REPORT

Spending, Saving, Investing: Consumer Trends Around Financial Services in 2022

How have conversations and perceptions around the financial services industry changed?

Book a meetingThe financial services industry has faced many changes since the pandemic began.

Consumer spending fell sharply in 2020 when many money-worried consumers simply stopped spending on anything but essentials.

Then, as lockdowns came to an end, and COVID-induced restrictions were lifted, some areas began to see recovery. That said, there’s no linear story to tell – personal financial outlook is very different depending on who you ask.

In this report, we analyze how different consumers are discussing their 2022 finances in public conversations on social media and forums.

For more recent insights, check out the latest version of our Consumer Finance Trends report.

You’ll learn about:

- The payment methods that are seeing growth in consumer interest

- How different generations are discussing spending vs saving

- What’s been trending in conversations about investing, including topics like beginner investors, crypto, and NFTs

Spending

We’ll start by looking at how people have discussed spending money on social media over time.

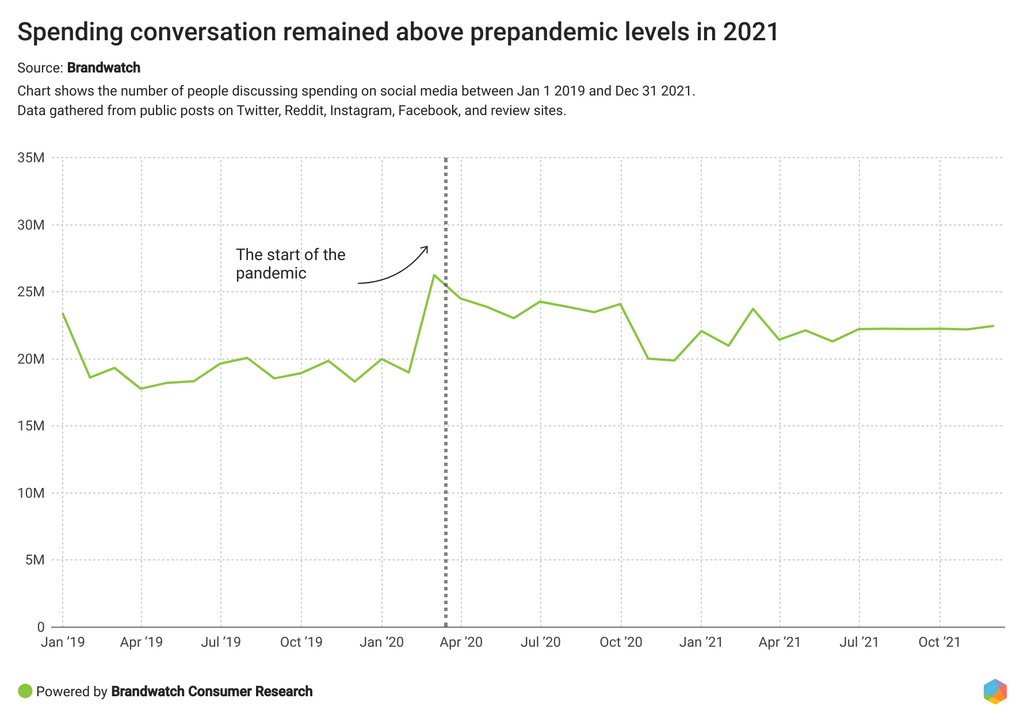

As you can see from the chart below, the volume of conversation around spending in 2021 remained higher than prepandemic levels.

There could be several reasons why spending mentions remained elevated in 2021 specifically.

One could be that, with vaccines becoming more common and restrictions easing for those who are vaccinated, consumers felt more confident about venturing out to bars and restaurants as well as traveling and shopping. A recent analysis by Deloitte confirms that consumer spending was up 2.8% in August 2021 when compared to prepandemic levels.

Another reason could be so-called ‘revenge spending’ behavior, a pattern that emerged in 2021 where, with restrictions lifted, some consumers spend more ‘in revenge’ to make up for the lost time. In fact, it was reported that Americans spent on average $765 more per month in 2021 when compared to 2020.

Our sentiment analysis of the spending conversation revealed that:

- Despite many consumers complaining in conversations around spending money, the number of angry mentions decreased by 9% in 2021 when compared to the previous year

- The spending conversation saw a small increase in joyful mentions, including keywords and phrases like “enjoy spending money”, “love spending”, and “buying things”, suggesting consumers might be regaining a positive attitude towards spending.

- Surprise was expressed 13% more in consumer conversations around spending in 2021 when compared to the previous year, with discussions including words like “first time”, “wow”, and “pay rise”. For some, 2021 represented new-found financial freedom.

It should be said that mentions of spending don’t necessarily correlate with increased spending (otherwise we wouldn’t have seen the aforementioned dip in spending in 2020). That said, consumers are certainly sharing more about their spending habits online – a positive sign for those who wish to study those habits.

Payment methods

The COVID-19 pandemic has accelerated the shift to digital payment, and the pandemic period has seen an expansion in the variety of ways consumers can pay for goods and services (on and offline).

Let’s take a look at the stats around some of the most popularly discussed payment methods in 2021.

We found that while the number of unique authors mentioning PayPal, Cash App, credit cards, and debit cards in conversations about spending were much higher than other payment methods, those numbers had actually fallen when compared to the previous year.

On the other hand, the number of people mentioning “buy now, pay later” grew significantly (181%), along with Klarna, Apple Pay, and Venmo which saw increases of 75.7%, 31.5%, and 8.5% in 2021, respectively.

Consumers are embracing and discussing the merits of alternative and potentially more convenient ways to make digital payments, and businesses need to take note if they’re to create great customer experiences.

Saving

According to Statista, after reaching an all-time high of 33.8% in April 2020, the consumer personal saving rate (calculated as the ratio of personal saving to disposable personal income) in the United States declined in 2021, reaching a low of 7.6% in September.

Social media conversation around saving has also seen a downturn as the pandemic has continued, suggesting a correlation between saving patterns and the amount we talk about saving online.

Brandwatch data also revealed that unique authors talking about savings decreased 4% (from 4.52M to 4.36M) in 2021, and total mentions saw a 12% drop when compared to the previous year.

Looking at broad trends within the data, social conversation around savings in 2021 seemed to display two big themes: some consumers discussed the intricacies of actually saving money, and others stressed the need to live their lives after two years of the pandemic – a choice that tends to come with splashing the cash.

There’s certainly a mixed picture emerging. Let’s look into how different generations discussed spending and saving in 2021 to see if we can shed more light on different attitudes.

Breaking down the spending and saving data by generation

We used Brandwatch’s Ready to Use Social Panels to break down our data by generation, allowing us to get a better sense of perceptions and attitudes towards spending and saving.

How were different generations discussing spending in 2021?

At first glance, baby boomer and Gen X spending conversations seemed to have a common theme – taxes. Both generations discussed tax breaks, tax rate, and how their income tax is spent. ‘Insurance’ was a unique topic that trended in discussions among the baby boomer generation, while Gen X discussed getting kids through college as part of the spending conversation.

Gen X on spending

Millennials, on the other hand, talked about covering everyday costs such as food, paying rent, and spending on care of different kinds, with many expressing concerns over accessibility and affordability.

Gen Z on spending

Unlike the rest, Gen Zers’ conversations included discussing alternative ways of making and spending money including gaming and selling commissioned work on social media. They also suggested different payment plan options.

How did different generations discuss saving in 2021?

What was the baby boomers’ outlook on saving in 2021?

Baby boomer conversations around saving revolved heavily around politics, with many discussing their government and representatives’ actions and efficiency, and how those affect the economy and consumers’ pockets.

How was Gen X discussing saving last year?

Health was one of the topics frequently discussed in conversations by Gen Xers in 2021. The generation, that was born between 1965 and 1980, discussed saving money in the context of covering insurance costs, spending or not spending money on medical care even when it’s needed, and the growing prices for life-saving medications.

Saving long term such as retirement or kids’ college tuition were also widely discussed by this subset of the population.

Lastly, we saw Gen X consumers express concerns in discussions around savings and food, with some discussing eating less to save more – and others mentioning food banks as an option.

Millennials on saving

Unlike boomers, Gen X, and Gen Z, millennials seemed highly engaged in conversations about financial planning. The millennials’ topic cloud is dazzling with hashtags related to spending and personal finance: #financialfreedom, #financialplanning, #millennialwealthplanner, #debtfree, and, finally, #freedom framed those discussions.

Gen Z on saving

Gen Z conversations seemed to evolve around balancing saving with living life.

As you can see, the conversation among Gen Z was populated by keywords like “live”, “time”, and “life”, which gives us a pretty good indication of the financial state of mind of Gen Zers.

The tweet below summarizes it well:

Crypto, NFT, and investing

Investing

In the last two years, many people have rethought how they view work and make a living. Many have found themselves quitting their jobs to improve their well-being as part of the great resignation trend, and some have looked for ways to diversify their income sources – including trends like taking on a second remote full-time job or by throwing themselves into the world of investing.

According to BuzzSumo’s Content Analyzer, 29,241 “how to” posts about investing were published between January 1 2020 and December 31 2021, generating 1,730,242 total engagements.

Just to give you some perspective, between January 1 2018 and December 31 2019 only 15,276 posts were published that together generated 801,536 engagements – that’s nearly twice as many articles published in the last two years (up 91%), generating 116% more engagement!

Using Brandwatch Consumer Research, we discovered that in 2021, 1.74m unique authors voiced their thoughts on investing online – up 58% from 2020.

Let’s explore a trend within this conversation: Casual investing.

The last few years have seen a new wave of investors – those who have been curious about investing for a while but hadn’t had enough courage to try.

With more robo-advised apps and automated investing services available, consumers started feeling a lot more optimistic about their ability to invest and make some profit.

How did consumers discuss engaging in casual and passive investing in 2021?

This is a trend that continues to grow.

Where do people share about their experiences with casual investing?

While Twitter and Reddit were the most popular channels for consumers to talk about this kind of personal investing in 2021, both only grew by 57% and 54% in mention volume respectively when compared to the previous year. That might sound impressive but YouTube, on the other hand, saw whopping 264% growth in casual investment content.

A quick search for the term ‘investing’ using Buzzsumo’s YouTube Content Analyzer revealed thousands of organically posted videos last year alone teaching consumers about investing. They include this video, ‘Online Course on Investing & Trading in Stock Market’ by Varun Malhotra, that has already gained over 5m views since being posted (less than two months before the time of writing).

How did people emote in conversations about casual investing in 2021?

We used automated emotion segmentation in Brandwatch Consumer Research that analyzes and groups conversations by the emotions joy, disgust, sadness, anger, fear, and surprise.

The graph below shows how the use of emotional language in conversations around casual investing has changed in 2021 compared to the previous year.

As seen on the chart, while anger, sadness, disgust, and fear saw a 35%, 31%, 25%, and 21% growth in mention volume, respectively, when compared to the previous year, the emotions of surprise and joy turned out to be the most frequent emotions expressed by users on social in 2021 in conversations about casual investing.

Crypto

The general cryptocurrency conversation has skyrocketed since 2020.

Until very recently, for many consumers, cryptocurrency was synonymous with just one word: bitcoin. However, as reported by Statista the first week of January 2022, the number of cryptocurrencies has reached 9,929 – a 31% increase since the last reported number in November 2021!

While the cryptocurrency market is expected to “more than triple by 2030”, it’s currently believed that the core group of 20 coins constitutes around 99% of the total market by volume.

We analyzed the top 10 cryptocurrencies based on their market capitalization (as of January 2022) to understand how people think of them versus their competitors, the overall sentiment, and their share of voice.

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Tether (USDT)

- Solana (SOL)

- Cardano (ADA)

- U.S. Dollar Coin (USDC)

- XRP (XRP)

- Terra (LUNA)

- Polkadot (DOT)

Share of voice is an important metric which can help brands understand the size of their online presence relative to their competitors over a given timeframe.

We compared the social share of voice of the above 10 crypto brands. Bitcoin’s share of voice was significantly higher than its competitors, estimated at 50% of the total conversation.

A quick glance over 2021 social data also shows that Bitcoin has been generating increasingly more conversation despite the competition. It’s no surprise given that, released in 2009, Bitcoin is widely considered to be the first cryptocurrency.

But from the chart above, you can see that interest in other crypto investment options has been growing with it as well.

Which currencies saw the most growth in conversation in 2021?

Evidently, while Bitcoin (BTC) and Binance Coin (BNB) generated a larger volume of conversation, consumer interest around newer cryptocurrencies has grown, with Solana (SOL) topping the top 10 chart at 34,441% growth in conversation volume when compared to 2020.

What’s unique about Solana?

Solana was released in April 2019, and after less than two years of operation, it is now in the top five largest cryptocurrencies by market cap (valued at $42B as of Jan 2022).

This cryptocurrency is said to offer user-friendly scaling and “gas fees” or fees that users pay to process transactions or contracts. And fair prices and the network’s ability to process transactions fast – potentially faster than any other network today – has helped Solana attract users in large numbers in a short period of time.

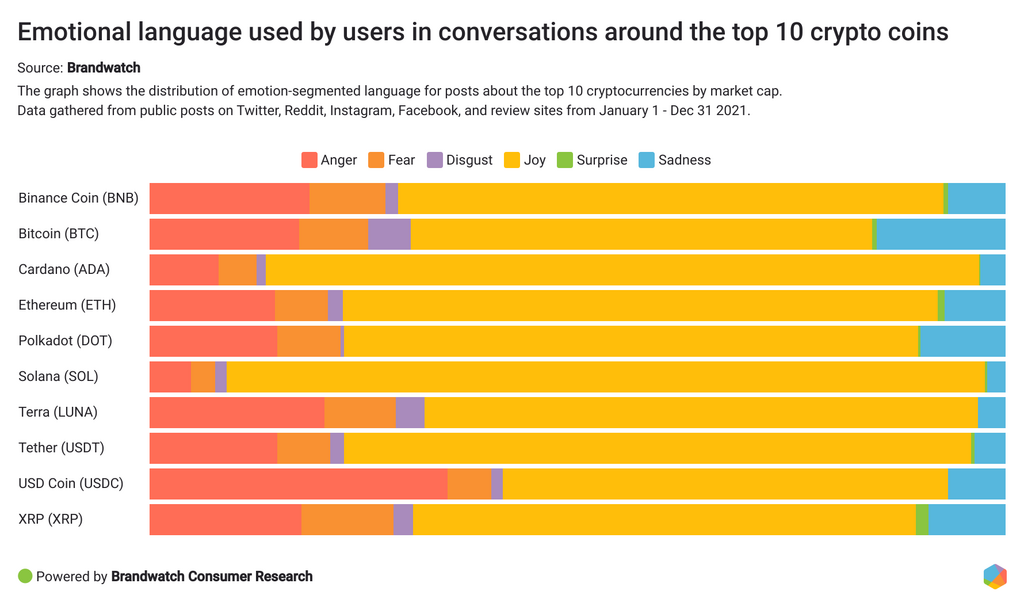

Emotional language in social conversations about the top 10 cryptocurrencies

Sentiment analysis can help brands keep a finger on the pulse of how consumers are feeling generally, but it can also help us understand the public sentiment around specific topics like popular cryptocurrency products.

We looked at sentiment distribution in conversations mentioning the top 10 cryptocurrencies.

Solana and Cardano had the highest percentage of joyful mentions out of the top 10 coins.

Our emotion analysis also revealed that:

- USD Coin had the highest portion of angry mentions and zero surprise mentions

- Bitcoin had the highest portion of sad mentions

- XRP and Binance Coin had the highest portion of mentions expressing fear

Overall, joyful mentions prevailed in conversations around investing across all 10 cryptos in 2021. It seems there’s a lot of optimism surrounding the investing conversation. Until very recently, investing was mostly reserved for a selected few, but with the growth of investment mobile apps, trading is now becoming accessible to the general public, making the idea of getting “rich” or simply diversifying income sources a reality.

NFTs

You’ve likely heard or seen the acronym "NFT" at some point today. They’ve exploded in interest since the pandemic began.

What’s an NFT?

NFT stands for “non-fungible token”, and it allows buyers to purchase ownership of a digital good – a virtual piece of art, for example – in the form of a unique digital token.

What did the NFT conversation look like in 2021?

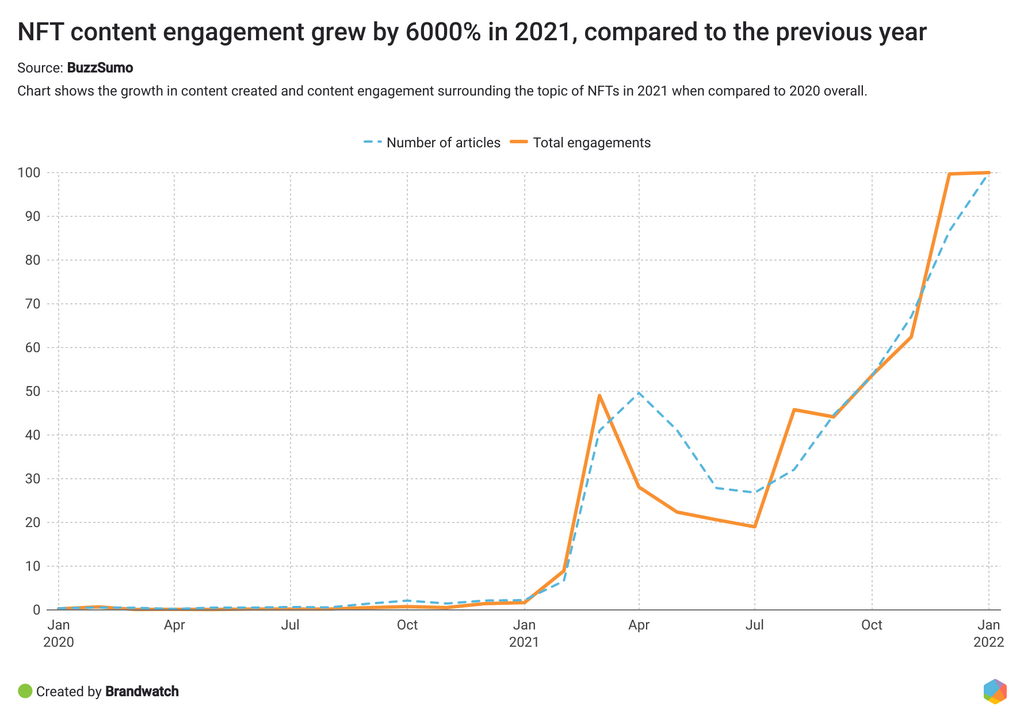

A quick search using Buzzsumo revealed that NFT content engagement grew 6000% in 2021 when compared to the previous year!

And social data from Brandwatch Consumer Research echoed this growth in interest.

Total mentions of NFTs in conversations last year were up by 10660% when compared to 2020 (from 1.48m to 159.15m).

Where did consumers talk about NFTs online?

Our content analysis showed that Twitter saw the most growth in volume of conversation around NFTs, growing by 11,239% compared to 2020.

Our research also revealed that several other platforms have seen a growing interest in NFTs:

- Blogs saw a 8,456% growth

- Reddit – up 8,271%

- YouTube – up 8,101%

- News – up 4,626%

- Tumblr – up 3,127%

- Instagram – up 2,558%

What were the biggest topics in conversations about NFTs?

A topic cloud visualizing consumer discussions around NFTs revealed that topics like NFT giveaways, airdrop, and the NFT community trended in conversations.

The hype around NFTs is huge.

What are NFT giveaways?

Launching anything new without proper promotion can be a missed opportunity. That explains why in order to promote new NFTs, NFT project owners often distribute free tokens as part of their marketing efforts through a process known as NFT ‘Airdrops’.

Experienced crypto investors recommend that people be cautious when accepting free tokens as these marketing airdrops are often used by crypto scammers who place free coins into their victims’ wallets to incentivize them to use phishing websites.

Nevertheless, the hashtag #NFTgiveaway was the 4th most-used hashtag in NFT conversations, and together with its plural form #NFTgiveaways they generated 20,979,444 mentions in 2021.

The NFT community

Communities in general carry a lot of power – they can amplify a message, provide support, and even lucrative business opportunities. And the NFT community is no different.

#NFTcommunity was the third most frequently used hashtag in conversations about non-fungible tokens, generating 24,188,337 mentions.

Members treat the NFT community as the space dedicated for people with shared experiences where they can discuss ideas, projects, and build relevant connections, sometimes coming together for IRL events.

Our analysis of the community hashtag showed mostly positive sentiment with keywords like “support”, “hope”, “love”, “work”, and “project” driving positivity in NFT community discussions.

When your community has got your back, why not share your excitement and accomplishments with them and the world?

Final thoughts:

With more cryptocurrencies emerging, more brands and celebrities across all industries joining the NFT space, and new payment methods being evaluated by consumers, companies can risk missing out on many opportunities because the window closes sooner than they get the information on emerging trends.

Brands need to get equipped with knowledge and tools to help them navigate this fast-paced environment so they don’t get left behind.