REPORT

Spending, Saving, Investing: Consumer Finance Trends for 2024

How have consumer behaviors and preferences changed in the financial services sector?

Get started with BrandwatchThe past few years have been financially challenging for many consumers with rising inflation and struggles with the cost of living.

Consumers are definitely making adjustments, but how has their behavior changed specifically? What trends will we see in 2024 in the financial services sector, and what trends are fading?

In this report, we look at several financial topics to see how consumers think about finances and what brands can learn from these insights.

You'll learn about:

- Consumers use personal finance apps to stay on top of their budget

- Fewer consumers talk about investing in cryptocurrencies

- Loyalty programs are becoming more popular

- I don’t need it, but I want it — the “girl math” trend

How are consumers spending their money?

What are consumers saving for?

Personal finance trends

Consumers use personal finance apps to stay on top of their budget

It's almost cliché to say 'there's an app for everything these days', but there are many apps for personal finance and budgeting, and they are becoming more popular. According to Google Trends, search interest for “finance app” reached its second-highest peak in the past five years in January 2024.

People are also talking more about finance apps online, with conversations increasing 35% from March 1, 2023, to February 29, 2024, compared to the previous 12 months.

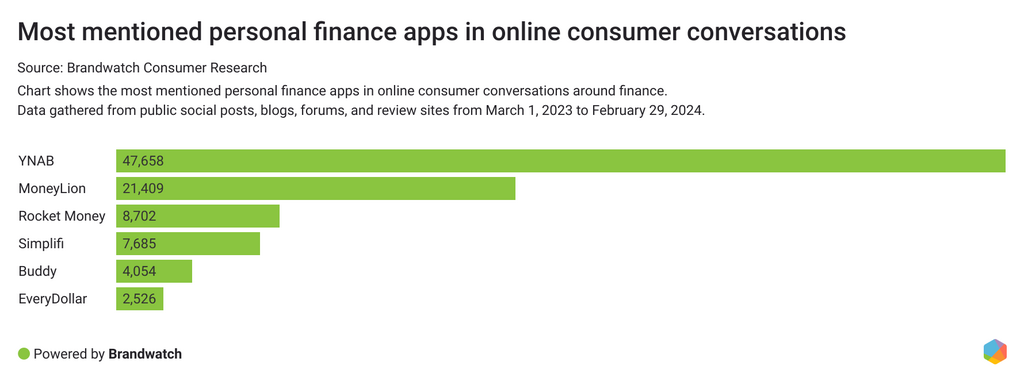

What personal finance apps are popular? In conversations around finance apps, You Need a Budget (YNAB), MoneyLion, and Rocket Money are the top mentioned apps.

The primary emotion people talk about with financial apps is joy, with 45% of emotion-categorized mentions being joyful. Consumers in these conversations praise apps that are free, easy to use, and have useful features.

On the other hand, anger is the second most expressed emotion, with anger making up 38% of all emotion-categorized mentions around financial services apps. Anger is also one of the fastest-growing emotions, with mentions increasing by a third from March 1, 2023 to February 29, 2024 compared to the previous 12 months.

In angry mentions, consumers complain about having to pay a subscription to use the app or to get access to more features. App issues, such as too many ads or features that don't work, are another consumer pain point.

Fewer consumers are talking about investing in cryptocurrencies

Consumers have been less talkative online about investing, with the number of unique authors dropping 3% from March 1, 2023 to February 29, 2024 compared to the previous 12 months. Not only are consumers talking less about investing, they are also talking less positively about the topic, with positive mentions down 20%.

According to the number of unique authors, stocks, real estate, and ETFs are the most discussed types of investments. ETFs are the exception to the rule in terms of how the number of authors discussing it are trending – they have become more popular, with almost a third more authors talking about it.

Crypto in particular has become a less important topic, with the number of people discussing it declining by over 40%. Consumers appear to be less interested in cryptocurrency investments and more interested in ETFs, both in terms of number of authors and how those are trending over time.

A look at generational data reveals some interesting differences:

- Baby boomers are more likely to talk about bonds than other generations.

- Gen X and millennials are more interested in cryptocurrencies than other generations.

- Millennials are more likely to mention ETFs than other generations.

- Gen Z are more interested in stocks than other generations.

Generational data can help brands identify how consumer preferences differ from generation to generation and use these insights to craft targeted messaging. Especially in the financial services sector, it's essential to understand the different financial stages consumers are in and the pain points they face to create content that resonates with them.

Loyalty programs are becoming more popular

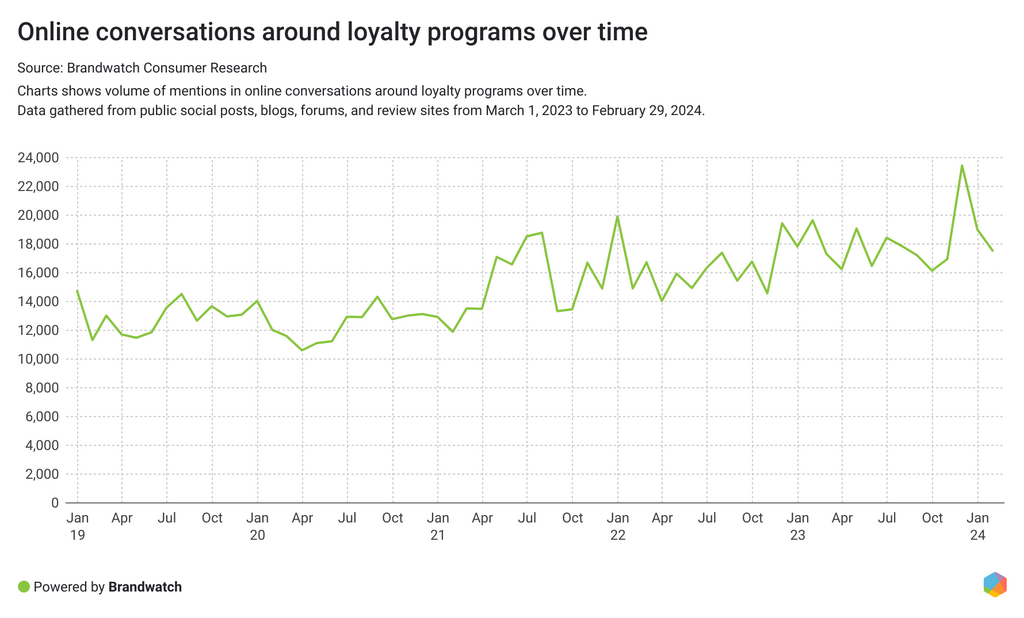

Loyalty programs are nothing new, but as consumers have become more price-conscious in the past few years, loyalty programs are a great way to encourage customers to come back with the promise of savings. And they have become more popular in online conversations lately, with 24% more people talking about the topic leading to 18% more online conversations from March 1, 2023 to February 29, 2024 compared to the previous 12 months.

Millennials discuss loyalty programs more than other financial topics such as spending money, investing, or insurance, suggesting a keen interest from this demographic. Diving into these mentions can reveal valuable insights for brands that are looking for ways to increase loyalty among millennial customers.

More than half of online conversations around loyalty programs are positive, and positive mentions are up 16%. In fact, it's the most positive of all the financial topics we analyzed. In these positive conversations, consumers emphasize that they love rewards programs that give them something back for their loyalty, whether it’s earning bonus points, discounts, or cash back.

Some of the most commonly used words in positive conversations are “love,” “good,” and “happy.” Loyalty programs can help brands not only deepen customer loyalty, but also contribute to a positive customer experience.

A bad experience, on the other hand, can lead to customer frustration – especially as there’s an expectation that loyalty should result in beneficial treatment. In negative conversations, consumers complain about issues with the loyalty program, such as slow app performance, loss of loyalty points after an update, or poor customer service. Brands need to be aware of common pain points so they can improve the customer experience and not risk losing high-value customers instead of deepening the relationship.

I don’t need it, but I want it — the “girl math” trend

We all like to treat ourselves. Whether it's an iced coffee from our favorite coffee shop, a new pair of shoes, or a trip to the movies, we all buy things that make us feel good from time to time. And there's a term that's been trending on social media networks like TikTok and Instagram to describe a very specific approach to these purchases: “girl math.” On TikTok alone, videos about girl math have been viewed 3.2 billion times at the time of writing.

What is girl math? Girl math is used by consumers to describe the reasons they tell themselves and others why they buy products they don't necessarily need.

For example, this user on X describes adding more products to the online shopping cart to get free shipping:

Or this user buys lip balms for different places and occasions:

The tone in posts about girl math is often funny or sarcastic. The most expressed emotion in these online conversations is joy. Over 40% of the mentions around girl math are joyful. Talking about these types of purchases helps consumers feel less bad about spending money, and seeing others sharing the same thought process can be reassuring.

Some consumers admit to sometimes “fooling” themselves into thinking they got products for free when they did not. When they pay cash and their bank balance stays the same, or when they receive products they forgot they’d ordered months ago, “girl math” logic is that these items are basically free.

But not all conversations are light and fun. The second-most expressed emotion in girl math discussions is sadness, with more than a quarter of emotion-categorized mentions being sad.

This mindset can put consumers at a financial disadvantage. Being “broke” is one of the most frequently mentioned topics in sad conversations about girl math. Not only can impulse purchases negatively affect personal finances, but experts say the girl math trend itself can feed into stereotypes that women are bad at finances.

Jumping on internet trends is a great way for brands to be relatable to their target audience and have the chance to go viral. That said, brands that want to repurpose the girl math trend for their marketing efforts should be careful not to promote these negative stereotypes or risk backlash.

How are consumers spending their money?

Spending money is a big topic online. People love to discuss how they spend their money and ask their online communities for advice. We analyzed over 130 million online conversations about spending money from March 1, 2023 to February 29, 2024. Overall, online conversations are down slightly compared to the previous 12 months.

When consumers discuss spending money, they talk more negatively than positively about the topic, with 68% of all sentiment-categorized mentions being negative. Aside from the general negativity of having to spend money to pay bills, these are the top topics of negative conversation around spending money:

- Poor customer service: Customers have trouble reaching customer service, or customer service isn't helpful in solving the problem.

- Payment issues: Customers having issues with payments, subscriptions, and rewards programs.

- Poor quality products: Spending money on products that don't live up to expectations due to poor quality or arriving damaged.

While these online conversations might be talking about spending money, not all of these mentions are relevant to financial services brands. Businesses in general need to be aware of the most common pain points relating to their products and services, especially at the moment of sale, to identify areas for improvement. Brands that ignore these negative conversations risk losing customers and being overtaken by competitors.

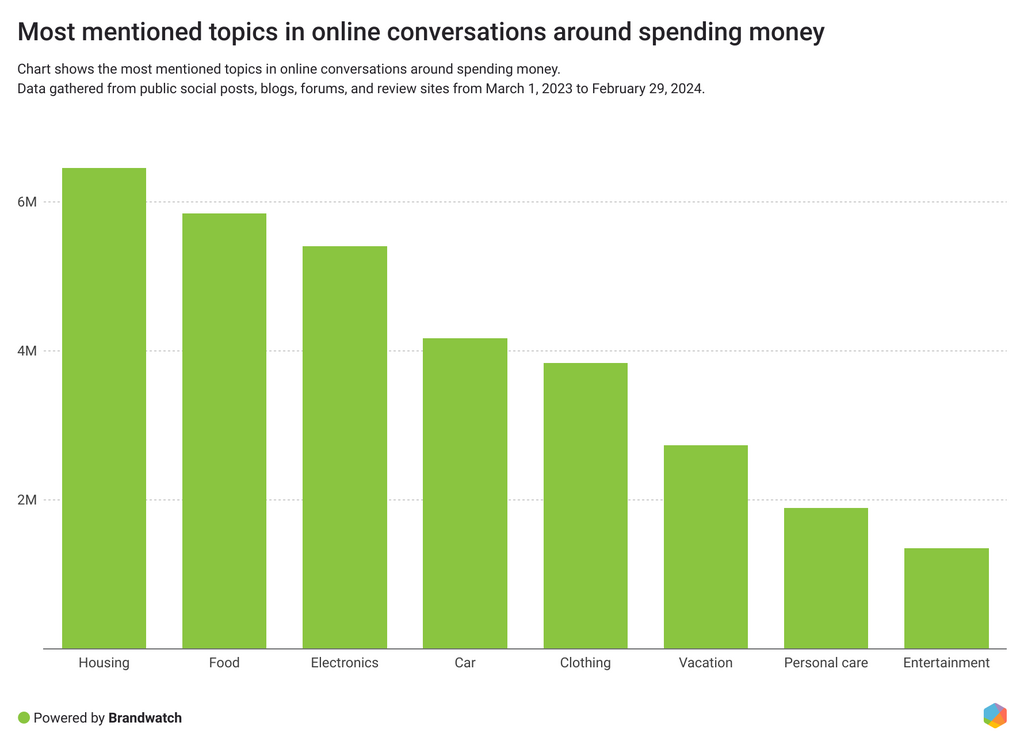

What do consumers spend their money on? We analyzed online conversations about spending and broke them down into the most frequently mentioned topics.

Consumers talk most about spending money on housing, food, and electronics. Cars, clothes, and vacations are also popular topics. Discussions about food, housing, and vacation increased the most from March 1, 2023 to February 29, 2024 compared to the previous 12 months. Consumers are particularly negative about spending money on housing, cars, and electronics, driven mainly by higher prices.

Looking at generational data, there are some interesting differences:

- Baby boomers and Gen X talk more likely about spending money on housing, vacations, and cars than other generations.

- Millennials express more anger on this topic than other generations.

- Gen Z express more sadness than other generations, and they talk more likely about spending money on electronics and entertainment.

Most talked about payment methods

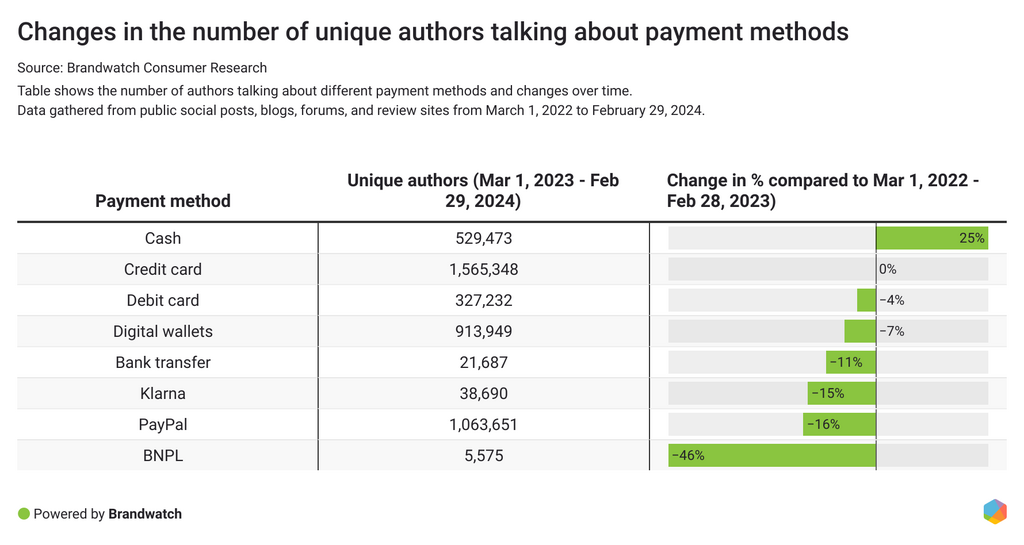

According to online conversations, the most popular payment methods are credit cards, PayPal, and digital wallets.

Most conversations about payment methods decreased or stayed the same, except for cash. Here, mentions increased by 28% and the number of unique authors increased by 25% from March 1, 2023 to February 29, 2024 compared to the previous 12 months.

Mentions of cash also became more negative compared to other payment methods. In negative conversations, consumers complain about not being able to pay with cash in stores. This is a bigger issue for older generations, while Gen Z is the least likely to talk about cash. Gen Z and Millennials are more likely to talk about paying with digital wallets or PayPal.

According to a PYMNTS Intelligence and Adobe study, 70% of consumers say the availability of their preferred payment method influences where they shop. Businesses that offer a variety of payment options have a better chance of winning customers.

What are consumers saving for?

Saving money has become more difficult in the past few years with the rising cost of living, and consumers are talking more about saving money online. Mentions of saving money increased by 7% from March 1, 2023 to February 29, 2024 compared to the previous 12 months. As with most financial topics analyzed in this report, the conversations are predominantly negative, with 76% of sentiment-categorized mentions being negative.

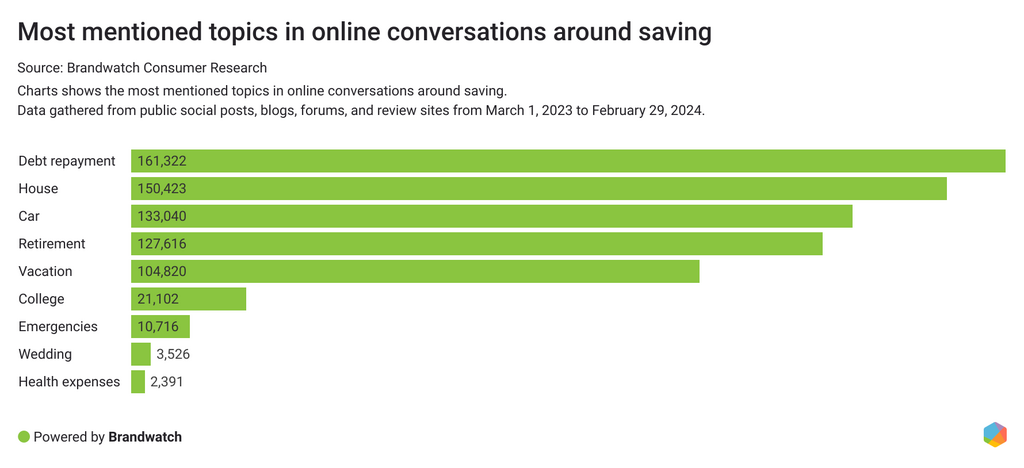

Looking at what consumers are saving for in online conversations reveals why many mentions are negative. At the top of the list is saving money to pay off debt. It comes ahead of saving for a home, a car, and retirement. It's also one of the topics with the highest percentage of negative mentions, with 88% of sentiment-categorized mentions being negative. Mortgages and credit card debt are the most mentioned topics in debt conversations. This isn’t surprising. According to the Federal Reserve Bank of New York, the US mortgage and credit card debt increased by $50 billion and $112 billion, respectively.

Debt repayment conversations are not only very negative, they are also one of the topics in saving conversations that have increased the most with an uptick of 28% more mentions from March 1, 2023 to February 29, 2024 compared to the previous 12 months. The only topic with a higher percentage increase is saving for emergencies, with a 57% increase in mentions.

Another topic that has increased is saving money for vacations, with mentions seeing an uptick of 23%. Consumers talk more positively about saving for vacation than saving for other things, with a third of sentiment-categorized mentions being positive. A look at generations shows that Gen Z talk more likely about saving for vacations than other generations.

The most common consumer pain points with insurance

Insurance may not be the most exciting thing to talk about, but online conversations and the number of authors talking about the topic online are increasing. Mentions are up 8%, with 6% more authors discussing insurance from March 1, 2023 to February 29, 2024 compared to the previous 12 months.

Consumers are turning to the internet for advice when they're having problems with their insurance or are looking for recommendations to find the best insurance provider. “Pay”, “company”, and “questions” are some of the most mentioned words in insurance conversations.

The number one place they go for advice and recommendations is Reddit, with 45% of online mentions we captured posted on this platform. Popular Subreddits include MechanicAdvice, Insurance, and Personalfinance. These Subreddits have hundreds of thousands to millions of members and offer brands a valuable pool of unsolicited consumer opinions. Brands that analyze these conversations can gain valuable insights into their strengths and weaknesses, as well as opportunities to reach new audiences.

Talking about insurance in general is not a positive topic for consumers. According to our analysis, the most commonly expressed emotion in insurance conversations is anger, with more than half of the emotion-categorized mentions being angry. Whether it’s costs, unclear policies, or poor customer service, consumers have a lot of pain points. This is an opportunity for insurance brands to educate their customers with clear and helpful content to reduce frustration and increase customer satisfaction.

Which insurance is most discussed online? Health, car, and life insurance are the most talked about in terms of number of unique authors.

The number of unique authors talking about car insurance increased by 14% between March 1, 2023 and February 29, 2024, compared to the previous 12 months.

Car insurance presents some major pain points for consumers. No other insurance category causes more angry conversations than car insurance. Cost is the main driver of negative conversations. And no wonder. In the US alone, the average cost of full car insurance increased by 26% in 2024.

Another type of insurance that has seen an increase in online conversations is pet insurance. Nearly 146 million households in the US have a pet. Vet bills are one of the most feared financial expenses for pet owners, and pet insurance is becoming an increasingly important topic. Looking at audience data, millennials and Gen Z are more likely to talk about pet insurance than other generations. This is an opportunity for insurance companies to dive into these conversations with helpful content that is targeted towards pet owners.

How different generations talk about retirement

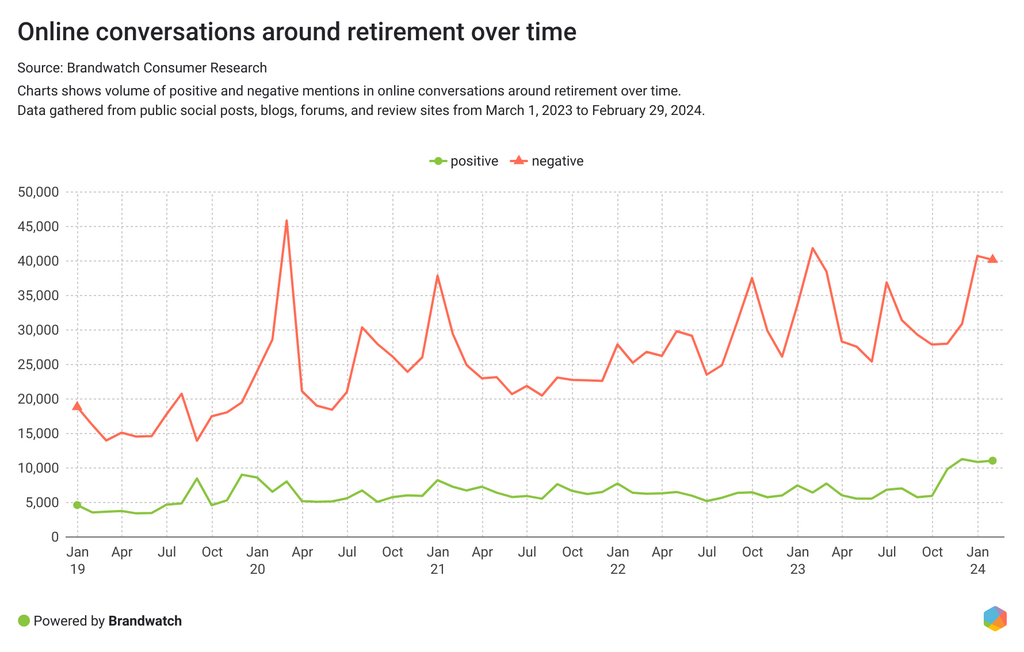

The retirement conversation has changed in 2023. For one, online conversations have increased from March 1, 2023 to February 29, 2024 compared to the previous 12 months, with 4% more authors talking about it, resulting in 10% more total mentions.

Second, discussions about retirement are particularly negative. An overwhelming 80% of sentiment-categorized mentions are negative, compared to 69% negative mentions in conversations around finance in general.

The gap between positive and negative mentions has widened over the years. In negative conversations, consumers worry that they will have to work longer before they can retire, that inflation will erode their retirement savings, and that their pension plan alone will not be enough to retire.

How do different generations talk about retirement? Generations that are closer to retirement, such as baby boomers and Gen X, talk about the topic more negatively than younger generations.

While retirement is a reality for older generations, it's a different story for younger generations, especially Gen Z. They talk less about retirement than other financial topics such as spending or saving money. At the same time, they talk about the topic with more anger and fear than other generations.

According to a McKinsey study, nearly a quarter of Gen Z don't expect to be able to retire. Gen Z's early working years have been marked by rising costs of living and a tough job market, leaving them wondering how much they can save for the future. This mindset may lead to a trend among Gen Z called “soft saving,” which involves living in the moment and saving less for the future.

It's important to understand the different attitudes of consumers at different financial stages in their lives. These insights can help create targeted content. Older generations, for example, will be more interested in concrete tips for making a successful transition from work to retirement. Younger generations, on the other hand, can benefit from content that helps them understand why saving for retirement matters and what options they have at each income level.

Conclusion

Brands need to understand consumer pain points and how preferences differ across consumer groups, such as generations. Companies that stay on top of the latest consumer trends can win consumers and turn them into loyal customers.

The financial sector is changing rapidly, and brands that don't listen to consumers risk being left behind. With consumer research platforms like Brandwatch, brands can analyze consumer conversations in real time and gain valuable insights to improve their marketing strategies.