal investment advice could unveil opportunities to empower women to make the most of their money. Meanwhile, helping young consumers with budgeting and spend tracking could be a great way to win these customers.

Perceptions of security

Generally, those in the US are confident in the security of traditional banks.

- Only 7% said traditional banks were ‘not secure’ or ‘not secure at all.’

- Meanwhile, 76% indicated they think traditional banks are ‘secure’ or ‘very secure’.

There is a bit of a disparity between male and female respondents on security. We found that 79% of male respondents said traditional banks were ‘secure’ or ‘very secure’, while only 60% of female respondents selected these options.

Those in the US are more unsure on the security of digital/branchless banks – the disruptors – especially in relation to those in other countries.

More evidence, then, that if digital-only banks want to find success in the US, they’ll have to deal with both security concerns and a general preference for visiting banking branches IRL.

Cash vs card: A cashless future for the US?

When asked ‘Between cash and card, what is your preferred method of payment in a store?’, those in the US are less likely than respondents in other countries to choose ‘card’ and more likely to use ‘cash’. That said, it’s incredibly balanced:

- 38% said card

- 38% said cash

- 25% said they had no preference.

We decided to take a look at what might affect someone’s decision to pay cash or card, by asking which they’d prefer in different scenarios:

How do US consumers prefer to pay? (Cash or card)

| Situation | Preferred method |

|---|---|

| Supermarket | Card |

| Clothing store | Card |

| Restaurant | Card |

| Gas station | Card |

| Bar | Cash |

| Taxi | Cash |

| Public transport | Cash |

| Street market | Cash |

| Charitable donation | Cash |

These preferences change across different countries.

For example, in Singapore, consumers were more likely to use card than cash on public transport and in bars. Meanwhile, in Germany, consumers were more likely to use cash than card in restaurants and at supermarkets.

When we asked global consumers about going cashless altogether, the US was among the countries we studied that were most against the idea.

That said, younger respondents were a lot more neutral on a subject, indicating a potential movement towards less cash use in the future.

Looking ahead, and the impact of Covid-19

Action to stop the spread of Covid-19

Looking at the above data, we’re able to see how US consumers have a unique set of priorities – and within the US there are many different factors that influence them, from age through to the situation someone is in.

The main finding here is that while future generations may be more inclined towards it, the US is not currently ready to go digital-only when it comes to banking services. Nor is it ready to become cashless. In fact, while the idea of these options go down comparatively well in some countries, the US is a long way from accepting them as any kind of norm.

That said, we are in a time of unprecedented behavioral change. We’re already finding that consumers are being urged to shift away from using cash where possible to help stop the spread of Covid-19 as money changes hands.

And with social distancing encouraged, unnecessary in-person bank visits don’t seem like a good idea.

Becoming more reliant on cashless payment and less reliant on face-to-face customer service will be a difficult but necessary change, especially for those in the US.

By looking at the preferences of the different types of consumers above and ensuring those preferences are spoken to, banks can help people get used to our new normal.

Dealing with the fallout

Beyond physical transactions, there is of course more financial institutions can do to aid consumers with the fallout of the Covid-19 epidemic.

For example, financial advice is being sought online by many. We’ve seen a large rise in posts on the subreddit r/PersonalFinance.

Even in early February, people were beginning to think about the potential economic effects of the spread of Coronavirus.

With hundreds of posts on the subreddit a day, the mods have even started a ‘megathread’ in which people can post about their questions and worries.

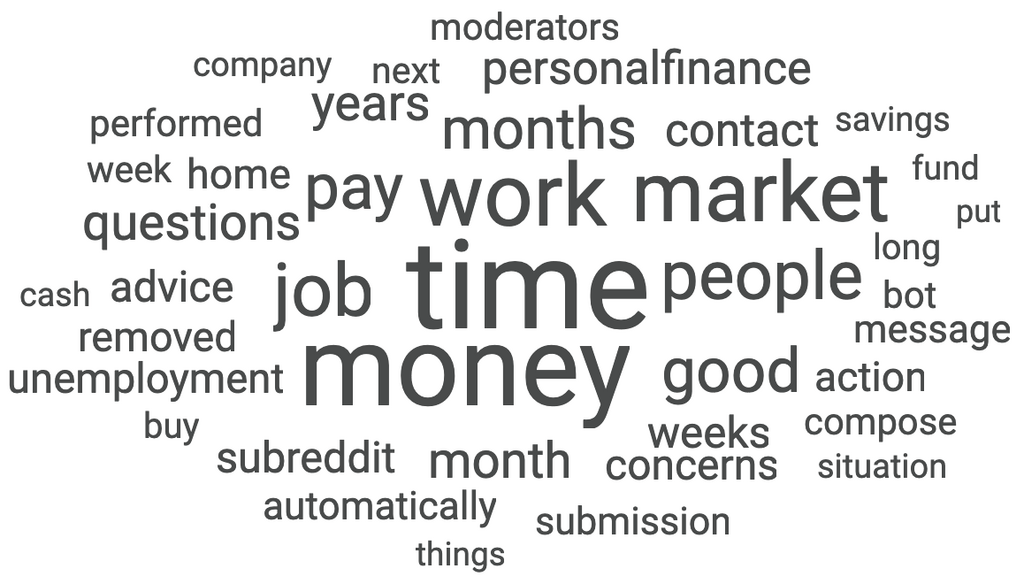

Within the overall subreddit, we’re beginning to see words like ‘unemployment’ and ‘savings’ come through. Here are some of the biggest topics (measured 12-18 March).

Studying what consumers are worried about can help finserv brands craft new offers and campaigns.

And they would do well to track competitors. Positive reactions to initiatives by competing providers could spell an uptick in churn. As card issuers take quick action to help alleviate financial hardship, all financial services players should be looking at rapidly creating and communicating consumer-friendly initiatives.

While the storm will certainly end, customers will always remember how they were treated during this time.

Only the beginning

Of course, we’re only beginning to see what the Covid-19 pandemic has in store for the world of finance and the impacts that it will have on consumers.

Continually evolving tastes and behaviors can be measured with the tools of digital consumer intelligence. To find out more, click the button below to book a meeting with an expert.