Case Study

AOL

Consumer insights on the propensity for American-made products

Originally known as America Online, AOL connected over 35 million people to the internet during its early days, becoming a cultural icon and business behemoth. Today, AOL is focused on delivering mobile-centric, data-enhanced and video-rich experiences across an open ecosystem and a global marketplace.

In this case study we explore how AOL used Brandwatch Analytics to reveal consumer insights on the automotive industry that, without social intelligence, would have been missed.

AOL’s continued growth and evolution is the product of nearly a decade of careful cultivation of its internal strengths, coupled with thoughtful acquisitions and integrations with the very best technologies and talents on the market.

As one of the early pioneers of the Internet in the 1990s, AOL provided a dial-up service to millions of Americans, as well as a web portal, e-mail, instant messaging and a web browser following its purchase of Netscape, and at the height of its popularity, purchased the media conglomerate Time Warner in the largest merger in U.S. history.

In 2015 Verizon announced plans to buy AOL in a deal valued at $4.5 billion. At the time of the deal, Tim Armstrong, CEO at AOL commented:

“If you look forward five years, you’re going to be in a space where there are going to be massive, global-scale networks, and there’s no better partner for us to go forward with than Verizon. It’s really not about selling the company today. It’s about setting up for the next five to 10 years.”

How AOL uses social listening

AOL has been working with Brandwatch since 2016. Jacob Chavis is an Analyst on the consumer analytics and research team, based in New York City.

Rather than using social intelligence to monitor its own brand, Jacob uses Brandwatch Analytics to monitor the conversation around its clients’ brands.

We use Brandwatch to get a pulse of the conversation - whether it be around a specific brand or topic - to arm our sales team for upcoming pitches, and also to assist with content ideation for our team at HuffPost.

Recently the sales team at AOL came to Jacob and the consumer analytics and research team to ask them to look into the social chatter and online discussion around the automotive conglomerate Ford.

The insights and information presented back to the sales team at AOL would be used to help Ford identify advertising opportunities for the future. Brandwatch helped the team at AOL discover new opportunities, that without social intelligence, would have been missed.

"A business that makes nothing but money is a poor business."

Henry Ford, founder of Ford Motor Company once said “A business that makes nothing but money is a poor business.” In this statement Ford conveys the idea that it’s important to create organizations that change lives through innovation, and also by creating opportunity and jobs for the American people.

Today, Ford is considered one of the most patriotic brands in the USA.

Strengthening a patriotic brand

Despite operating out of many different countries and producing cars in regions around the world, Ford still sit near the top of the list when it comes to the most “patriotic” brands in the U.S. Ford is above brands including Harley Davidson, Coors, Sam Adams, and Gatorade.

Why does this matter? Because according to a study, consumers are conscious of where a product is made.

AOL used traditional research methods to survey an online panel of over 1,000 internet users.

- 66% reported that they were aware of purchasing a product that’s made in the U.S

- 32% of those consumers decided not to make a purchase because a product was made outside of the U.S.

Brands, like Ford, are undoubtedly aware of these behaviors and it’s evident in how they position themselves in their marketing initiatives.

In September 2016, Ford CEO Mark Fields made the announcement that Ford would move all its small-car production to Mexico from the U.S, citing decreasing profit margins on these vehicles as the reason for moving the production plants. This came as a huge surprise to many, no one though was perhaps more vocal about their disdain for this business move than the then Presidential nominee, Donald Trump.

To think that Ford is moving its small car division is a disgrace. It’s disgraceful. It’s disgraceful that our politicians allow them to get away with it. It really is.

Trump and Ford

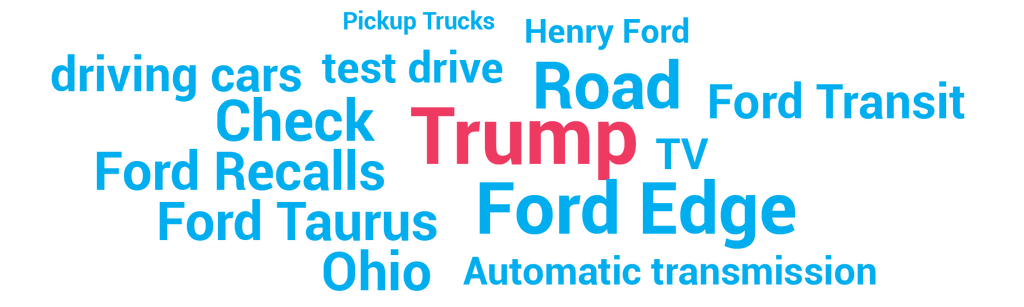

Using Brandwatch Analytics to look back at the online reaction to Ford’s announcement, Trump’s criticism was so loud over the past year that he is the most prevalent topic within all social discussion about the Ford brand.

Meanwhile, sentiment analysis showed that the decision by Ford created a considerable amount of negative sentiment.

Most prevalent topics of conversation

Sentiment over time by day

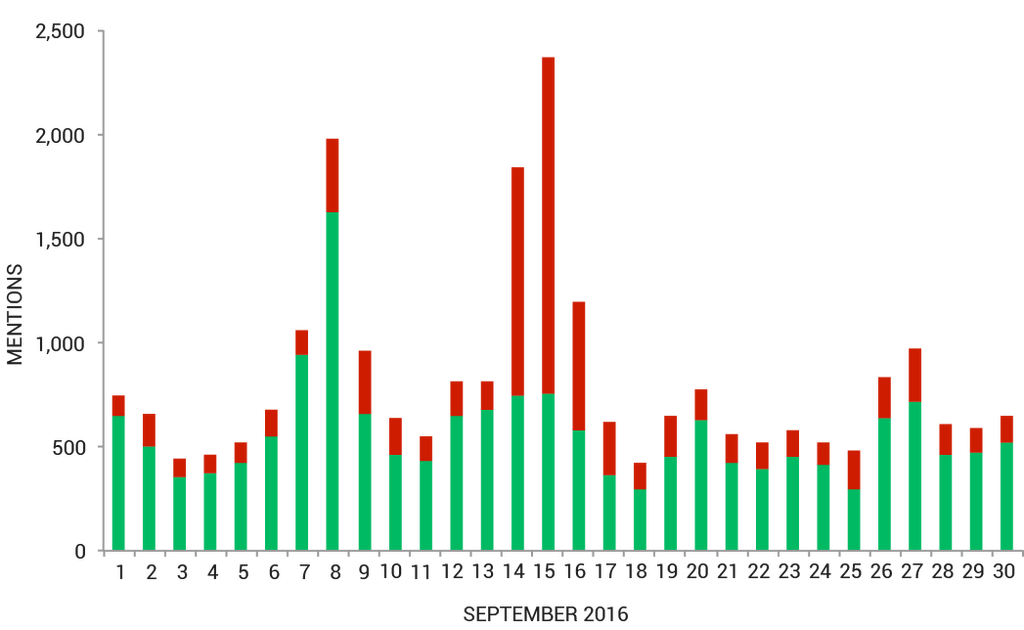

Jacob and the team at AOL were able to see that Ford’s announcement to open the Mexican plant in early 2017 ignited the social conversation.

Mentions over time by day

Analyzing the problem

Using Brandwatch’s powerful segmentation capabilities the team at AOL broke down the online conversation into specific categories and saw that 7% of the conversation around Ford was about production, with over 119,999 mentions from over 85,000 Authors.

To understand the magnitude of this conversation, AOL compared it to Honda’s airbag scandal, which resulted in thousands of recalls, many injuries and even some deaths. That portion of Honda’s social conversation made up only 3% of the entire discussion.

Mentions of production or Trump compared to the rest of the conversation

Pairing social data with other data sets can reveal striking insights. AOL analyzed online conversation around Ford from Brandwatch Analytics alongside Ford’s monthly sales figures.

The data showed that high negative social sentiment in September 2016 was followed with low unit sales in October 2016. Seasonality should be considered, but the 2016 unit sales in October were much lower than the 2015 October sales. This suggests the need for further investigation as Ford’s announcement was likely to have a real impact on sales.

Ford 2016 monthly sales vs. negative sentiment

What do consumers care most about when purchasing a car?

Given the vast criticism Ford received, AOL sought to uncover the importance of buying from a U.S. automaker to consumers.

Nearly 60% of AOL’s online panel stated it was important but only 10% said they would actually pay more for a domestic vehicle.

Trump supporters were much more likely to feel it’s important to them (71%), but similar to the general population, only a low percentage (15%) were willing to a pay a premium for a U.S. made vehicle.

AOL also asked its panel of consumers what top three factors they considered most important when purchasing a vehicle. Fuel efficiency was their top concern, followed by drive performance and safety rating. Whether the vehicle was made domestically was represented in only 5% of the total responses.

The importance of buying a U.S made car

| General population | Donald Trump Voters | |

|---|---|---|

| Buying a vehicle from a U.S manufacturer is very important | 59% | 71% |

| Willing to pay premium on U.S made vehicle | 10% | 15% |

Top factors when purchasing a new vehicle

| Factor | Percentage of people who rated this top |

|---|---|

| Fuel efficiency | 39% |

| Handles well | 35% |

| Safety rating | 32% |

| Good reputation | 30% |

| Budget orientated | 26% |

| Big enough for the family | 21% |

| Made domestically | 5% |

Contrary to popular belief, Japanese-owned manufacturers Toyota and Honda actually produce the most "American-Made" vehicles.

The true American brand

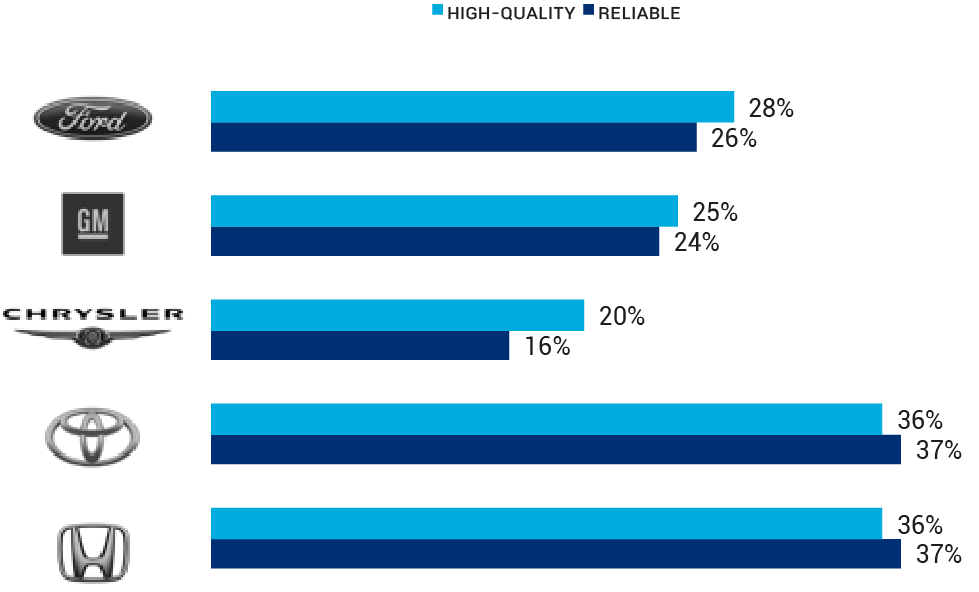

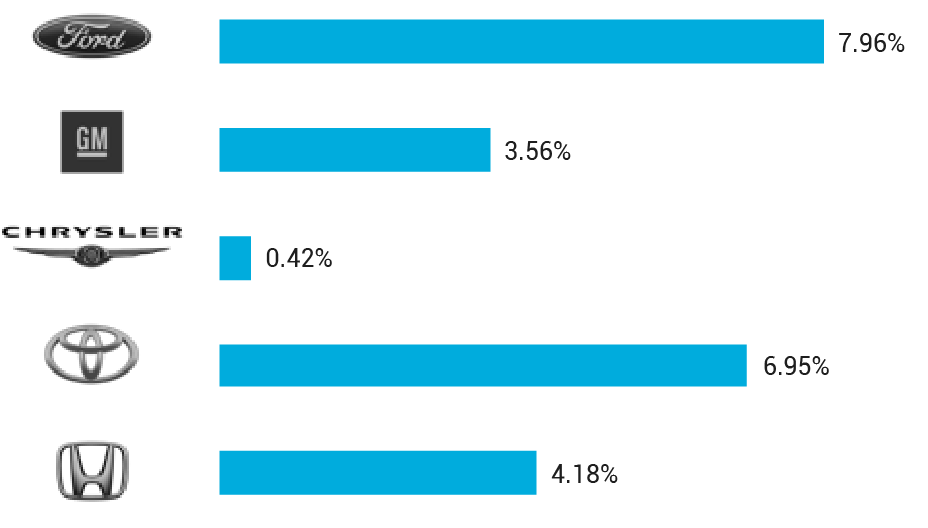

Looking at data from research organizations E-Poll and GFK, AOL saw that consumers perceive Ford as being of lesser quality and less reliable than Toyota and Honda. However, when asked if they were to “make a purchase today, who would they choose?” consumers report being more likely to choose Ford.

What separates Ford from its competitors?

AOL came to the conclusion that although Ford is viewed as being of lesser quality and actually less “American-Made” than Honda and Toyota, it dominates sales due to its perception of being made in America.

Customer perception of auto manufacturers

Likelihood to purchase if making decision today (% of consumers)

Looking back historically

To enrich its research further, AOL used Brandwatch Analytics’ Unlimited Historical Data offering, allowing you to instantly collect three years of historical conversations, making retrospective analysis easy. The benefits of this are it’s:

- Fast: It’s automated, just click and get historical data in seconds.

- Unlimited: No caps on the amount of Queries or mentions you use.

- Economical: Historical mentions don’t count towards your subscription caps.

- Insightful: Mentions include full Brandwatch metadata, such as authors, topic and sentiment, for deep analysis.

Looking back at online conversations from 2014, AOL saw that for consumers in the U.S, ‘American-made’ products are becoming a more prevalent issue. These results were also echoed by AOL’s consumer panel, in which 30% of the panel reported paying more attention to whether a product is made in the U.S. compared to a year ago.

American-made social conversations over time

AOL thought understanding how consumers responded to Trump’s “Buy American & Hire American” executive order in April 2017 might help shape their next steps with the research.

Data from Brandwatch Analytics showed an 80% negative sentiment reaction to the order. Much of the negative response stemmed from the apparent hypocrisy by Trump as evident in the topic cloud.

A more positive reaction would suggest that consumers value having more American-Made products, but as previous data suggests, consumers want the best products at the lowest prices. The origin of a product, trails in importance to the perception of being American-Made.

Topics discussed around the executive order

Key takeaways

AOL conducted extensive research, making use of traditional research methods (surveys) as well as more modern research methods (online conversation). Having access to multiple data sources provided AOL with rich insights that then allowed them to conclude the following;

- Where products are made does impact consumers’ likelihood to purchase, but it’s not the most influential factor

- Data suggests that the perception of being “American-Made” outweighs the product’s actual origin

- U.S. automakers like Ford should continue to take advantage of the reputation they’ve built, while also looking to improve their reputation for quality and reliability

- Foreign-owned automakers could benefit by placing more emphasis on being more “American-Made” than U.S. competitors

- Higher consideration products, with longer purchase cycles, may be less impacted by negative publicity