REPORT

Food and Beverage Trends Report

What can millions of online conversations tell us about the latest food and beverage trends?

Book a meetingWe analyzed more than 165 million global online conversations to explore current culinary trends, consumer eating and drinking habits, restaurant experiences, and food delivery insights.

The last few years have had a big impact on consumers' eating habits and grocery shopping. Consumers experimented in the kitchen during the pandemic, and food delivery became popular. What trends are staying, and what new trends are emerging in food and drink?

In this report, we cover the following:

How are we talking about food online?

Online conversations around food are on the decline

Compared to last year, people are talking less about food online. From June 1, 2022 to May 31, 2023, mentions are down 16% compared to the previous 12 months. Especially positive mentions are down by a staggering 45%. But with inflation and record-high food prices, it may not be surprising that food is becoming more of a struggle for more consumers.

Disgust is the most prominent emotion in online conversations about food, followed by joy and then anger. Disgust is also the only emotion that has increased; there are 3% more mentions from June 1, 2022 to May 31, 2023 compared to the previous 12 months.

What causes the sentiment of disgust related to food conversations online? Some consumers complain that they can't eat certain foods due to allergies or illnesses or that they've eliminated certain foods from their diets to improve their eating habits. Taste is another significant factor. Consumers express disgust with foods they don't like or share bad experiences with certain products.

On the other hand, consumers enjoy positive experiences and share them online. Some of the most popular positive activities are eating at restaurants, sharing meals with family and friends, or talking about the food at their travel destinations. The most positively discussed meal is brunch. Conversations around brunch have the highest number of positive mentions.

Most-used food emojis

Emoticons are one of the most convenient ways to express your emotions online. As of January 2023, there are 3,363 emoji available, 130 of which are food-related.

Which food emoji is the most popular in online conversations about food and eating?

Top 10 food emojis:

- 🌱 (often referenced in posts about vegan and healthy food)

- 🍕 (used in conversations about ordering and eating pizza, especially in Italy)

- 🍔 (prominent in posts about eating in restaurants)

- 🥗 (often added in conversations surrounding lunch)

- ☕ (this emoji is most popular on Twitter)

- 🍓 (fruit emojis are frequently used in posts about healthy food and lifestyles)

- 🍌 (another healthy lifestyle emoji)

- 🍎 (and another one)

- 🎂 (popular choice when wishing someone a happy birthday, but also used about wedding cakes)

- 🍰 (prominent in posts about eating desserts and breakfast)

The top food emoji in positive conversations is birthday cake, wishing others a happy birthday, or celebrating your own birthday party. A look at generations reveals differences: While the top food emoji for baby boomers is a cup of coffee, it’s steak for Gen X, and a slize of pizza for millennials and Gen Z.

Top food emojis for different languages and locations:

- US: 🍕

- UK: 🍕

- APAC region: 🍰

- French: 🌱

- German: 🌱

- Spanish: 🍕

Instagram post with 🌱 emoji

Top Hashtags

Hashtags are another important means of communication online. They provide a quick glimpse into the post and make it easier for social media users who do not follow the account but are interested in the topic to find the post.

Of the hashtags used in food-related conversations, #vegan is at the very top. The top 10 include hashtags that promote healthy and vegan lifestyles. Interestingly, the second most popular hashtag is travel, a hashtag not directly related to food. It's also the hashtag that grew the most over the period analyzed. The pandemic had an impact here, as consumers obviously weren’t able to travel much in 2021. This changed in 2022, and we can see a lot more social media posts related to food and travel.

Not surprisingly, the top platform for the #travel hashtag is Instagram. When drilling down further, we can see that the most commonly used hashtags in posts using #travel is #pizza, indicating that the most popular food for travelers is made of cheese and ends with ‘za.’ Posts using the #travel hashtag are mostly on Instagram. Looking at the most mentioned locations, the most mentioned places are Italy, Canada, Greece, and the Caribbean islands.

Instagram post about traveling in Italy and eating pizza

What are the most photographed foods?

Speaking of Instagram, visuals are an essential part of food conversations. Who doesn't enjoy looking at a delicious-looking meal? Using our image analytics tool, Image Insights, we analyzed the images posted in online food conversations to see the most photographed foods.

Prepared foods, meats, vegetables, desserts, and baked goods are the most photographed foods. Pictures of prepared foods most often include vegetables, fruit, or salad. Meat dishes most often have fried foods on the side.

Post with a picture of prepared food:

Top food trends

Like all trends, food trends come and go, and social media is increasingly influencing which trends go viral and are picked up and tried by consumers. TikTok plays a bigger role in setting these trends than it did a few years ago.

Food trends that go viral on TikTok don't take long to spread to other social networks. For example, the famous baked feta pasta trend took social media by storm in 2021. On TikTok, baked feta pasta videos were viewed over 213 million times. Videos on YouTube received millions of views, and according to BuzzSumo, nearly 1,550 baked feta pasta articles have been published since 2021, with nearly 1.08 million total engagements. From cloud bread to charcuterie boards to pasta chips, numerous food trends have gone viral on TikTok and we don’t expect anything less in the coming months and years.

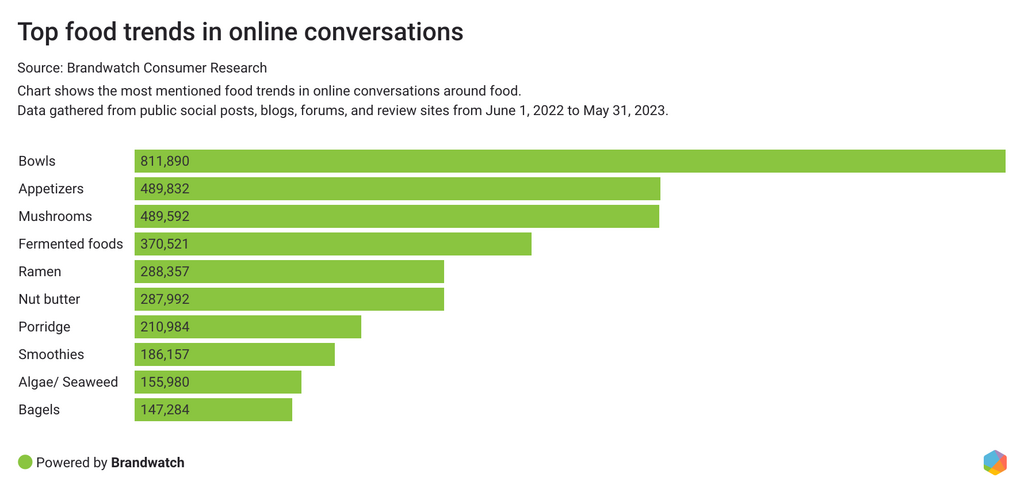

What foods are popular? We looked at the social media conversations.

Bowls are still popular

Aesthetics still play an important role in how tasty we find a dish. So it’s no surprise that bowls lead the list of food trends. With bowls it’s all about aesthetics. Bowls are not a specific type of food but the presentation of food in a bowl. It can be breakfast, lunch, or dinner. They can be sweet or savory. There are smoothie bowls, oatmeal bowls, poke bowls, burrito bowls, or Buddha bowls. The options are endless, which might be why bowls are a food trend that shows no signs of slowing down.

Bowls are most popular for dinner, followed by breakfast. Smoothie bowls, poke bowls, and rice bowls are the most mentioned types of bowls in online conversations.

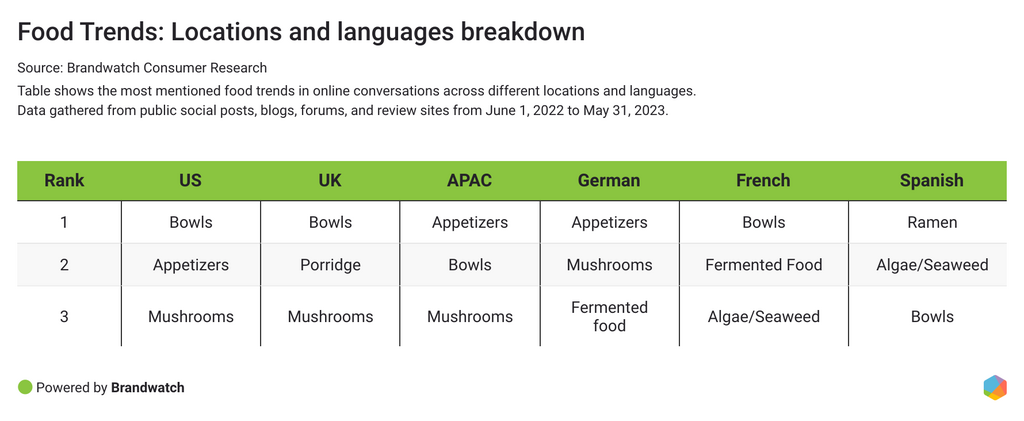

Regional differences in online conversations about food trends

Looking across languages and locations, there are some interesting differences in the way people talk about different food trends:

While bowls are the top food trend in the online conversations of consumers in the US, UK, and French-speaking countries, appetizers are number one in German-speaking and APAC countries. Ramen is a favorite in Spanish-speaking countries, and consumers in the UK talk more about porridge than in other countries, making it the second most discussed food trend in their conversations.

The undying love for Charcuterie boards

Appetizers are the second most talked about food trend after bowls. Appetizers and hors d'oeuvres are popular choices at restaurants and parties. Appetizers are nothing new in the food world, but why are appetizers so popular in consumers' food conversations these days?

The top appetizers mentioned in their online conversations are appetizers with chicken, bread, or cheese. Cheese boards and cheese plates are among the most popular choices. Charcuterie boards were big in 2022 and are still a big trend in 2023.

TikTok videos with the hashtag #charcuterieboard have been viewed 1.6 billion times at the time of writing, and nearly 400k people have talked about charcuterie online in the last year. The subreddit on Reddit has over 38k members that are sharing their charcuterie board ideas.

According to online conversations, these are the most popular foods for charcuterie boards:

- Cheese – 98k mentions

- Vegetables – 40k mentions

- Meat – 22k mentions

- Fruits – 20k mentions

- Desserts – 11k mentions

While online conversations about cheese charcuterie boards have decreased over the past year, mentions of butter boards have increased by over 180%, and dessert boards have increased by 136%. Butter boards feature a variety of butter, often flavored with garlic or herbs, served with bread or crackers. Chocolate is the go-to food for dessert boards. From chocolate-covered fruit to cookies to pralines, there's plenty of variety for those with a sweet tooth.

Instagram post about cheese charcuterie:

Consumers like to be creative with their food presentations. As we saw with the bowl trend above, charcuterie boards are a visually stunning way to serve food. And consumers don't seem to be getting tired of them. Although one tweet points out that the charcuterie hype has gone too far when people are using the word charcuterie for foods that don't fall into that category, like desserts or vegetables.

Mushrooms, the all-rounder

Mushrooms are an important part of a healthy diet, which is also seen in online conversations where consumers talk about mushrooms as part of vegan dishes or in combination with chicken, potatoes, or rice. Oyster mushrooms are a popular meat substitute, and enoki mushrooms are popular on TikTok, especially in mukbang videos (people eating large amounts of foods) or ASMR videos that feature the sound of chewing, chopping, and crunching mushrooms.

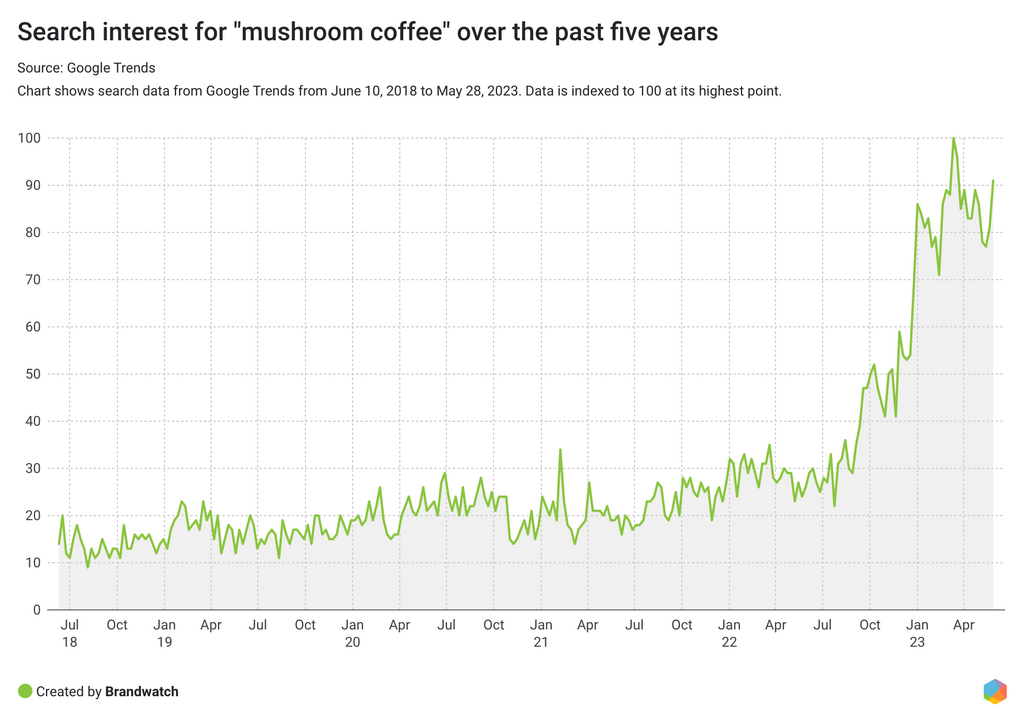

Another trend that has recently gained traction is mushroom coffee. Consumers are switching from regular coffee to mushroom coffee to try something new or for health benefits. According to Google Trends, search interest in mushroom coffee increased in late 2022 and reached a 5-year high in March 2023.

TikTok videos about mushroom coffee have been viewed 37 million times (as of June 2023). The number of people talking about mushroom coffee online increased by 35% from June 1, 2022 to May 31, 2023, with a 44% increase in mentions compared to the previous 12 months.

With 52% of sentiment-categorized mentions being positive and 48% negative, the topic is polarizing. In positive conversations, consumers say they drink mushroom coffee for health reasons or to reduce their caffeine intake while still wanting an energy boost. Not all consumers appreciate the taste, which is also a prominent topic in negative conversations. Others say that mushroom coffee has nothing to do with coffee and that the name is misleading.

As we will see later with the latest beverage trends, consumers like to experiment and try new things, and mushroom coffee is an alternative for consumers who want to reduce their coffee intake, either because they want to be less addicted to caffeine or because they experience stomach problems after drinking regular coffee. It's hard to say if this trend will stick or fade quickly, but it's a hot topic right now.

Fermentate, fermentate, fermentate

Like bowls, fermentation is a food trend that has been around for a few years. During the pandemic, consumers experimented with sourdough (which is obviously also fermented) and since then, healthy lifestyle enthusiasts have sworn by kefir and kombucha. Online conversations around fermentation are seeing the resurgence of longstanding fermented foods like sauerkraut and kimchi along with entirely new dishes. Last year, for example, pickled garlic took off with #pickledgarlic TikTok videos getting over 309 million views.

In online conversations about fermentation, ‘pickles,’ ‘kimchi,’ and ‘sourdough’ are the three most talked about. A new trend that has recently gained traction is gochujang, which is a Korean chili paste made from fermented soybeans. The popularity of K-pop and Korean movies and TV shows has also fueled the popularity of Korean cuisine, and dishes like bibimbap (mixed rice with veggies) or tteokbokki (spicy rice cakes) are spreading outside of Korea.

According to Google Trends, search interest in gochujang reached a 5-year high in April 2023, and U.S. sales of rice cakes used in tteokbokki increased by 450% in the past year. Already, the number of people talking about gochujang online has increased by 18% since the beginning of this year. Joy is the number one emotion expressed in these conversations. Common phrases used in joyful mentions of gochujang are "delicious," "amazing," or "love.” Consumers enjoy trying traditional Korean dishes or experimenting with infusing chili paste into other cuisines.

According to online conversations, people most love stirring their gochujang into rice, chicken, garlic, kimchi, sesame oil, and tofu. Using gochujang in pasta or BBQ sauce or to punch up soups are some popular examples of how consumers adapt the thick, sticky condiment to their cuisine. There's even a gochujang caramel cookie recipe that's gone viral.

Consumers love to experiment in the kitchen, and gochujang allows them to add a kick and depth of flavor to their dishes. We're likely to see more experimentation like this going forward.

Top beverage trends

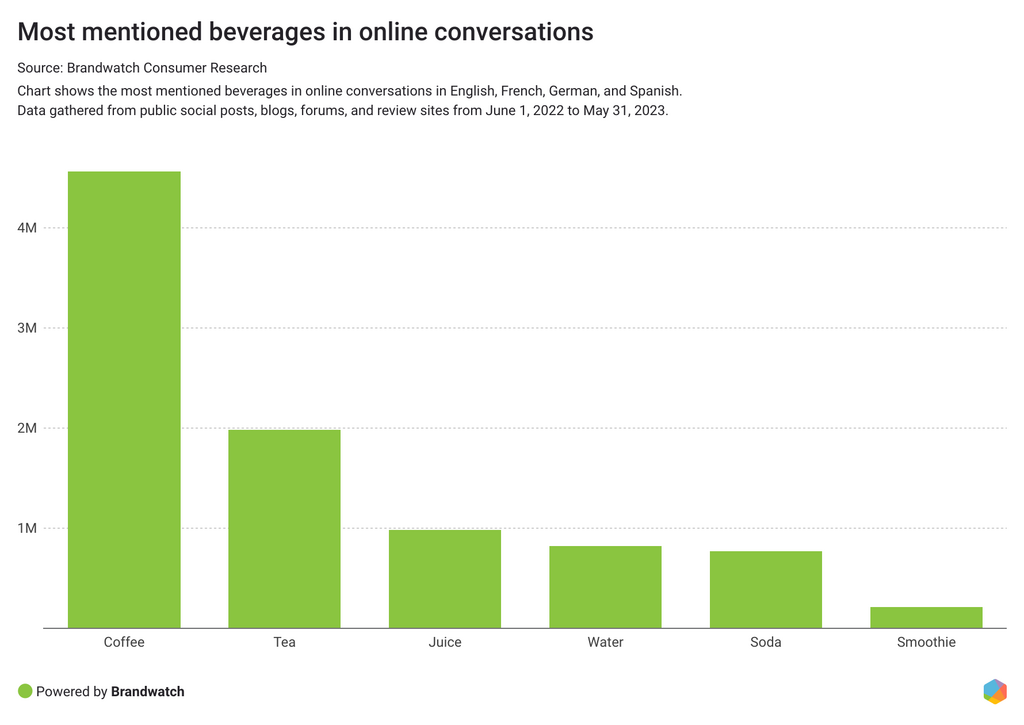

What is trending in the world of beverages? In online conversations about non-alcoholic beverages, coffee is by far the most talked about beverage. Tea and juice come in second and third.

Coffee, along with hot chocolate, is also the beverage talked about with the most joy. In these joyful conversations, consumers associate a good morning and a pleasant start to the day with a cup of coffee.

Generational differences in coffee drinking

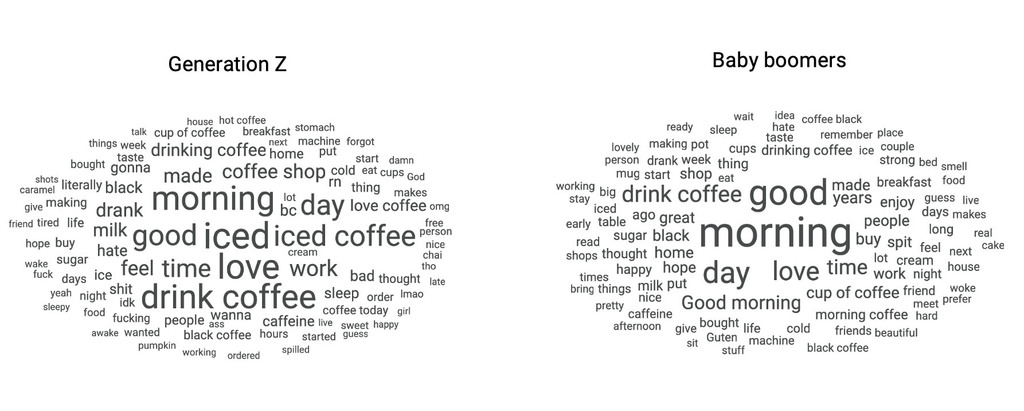

Coffee is not equally popular across all generations. While the coffee conversation has the highest percentage of mentions from Baby Boomers and Gen X, it also has the lowest percentage of Gen Z mentions of all beverages analyzed. In a YouGov survey, 46% of UK Gen Z consumers said they never drink coffee at home or at work, compared to 31% of Gen X and 24% of Baby Boomers.

Baby Boomers talk about drinking their coffee black or adding sugar or milk. Gen Z prefers iced coffee instead, and they are more likely to talk about visiting coffee shops. They also talk about the topic much more negatively than Baby Boomers. 50% of Gen Z’s sentiment-categorized coffee mentions are negative, while only 31% of Baby Boomer’s coffee conversations are negative. Gen Z is more likely to talk about how they hate coffee or how they have trouble sleeping and therefore need to drink coffee in the morning.

The popularity of energy drinks

Energy drinks have been around for a while. Still, the number of people talking about energy drinks online increased by 18% from June 1, 2022, to May 31, 2022, compared to the previous 12 months. Search interest in energy drinks reached a five-year high in July 2022. After a dip, interest has been on the rise again since early 2023.

Gen Z is particularly interested in energy drinks. Next after bubble tea, energy drinks have the highest percentage of Gen Z mentions of all the non-alcoholic beverages analyzed. 51% of bubble tea generational mentions are from Gen Z, followed by 43% for energy drinks.

It's important to note that conversations about energy drinks tend to have a predominantly negative tone. In fact, approximately 44% of all discussions surrounding energy drinks are negative. Furthermore, compared to other beverages analyzed, energy drinks stand out with the highest percentage of angry mentions, accounting for 21% of emotionally categorized discussions expressing anger. This begs the question: what are the factors contributing to this frustration?

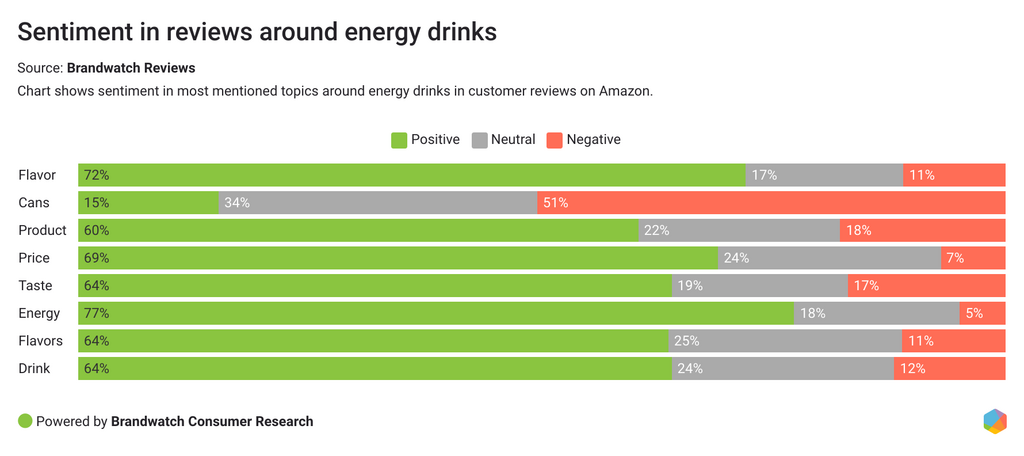

To better understand what consumers like and don't like about energy drinks, we analyzed consumer reviews of popular energy drinks using Brandwatch Reviews.

Consumers praise energy drinks when they’re expectations are met or exceeded. Other positive topics include taste and price. Interestingly, reviews that mention "cans" are over 50% negative. Consumers who mention cans in their reviews complain about poor packaging and cans being damaged during shipping. Others say that the box of cans they ordered wasn't worth the money. Negative experiences with shipping and damaged products can drive consumers to other brands and discourage other consumers from buying.

The flavored water hype

Drinking plenty of water is no secret to a healthy lifestyle, but plain water can get boring. So it's no surprise that there's a new TikTok trend going around: Water of the Day.

Videos with the hashtag #WaterTok share "water recipes" for flavored, zero-calorie water to boost your water intake. People are mixing powders and syrups in their big jugs to create drinks like "birthday cake" or "mermaid water," and these videos have been viewed nearly 380 million times. Search interest for water and flavoring hit a five-year high in mid-April 2023, according to Google Trends.

Obviously, the water conversation online isn’t all about lemon infused mermaid drinks and hydrating electrolyte mixes. With 53% of all emotionally categorized mentions around water expressing disgust, conversations about water have the highest percentage of disgust mentions of all non-alcoholic beverages analyzed. This emotion is driven by a number of things. Some people complain about not having access to clean drinking water. Others mention water in conversations about illness, specifically, that they need to drink more water, or that they recommend others to do so. Another group says they have trouble drinking enough water because they either forget or don't like the taste of plain water.

Adding flavors can help people who struggle to drink enough water and make it more interesting without switching to carbonated sugar drinks. And consumers are interested. Online discussions about flavored water have increased by 20% in the last 12 months. Consumers are sharing their ideas on how to add flavor to their daily water intake by adding juice, fruit, or syrup. According to online conversations, the most popular flavors are lemon, strawberry, orange, and coconut.

While the Watertok trend has consumers discussing the healthfulness of syrup packets and the misuse of flavored water itself, the trend of adding flavor to your water doesn't have to be with artificial ingredients, as one Twitter user points out:

The sober-curious movement

Younger generations are drinking less alcohol for a number of reasons, including health concerns, to save money, and a shift in perception that people don't need to rely on alcohol to have fun at a party. According to Nielsen UK, alcohol sales in the UK fell by 9% in 2022 compared to 2021, and sales of non-alcoholic or low-alcohol drinks rose by 3%.

Especially in Western countries, a good chunk of Generation Z is transitioning to sobriety, and the trend shows no signs of slowing down anytime soon. More and more celebrities are expanding their beverage brands to include non-alcoholic alternatives such as energy drinks and mocktails.

The number of people talking about mocktails online increased by 14% from June 1, 2022 to May 31, 2023 compared to the previous 12 months.

The most popular days for drinking mocktails are Fridays. On average, online conversations about mocktails occur most frequently on this day of the week.

According to online conversations, these are the three most popular mocktail versions:

- Mojitos, with 3.6k mentions

- Margaritas, with - 2.5k mentions

- Martinis, with 1.6k mentions

Overall, the conversations are overwhelmingly positive. 74% of mentions categorized by sentiment are positive. In those conversations, consumers talk about drinking mocktails at restaurants or parties as part of their vegan diet, they praise the taste, and some praise having more non-alcoholic options to choose from events and restaurants.

In the negative conversations, consumers fittingly criticize the limited options for non-alcoholic cocktails or they are displeased with the taste. Other consumers complain about the price tag of mocktails being almost as high as regular cocktails. This represents an opportunity for beverage brands to offer a greater variety of mocktails at reasonable prices to attract sober consumers.

In terms of regional differences, the mocktail conversations increased in all regions analyzed except in the UK and APAC region. Here, online conversations and the number of people talking about the topic decreased. However, APAC and the UK are the regions that talk most positively about mocktails (83% and 82% of mentions, respectively, are positive mentions). In comparison, Spain and the US are the least positive about non-alcoholic beverages (65% and 69% of mentions are positive).

The meal situation in 2023

Gen Z and millennials love to snack

Dinner is the most popular meal in food conversations. And following dinner, breakfast and lunch are the second and third most popular meals. Globally, there are some differences in meal conversations. While dinner is the number one meal in food conversations overall, German-speaking people talk the most about breakfast, and Spanish-speaking people post the most about lunch.

As the online food conversations in general have decreased, all meal conversations have slowed down. Except for one: The snack conversation. Mentions of snacks remain at the same level. Gen Z and millennials talk about snacks more often than Gen X and Baby Boomers.

Snacking increased during the pandemic. Probably because staying home meant getting bored and therefore being more easily tempted. In a 2020 survey, 88% of consumers said they snacked more or the same amount as before the pandemic. How has snacking evolved?

Consumers are talking less positively about snacking. Positive mentions of snacking have decreased by 10%. Gen Z is not only talking more about snacking than Gen X and Baby Boomers, but they are also talking more negatively about snacking. 42% of all sentiment-categorized mentions from Gen Z around snacking are negative. In negative conversations, consumers talk about trying to snack less, snacking healthier, and craving certain types of food.

When consumers talk positively about snacking, they say they love snacks and how delicious they are. They say they snack at home or at work, and the most common foods mentioned in snacking conversations are fruit, cheese, and vegan options.

Millennials: The brunch generation

Millennials love brunch. No other generation talks about brunch as much online as millennials. A whopping 56% of generation-categorized mentions around brunch come from millennials. And that may not be surprising since millennials are the generation that made brunch popular – and they know it.

Brunch is also the meal that people talk about most positively. 64% of emotionally categorized brunch mentions are happy. Millennials love going out for brunch, enjoying bottomless brunch specials, or hosting brunch at home with family and friends. When they have a great restaurant experience, they are eager to share the excellent service and great food online.

Popular brunch foods include chicken, waffles, pancakes, eggs, French toast, and various cheeses. In terms of drinks, mimosa is the most popular brunch cocktail. The location with the most brunch conversation is New York.

Grocery delivery is here to stay

Grocery delivery boomed in 2020 as many consumers turned to delivery services due to the pandemic. Especially in March and April, when the first COVID-19 restrictions were implemented in many countries, people went online to click their groceries home. Since then, physical stores have reopened and the shopping experience has returned to normal, but not all consumers are giving up the convenience of having their groceries delivered at their doorstep.

According to Kantar, 12.6% of UK grocery sales were made online in March 2022, which is 4.6% more than in 2019. Consumers over the age of 65, in particular, continue to shop online, accounting for 18% in March 2022, up from 9% three years ago. So online grocery shopping is here to stay. While the number of people talking about online grocery delivery from June 1, 2022 to May 31, 2023 is down slightly (by 4% from the previous 12 months), it's still at a higher level than pre-pandemic.

In online conversations, consumers talk about ordering groceries online because they don’t feel they have enough time to go shopping. Work is a big part of the conversations, and they say that delivery services make their lives easier. But money is one of the main topics in the negative conversations. Higher prices and increases in delivery fees are a pain point for many consumers, and price sensitive consumers are rethinking their shopping habits.

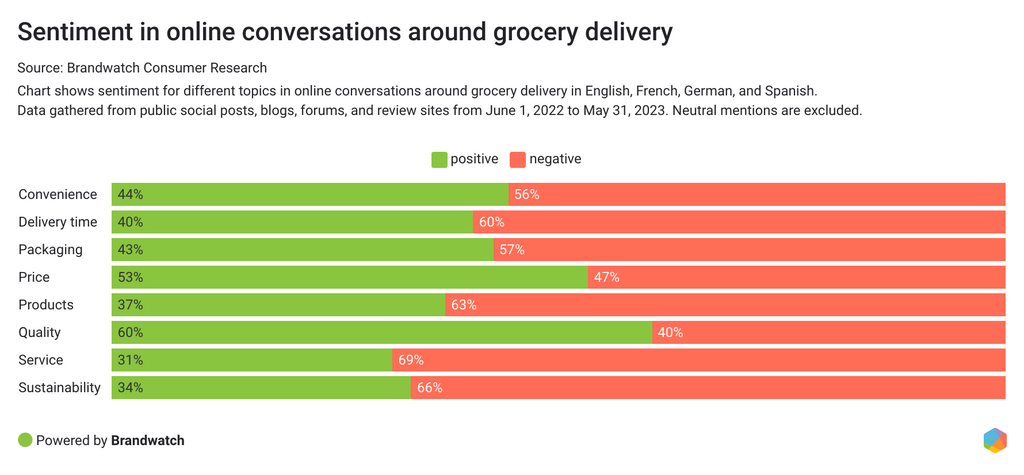

In the grocery delivery conversations, consumers talk most about service, price, and products. A breakdown of the consumer conversations by region shows that French-speaking consumers and consumers from the UK and the US are more likely to talk about quality than other regions analyzed. German-speaking consumers are more likely to discuss sustainability, ranking third after price and products.

Service and sustainability were both among the most negatively discussed topics, followed by products and delivery time. Late delivery is a pain point for customers. If the service is generally poor, or if people have trouble getting help from customer service, they will go online and talk about their bad experiences. Delivery companies need to make sure they provide excellent customer experiences to keep their customers in a tough economic time.

When brands get it right, consumers are eager to praise brands and point out the quality of products and services. While for some consumers, the limited variety of products compared to big stores can be a drawback; others prefer not being overwhelmed by too many choices.

Consumer insights on restaurant habits

Positive restaurant experiences are on the decline

Restaurants faced tough times during the pandemic and lockdowns, and after the restrictions were lifted, consumers were reluctant to return. Now, with exploding energy prices and rising inflation, restaurants are facing yet another round of challenges. As customers adjust and rethink their spending, dining out is considered an unnecessary luxury for more and more consumers. In a survey by the National Restaurant Association, only 16% of U.S. restaurant owners expect to make higher profits in 2023, and 50% say they expect to make less money than in 2022.

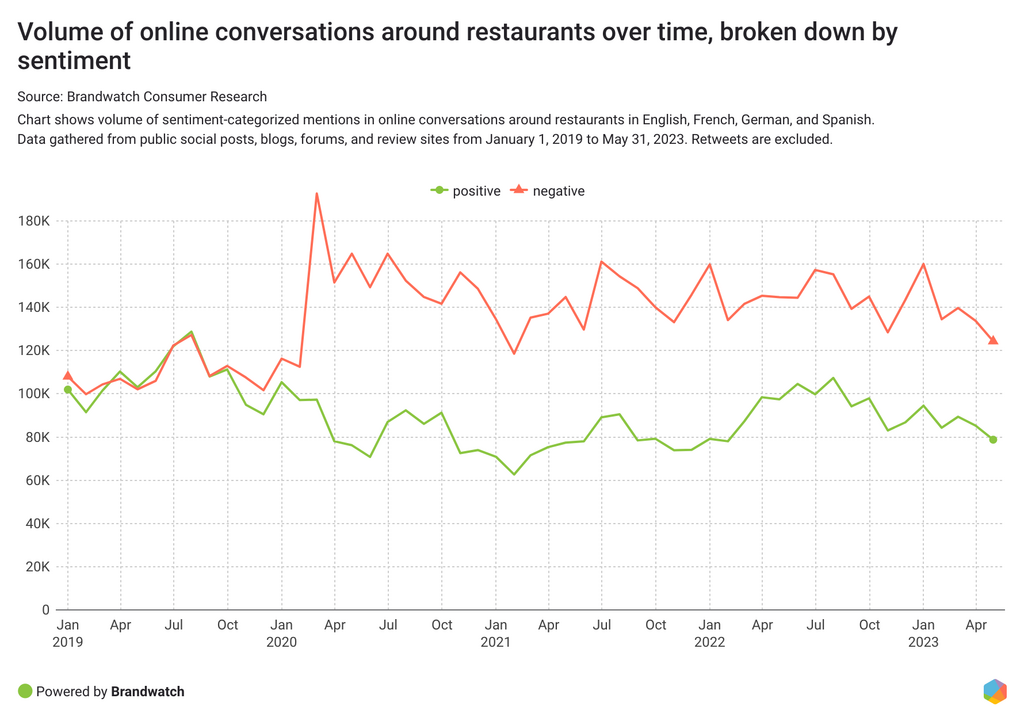

Online conversations about restaurants and dining out from June 1, 2022 to May 31, 2023 declined by 33% compared to the previous 12 months. Looking at the sentiment, positive mentions decreased even more. Over the same period, positive mentions decreased by nearly 50%. At the beginning of the pandemic, the gap between negative and positive mentions widened, and while it narrowed in 2022, it's still a huge difference compared to 2019.

Higher prices play a significant role in negative conversations. Consumers say that eating out is too expensive or that they expect better food and service for their money. Time was another issue in negative conversations. Waiting too long for their order doesn't make consumers happy. In these mentions, consumers also talked about trying a new restaurant for the first time or eating out after a long time and how disappointing their experience was.

But restaurants that manage to meet their guests’ high expectations can look forward to customers going online to talk about their positive experiences. Delicious food is the most frequently cited, followed by good service, prime location, and a nice atmosphere. As consumers become more price-sensitive, they expect a certain level of quality for the higher prices they pay. Restaurant brands need to ensure they are providing quality food and excellent service to keep customers happy.

The rise of solo dining

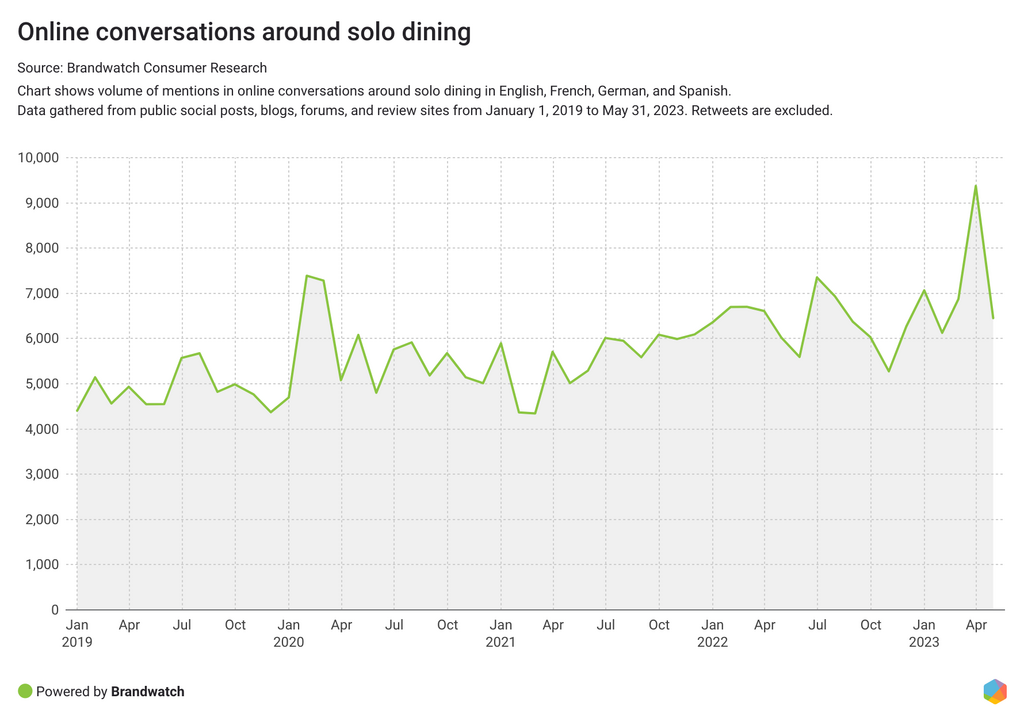

Solo dining is on the rise. Eating out alone – whether for business or pleasure – is something consumers are becoming increasingly more comfortable with. This trend is also influenced by Korean culture. More and more people in Korea are living alone and embracing the single life. The trend is called honjok, which covers doing activities that are usually done with others alone, such as going out to restaurants. Korean culture has become quite popular in Western countries lately, so it's no wonder that certain lifestyle trends are also becoming more popular.

From June 1, 2022 to May 31, 2023, the number of people talking online about eating alone and eating solo increased by 7% compared to the previous 12 months, and the number of online mentions increased by 9%. Looking at different regions, there are some differences: While the number of German- and French-speaking people talking about eating alone has increased, fewer people in APAC countries are talking about the topic.

In positive conversations, people talk about their positive experiences eating alone in a restaurant and the benefits of going out alone, such as not being forced to socialize or being able to leave whenever they want.

Others have a less positive experience, adding to the negative conversations that they feel awkward and uncomfortable eating alone in a restaurant or are unsure where to sit if the restaurant doesn't have a bar. In fact, negative mentions of solo dining increased by 24%, indicating that the experience of solo dining doesn’t live up to the expectations.

Restaurant brands can make consumers more comfortable by offering tables for one person to enhance the solo dining experience. Considering that consumers are increasingly concerned about their finances when dining out, the experience should be excellent.

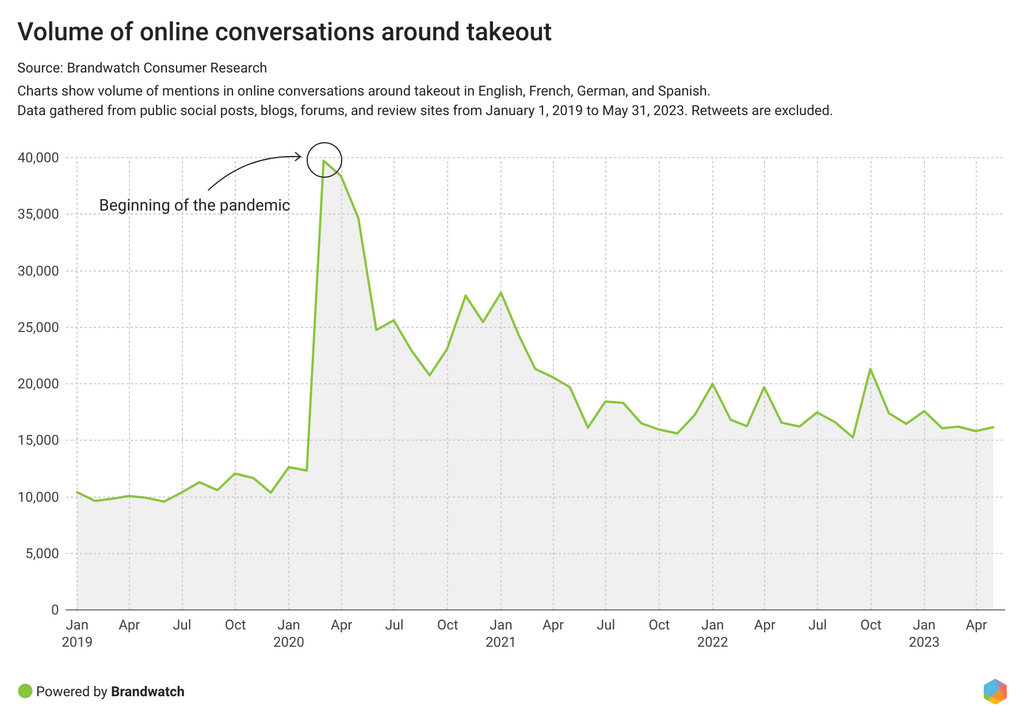

Takeout remains popular

Despite the toll that the rising cost of living is taking on people's budgets, ordering food to go is still more talked about than it was pre-pandemic. After exploding in 2020, online conversations remain at a higher level in 2023 than in 2019.

Why do consumers like to order takeout? One reason consumers point out is that they don't have enough time to cook. "Time" and "work" are some of the most frequently mentioned words in these conversations and are often mentioned in a negative way. When consumers talk positively about ordering takeout, they say they look forward to treating themselves to delicious foods after a long day at work. In joyful conversations, consumers praise the convenience of ordering takeout and the high quality of the order.

Gen Z is much less positive about ordering takeout than other generations. They have the highest percentage of negative mentions and the lowest percentage of joyful mentions. "Money" is one of the most frequently mentioned topics in negative conversations from Gen Z. They talk more negatively about the price of takeout than other generations. In a Deloitte survey, more than half of Gen Z and millennials say they live paycheck to paycheck. As the cost-of-living crisis continues, consumers are having to be more careful with their budgets, and that may mean cutting back on takeout.

There are some slight differences in how consumers from different regions talk about takeout. Overall, price, service, and quality are the top topics in conversation about takeout. French- and Spanish-speaking consumers are more likely to talk about products, with quality coming in fourth. German-speaking consumers are less likely to talk about quality, with products and convenience being more popular topics of discussion.

Trends in diet

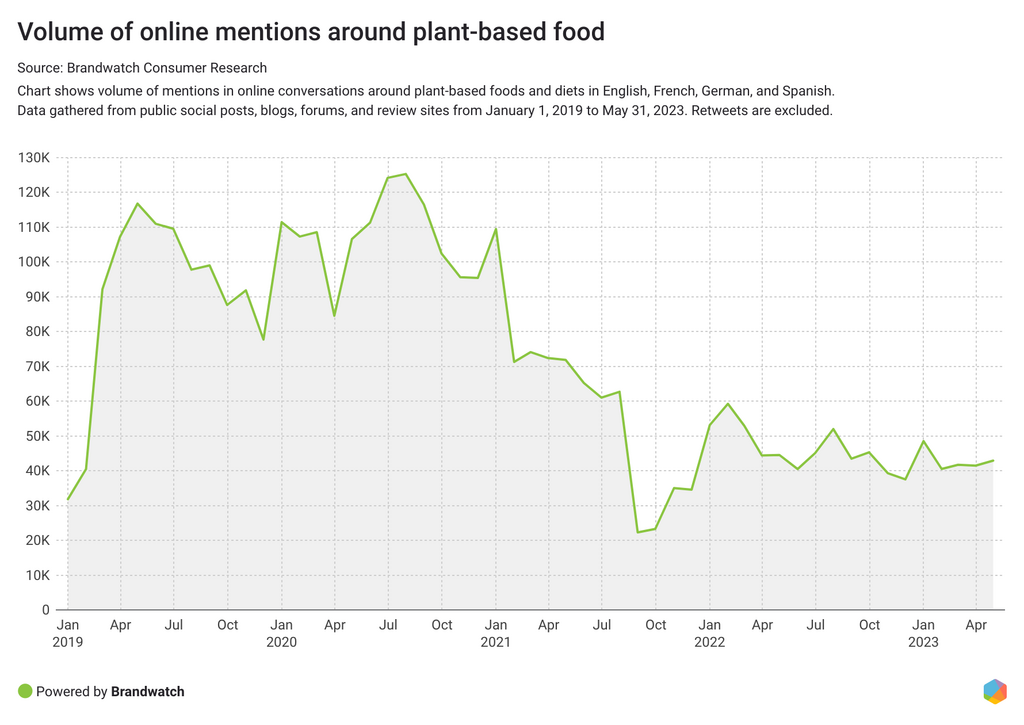

Plant-based diet hype is slowing down

Plant-based diets have become increasingly popular in recent years. Especially during the pandemic, it seems like consumers were more open to experimenting with new food during the lockdown. But the plant-based diet hype is slowing down.

Online conversations about plant-based foods from June 1, 2022, to May 31, 2023, are down 7% overall compared to the previous 12 months.

But this doesn't mean that consumers have lost interest in plant-based products. Quite the opposite, in fact: As more products flooded the market, it’s become more normal to see plant-based products in grocery stores. Overall, online conversations about plant-based foods are more positive than negative. 62% of all sentiment-categorized mentions are positive while 38% are negative.

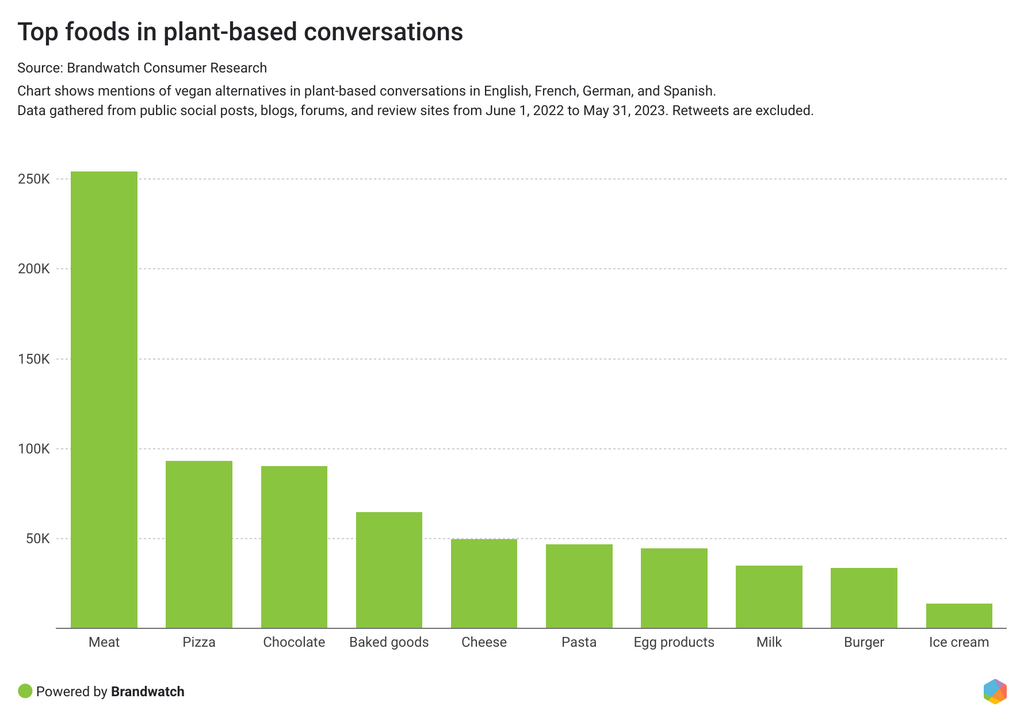

Though it might seem counterintuitive, meat is overwhelmingly the most discussed type of food in plant-based conversations, followed by pizza and chocolate. Conversations about plant-based meats decreased by 27%, and conversations about plant-based burgers decreased by 57%. Plant-based meats were also the product with the highest percentage of negative mentions of all the foods analyzed.

The topics that most concern consumers in conversations about plant-based meats are taste, ethics, and price. Topics with the highest percentage of negative mentions revolve around smell, texture, and price. Smell, taste, and texture are important product attributes that have a major impact on the eating experience. If a plant-based product is lacking in either one of these areas, consumers will not buy the product again and will switch to another brand.

On the other hand, there's more interest in plant-based chocolate. Online conversations are up 64%. Which makes sense as the global vegan chocolate market is expected to grow from $575 million in 2022 to $1.2 billion in 2028. In vegan chocolate conversations, consumers mention chocolate bars, using it in cakes, for breakfast, or as part of a healthy lifestyle.

Regional differences in consumer conversations about plant-based foods

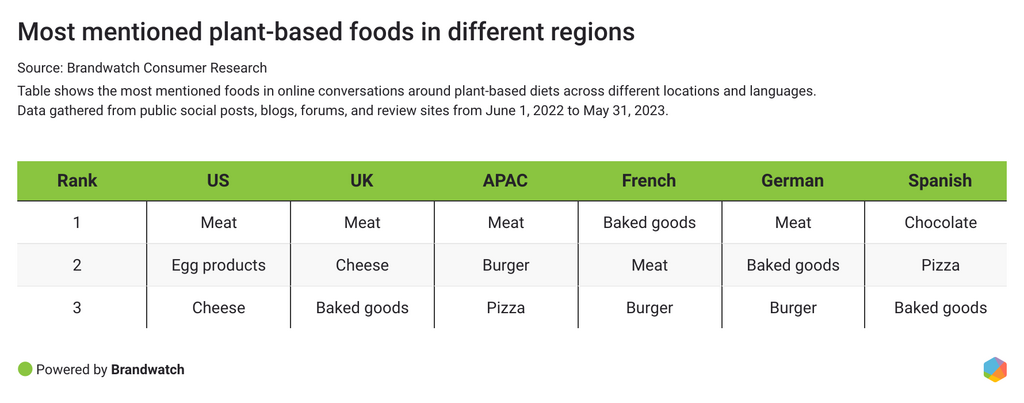

Plant-based consumer preferences vary from region to region. We broke down online conversations about plant-based foods by location and language.

Here are some interesting insights for global food companies to consider:

- Online mentions of plant-based diets decreased in all regions, except in German- and Spanish-speaking conversations where the number of conversations increased

- German-speaking consumers talk the most positively about plant-based foods, whereas, on the flip side, UK consumers talk about it the least positively

- Meat is the number one food in all regions analyzed, except for French and Spanish-speaking consumers. The top food in French conversations is baked goods. In Spanish conversations, it's chocolate.

- French- and German-speaking consumers talk more about ethics than the other languages analyzed.

- While Spanish-speaking and US consumers talk more about taste, UK and APAC consumers talk more about price.

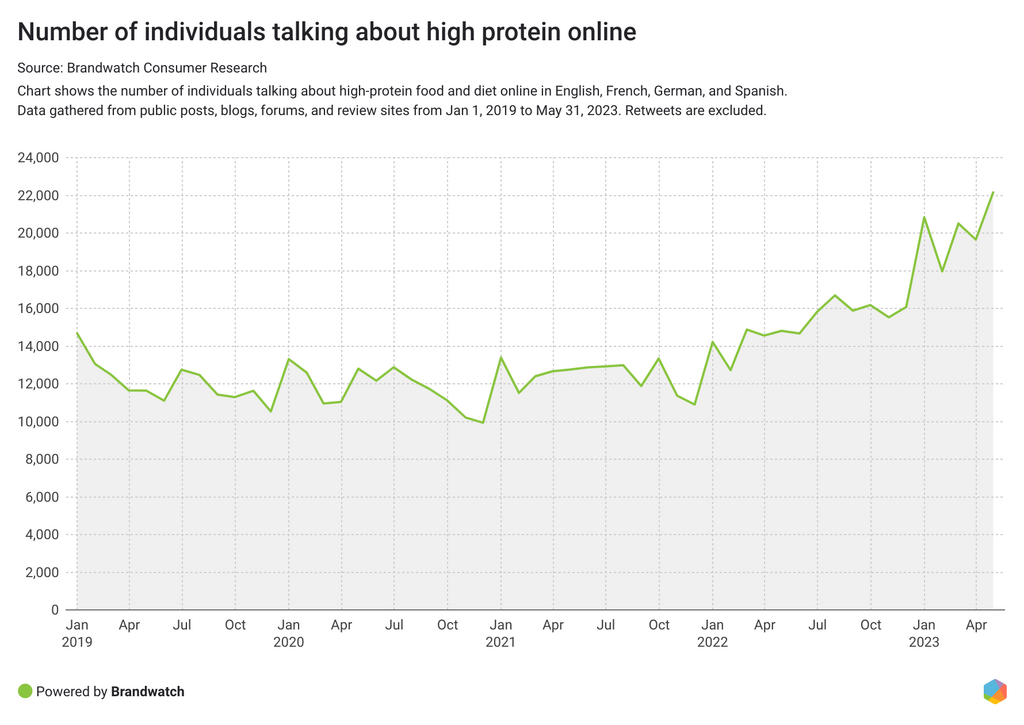

Consumers favor protein-rich products

High-protein products have gained popularity in recent years, and show no signs of slowing down in 2023. Search interest for "high protein" reached a five-year high in early 2023 and has remained high ever since. The number of people talking about high protein online and the number of people talking about high protein increased 32% from June 1, 2022 to May 31, 2023 compared to the previous twelve months

Snacks, chocolate, and beverages are the most commonly mentioned high-protein products. Millennials are more likely to talk about a high-protein diet than other generations. 52% of all generation-categorized mentions around "high-protein" come from millennials.

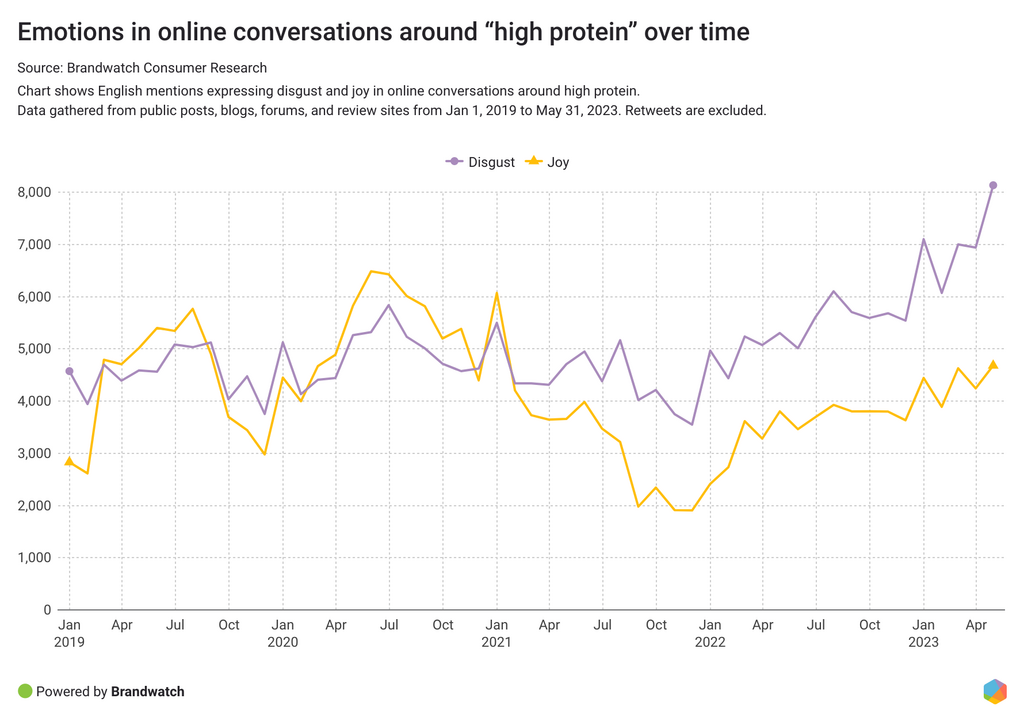

In terms of sentiment, positive and negative mentions are at similar levels, with 52% positive and 48% negative. The most commonly expressed emotion is disgust, followed by joy. Interestingly, while disgust and joyful mentions were at similar levels in the past, the gap widens from 2021 onwards, with disgust mentions overtaking joy mentions.

What are the topics of conversation that express disgust? Consumers complain that they want to eat more protein-rich foods but can't stand the smell of certain products. Another negative issue is price. High-protein foods often cost more than other foods, whether it is eggs or high-protein shake powder. With inflation and higher prices, price is a pain point in conversations with consumers struggling to manage the budget needed for a high-protein diet.

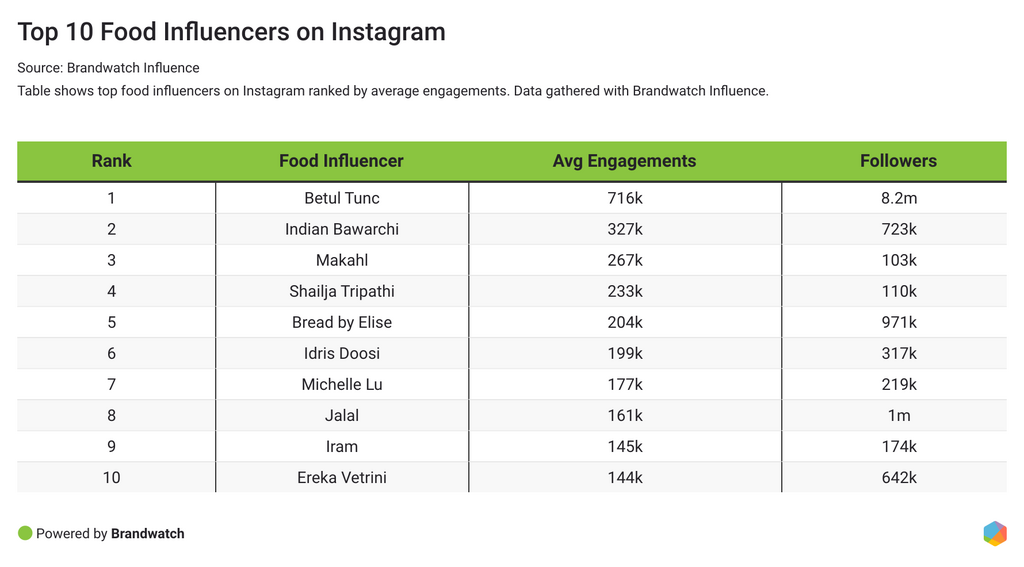

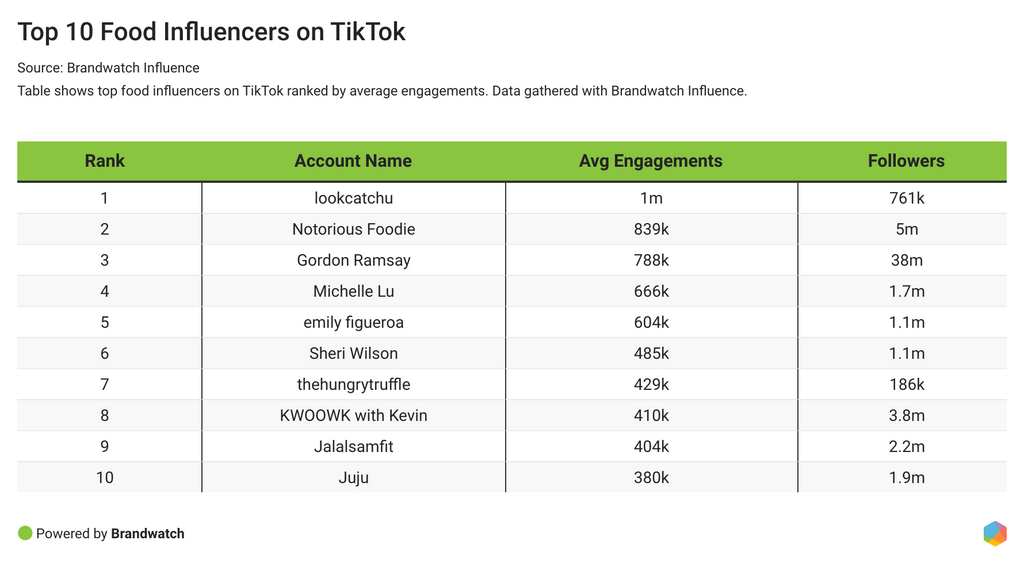

Top food influencers on Instagram and TikTok

Influencer marketing is an important tool in the marketing toolbox, and food is an industry with no shortage of influencers and content creators. Using Brandwatch Influence, we looked for influencers with at least 100k followers on Instagram or TikTok with mentions of "food," "foodblogger," or "recipes" in their bio description or account name.

Here are the top 10 food influencers on Instagram and TikTok, ranked by average engagements:

Top 10 food influencers on Instagram

Top food influencers on TikTok

From basic cooking tips to cake decorating, and from fancy bubble teas to bread baking, top influencer accounts post a variety of content.

For example, Betul Tunc, who sits very comfortably at the top of our Instagram list, is a baker and food photographer with Turkish roots who shares her favorite recipes from around the world on her account. Her trademark is aesthetically pleasing cooking videos accompanied with relaxing background music. Her content covers a lot of cuisines, and she shares all the information about her recipes on her Instagram posts below in the comments in English and Turkish. These factors could be reasons why her Instagram page is so successful.

Looking at Lookcatchu, the account at the top of our top TikTok food influencers, her strategy is obviously different. Lookcatchu focuses on sharing TikTok videos about the latest food trends: Whether it’s ice cream roll-ups, enoki mushrooms, gochujang garlic bread, or sushi waffles, following this account will serve you the latest viral food trend on a platter. She also keeps her videos snack-sized, with most of her videos running just under 15 seconds.

@lookcatchu Fruit Roll-Up Ice Cream (recipe in bio)

♬ masquerade - siouxxie sixxsta

On average, the audience of the analyzed food accounts is 64% female and 31% male. More than half of the audience is 24 years old or younger. 33% are between 25 and 34 years old. The audience on TikTok is younger than on Instagram, where over 60% are younger than 24. Followers are mainly from the US, UK, and India. A look at the other interests of Instagram followers shows that besides food, they are also interested in relationships, fashion, and photography

With influencer marketing tools like Influence, you can analyze potential influencers and gain a better understanding of the audience behind them. By utilizing these tools, you'll be able to make more informed influencer marketing decisions, set reliable goals, and ultimately achieve better ROI for your brand.

Final thoughts

Trends in the food and beverage industry can emerge quickly and spread like wildfire through social media platforms like Instagram and TikTok. Staying ahead of these trends and adapting to changing consumer preferences is crucial for brands to retain their customers.. By leveraging demographic insights, brands gain a deeper understanding of how consumer preferences and behaviors vary across demographics, such as location or generation. This knowledge enables brands to proactively cater to their target audiences and ensure they remain relevant in a constantly evolving market such as this.