REPORT

AI-Powered Consumer Insights for the Asia-Pacific Region

Learn about using online data to uncover APAC consumer insights about audience, brand, campaign, and more

See Brandwatch in actionIntroduction

The fast-growing APAC region is a goldmine for consumer brands. For starters, it contains the world’s most populated country, China, along with a range of others where prosperity and access to finance are rapidly increasing. People are willing to spend, and spend big, on all kinds of consumer products, from cars and electronic goods through to financial services.

Major cities in the region, such as Hong Kong, Tokyo, or Seoul, are a paradise for shoppers, offering all the latest global brands as well as a slew of inexpensive goods. Consumer spirit runs high, not just on the ground but also online, where locally founded marketplaces such as Alibaba are going head to head with global giants Amazon and eBay. The APAC region is not only hungry for international brands, but also bursting with homegrown contenders.

If your brand is considering APAC market entry you need to be as knowledgeable as possible about consumer preferences, latest trends, and the competition in the region.

In a fast-moving era where consumers are fickle and reputation is everything, monitoring your brand’s health is critical. That may mean watching audience responses to a freshly launched campaign, or gathering long-term consumer opinion on your brand.

Monitoring brand health is vital for any business, but particularly for those in fast-evolving industries such as CPG or technology, where competition is fierce and consumer attention spans are notoriously short. In the competitive APAC landscape where top-notch homegrown brands jostle with new contenders, you’ll need all the support you can muster.

“If you know the enemy and know yourself, you need not fear the result of a hundred battles.”

Fortunately, the digital world offers the ability to easily get to know your enemy, and your own brand perceptions, before even considering battlefield moves. Marketers can now equip themselves with an effective set of tools to anticipate changes in the fast-evolving consumer landscape.

In APAC, consumers are experiencing heavy growth in internet connectivity, particularly on mobile. That means billions of potential customers are having discussions online day and night.

As a marketer, you can tap into these to discover the latest emerging trends, insights about competitors, and consumer reactions and opinions about your brand or new campaign, along with a whole range of varied insights about your industry and target audience.

Listening to consumer conversations online helps you gain deep insights about their motivations and behaviors, which can help you design more targeted and engaging marketing campaigns. With Digital Consumer Intelligence at your command, you can tap into billions of conversations on various data sources. It’s the ultimate way to know yourself and know your enemy.

In this guide, we’ll give you some ideas for how your brand can get to grips with all aspects of consumer analysis. Using a range of APAC-focused case studies, we’ll explore how leading global brands can better understand the regional consumer landscape and get to know their audience.

Specifically, we will explain three ways that brands can use Digital Consumer Intelligence to improve their business:

- Brand Management – Discover how your brand fares in the eyes of consumers

- Campaign Monitoring – Evaluate campaign success and monitor for flashpoints

- Audience Analysis – Uncover target audience demographics and interests

AI-Powered Brand Management

Comparing APAC consumer opinions of Amazon and Alibaba

Our first chapter opens with a new battle, between two of the world’s ecommerce behemoths. Between them, Alibaba and Amazon account for over a trillion USD in market cap. Both are old hands in their respective markets, having been founded in the 90s and grown in the subsequent decades to become world leaders. So far, the two giants have avoided coming into direct competition with each other by focusing their activities on different geographical regions. But all that’s about to change.

Amazon has already expanded into multiple countries, with a strong foothold in its home turf, the United States, along with most of Europe. It has also launched regionalized websites in APAC locations such as Japan, Australia and now China. This is treading dangerously close to the home turf of Alibaba, whose chairman, Jack Ma, has already announced his intentions to go global. Up until now, Alibaba has mainly focused on dominating China, while also building strong networks of consumers across Southeast Asia. At a critical juncture like this, it’s important for many brands — not just Amazon and Alibaba — to understand what the region’s consumers are saying about them, in order to discover hints of their true potential for becoming the winner in APAC.

As we can see in the below chart, Amazon has dominated consumer share of voice in the region for the last eight years. In contrast, Alibaba has experienced a number of peaks and troughs, with the largest peak coming in 2014. In 2018 to date, share of voice largely favors Amazon, but that doesn’t necessarily mean that Alibaba has fallen out of favor with consumers. After all, consumers could be discussing a brand for negative reasons just as much as positive ones. That’s where sentiment analysis can help to give a clearer picture.

The below sentiment chart shows that the two brands have stayed mostly level with each other in terms of sentiment, with the conversation about Alibaba being a fraction more positive overall than Amazon.

But not all sentiment is created equal. Unearthing the discussion keywords related to each brand reveals a more specific picture of customer sentiment. As these word clouds show, there are some differences between the two brands when it comes to what’s driving conversation volumes.

The first two charts show the positive and negative keywords for Alibaba. Positive keywords mainly revolve around enthusiastic responses (‘great’, ‘amazing’ and ‘love’), along with mentions of Alibaba boss Jack Ma, and China, suggesting that the brand’s local heritage is a strong selling point for consumers. On the other hand, the negative conversation around Alibaba is often concerned with ‘counterfeit’ or ‘fake’ products, along with some mentions of ‘scams’.

Alibaba Positive Sentiment

Alibaba Negative Sentiment

For Amazon, we can see similar results to Alibaba with numerous positive discussion keywords, reflecting a strong sense of consumer enthusiasm about the products and the service Amazon provides.

In contrast, the negative conversation around Amazon is more aggressive than that of Alibaba, full of assorted expletives, many in relation to customer service, delivery and product orders. This explains the slight difference in negative/positive sentiment between Amazon and Alibaba, and should act as a warning sign for the former.

Amazon Positive Sentiment

Amazon Negative Sentiment

The data also shows some encouraging signs that suggest APAC consumers might be happy to accommodate both giants.

Therefore, the rise of Alibaba is just one of the many success stories emerging from China.

AI-Powered Campaign Monitoring

What makes a successful campaign in APAC?

We live in a world of information overload, where consumers are bombarded with marketing messages as well as a sea of online chatter.

Brands need to stand out to be heard, and an attention-grabbing marketing campaign is a good way to achieve this.

Many brands are now resorting to ‘shock marketing tactics’ to reach their target audiences. That’s all well and good, but a certain amount of care and awareness is needed to ensure the campaign doesn’t fall flat on its face, or even worse, stick in consumers’ memories for all the wrong reasons. Poorly timed, tone-deaf, or downright offensive campaigns can do your brand more harm than good, risking your reputation and even your bottom line.

The good news is that advances in technology make things less risky.

Thanks to the power of social analytics combined with AI-Powered Consumer Insights, brands can now track and evaluate audience responses in real-time, even while a campaign is still unfolding.

This gives you the ability to scan the horizon for potential flashpoints and adjust your messaging as necessary, while also being ready to spot and leverage new opportunities as they arise. What’s more, AI-Powered Consumer Insights can even help you predict what sort of marketing efforts might be effective in the future.

By tapping into the billions of online conversations happening around the clock, you can draw out reactions to specific marketing campaigns. This can help you achieve the following objectives:

- Measure campaign success and improve ROI

- Track conversation and engagement to spot new opportunities

- Monitor for flashpoints or potential crises

- Enhance future strategies with deeper understanding of consumer responses

A good way to illustrate campaign analysis is by looking at the fast-moving CPG industry in Asia-Pacific. We’ll focus on two major global French beauty brands, L’Oréal Paris and Lancôme, both of whom have launched significant promotional campaigns in the region over the last three years. Our goal is to discover insights about how consumers responded to those campaigns.

We can see right away that L’Oréal has been more active than Lancôme in terms of launching promotional campaigns in Asia-Pacific.

In May 2015, L’Oréal Paris’s ‘Color Riche by Chopard’ lipstick campaign attracted a lot of hype, causing a major spike in the discussion volume in the run up to the product launch date. Discussion around the product soon returned to normal levels, only to spike again three years later in May 2018 when the lipstick was featured in a popular makeup tutorial. This caused an organic spike even larger than the one around the original launch.

In contrast, Lancôme has launched only one notable campaign over the past four years, when the brand’s ambassadors attended the June 2017 ‘Declaring Happiness’ event in Shanghai. This caused a modest spike in discussion volume, followed by higher-than-normal discussion levels for the remainder of 2017.

Reputation is everything and knowledge is power, so knowing how consumers are responding to your campaign in real time can mean the difference between success and failure. Insights from consumer conversations can offer you the opportunity to boost promising areas of your campaign, or salvage it if things go wrong.

AI-Powered Audience Analysis

Insights about the APAC audience

When it comes to the financial services industry, the Asia-Pacific region has long been a key driver of global growth. According to a report from McKinsey, in 2015, 46% of the industry’s 1.1 trillion USD profits came from the region. This is a massive increase on figures from just a decade earlier (28%). Much of this upturn has been driven by China’s own economic growth. But with China’s economy now beginning to show signs of a slowdown, what’s next for the financial services industry in Asia-Pacific?

One interesting area to look at is consumer transactions, where we can compare older stalwarts like Visa, MasterCard and PayPal with newer contenders such as WeChat Pay. What really matters is what audiences are saying about these brands. Without knowing who you’re selling to and what they want, it’s impossible to succeed for long.

Brands have been analyzing their audiences for decades. In the 21st century, while the principle has stayed the same, the tools have changed. Marketers now have access to a massive volume of online consumer conversations, along with vastly improved tools for extracting insights from these conversations. The power of artificial intelligence has given brands a better way to understand the preferences, demographics, and opinions of their target audiences.

By examining the Asia-Pacific audiences of four major financial services brands, we’ll illustrate the value of AI-Powered Consumer Insights for conducting audience analysis. With audience analysis, brands can gain a better understanding of the following key areas:

- Evolving demographics and personas

- Interests of any target audience

- Major influencers and brands in the conversation

According to this share of voice analysis, PayPal has held its own in the Asia-Pacific region throughout the eight-year period to date. MasterCard is the closest contender, with WeChat Pay and Visa accounting for a mere fraction of the overall conversation volume. Recently, PayPal conversation volume has increased, further biting into the share held by MasterCard.

Exploring audience demographics shows us that consumers over 35 form the largest part of the discussion for all four brands, suggesting that demographic is the main target audience. The second largest age bracket is 17 and under. This may merit further investigation as this group could be just on the cusp of credit card eligibility, and could be a promising new target audience for payment services.

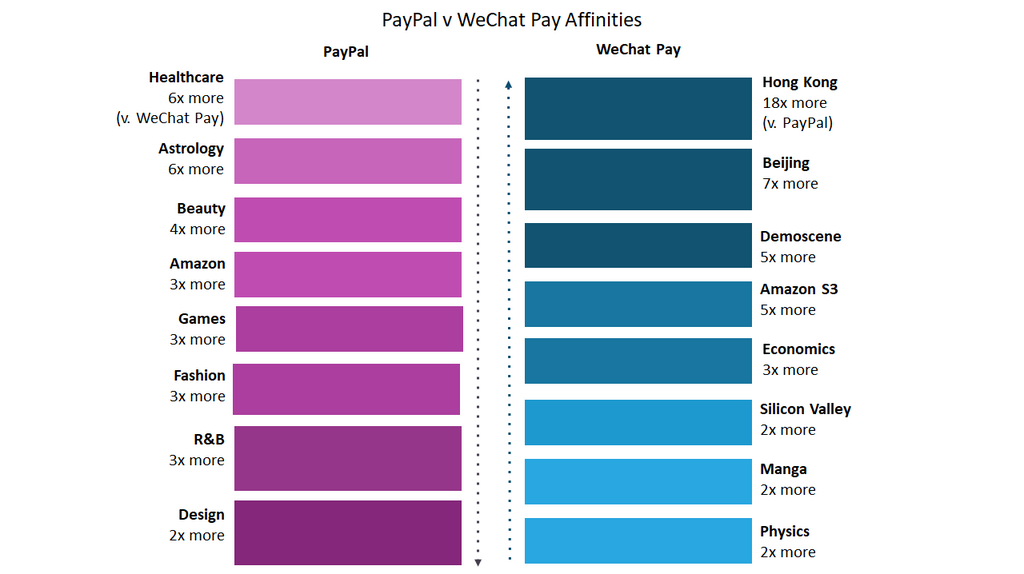

Learning about audience demographics is a valuable way to understand your audience better and uncover new ideas for marketing your brand to them in ways that resonate. Here we can see a stronger association of WeChat audiences coming from the Chinese demographics in Hong Kong and Beijing.

PayPal affinities are broader and a bit more varied, ranging from healthcare and astrology to beauty and design.

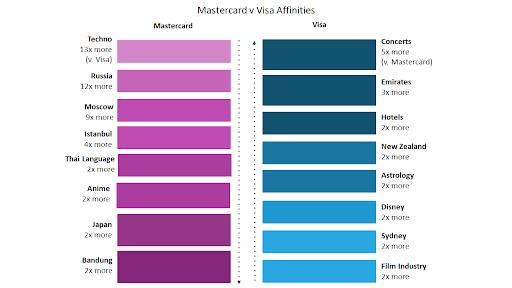

MasterCard and Visa audiences have a completely different set of interests, ranging from a passion for techno and Russia among the former, to concerts and Emirates airlines among the latter. All of these offer interesting angles for brands to explore further, with a view to creating new campaigns or targeting new influencers in these spaces.

Knowing your audience is all well and good, but it’s also important to have a clear idea of potential trends on the horizon. Analyzing conversations among your target audience gives you a better sense of what they’re talking about, revealing their interests – which could affect the future of your brand.

Conclusion

Social media conversations are rich with insights that can help you understand many key areas of consumer opinion.

Combined with AI-Powered Consumer Insights, social media conversations bring unrivalled ability to understand how your brand is faring in relation to its competitors, which new trends might be on the horizon, how consumers are responding to your latest marketing campaign (or that of a competitor), the make up and preferences of your target audience, as well as enabling you to gather a clear picture of real-time customer concerns about your product, helping you to deliver better customer care on the spot.

Combining AI with Digital Consumer Intelligence

Today’s AI is advancing rapidly, becoming more and more powerful. When we apply AI-powered analysis to digital consumer intelligence generated from strategic marketing campaigns, we can grasp their true impact in real time. What’s more, AI-powered analysis can reveal patterns in consumer responses that marketers can leverage, both to adapt ongoing campaigns and create more successful ones in future.