Report

The Cost of Living and Changing Consumer Behavior

How has consumer behavior changed, and what does this mean for brands?

Get StartedThe rising cost and prices in many sectors have a significant influence on how consumers buy and also how brands operate. People are looking for ways to save money, and the high energy prices are forcing many to rethink their buying decisions.

How are consumers talking online about the rising cost of living? What measures are they planning to take, and what does this mean for brands? To answer these questions, we analyzed with Consumer Research over 8 million online consumer conversations about the cost of living in English, French, German, Italian, and Spanish.

In this report, we will uncover:

The top 3 platforms for cost-of-living consumer conversations

The main platforms consumers use to discuss the rising cost of living are Twitter, Reddit, and forums. All three social networks are great places to express your opinions and ask for advice from the communities, so it’s not surprising that people discuss the cost-of-living topic on these sites. Of the three platforms, Twitter gained more popularity in the last two months: From July to August 2022, the mentions volume on Twitter increased by 25%.

Comparing the conversations on Twitter, Reddit, and forums shows some significant differences. While authors on Reddit and forums mainly talk about people and what the changes mean for society, consumers on Twitter are more specific: The most mentioned phrase from January 1 - August 31 2022 is “cost of living crisis.” Twitter authors talk more about the government and government actions and the rising gas prices. Reddit and forum authors instead talk more about the impact on their daily lives, like their pay and salary, housing situation, and affordability of products and services.

Consumers not only focus on different topics on different platforms, but our analysis also shows that the expressed emotions and sentiments in the conversations show distinct variations from platform to platform. While it’s not surprising that people on Instagram express the least negative emotions, we can also see that consumers on review sites talk less negatively about the cost of living than on other platforms. In the positive conversations, consumers highlight great customer service and making more expensive products or services worth it. Others praise the quality of more affordable alternatives to expensive products.

There are also some variations in the languages we analyzed. Twitter and forums are the main platforms for the cost of living conversations in all covered languages. Still, Spanish- and Italian-speaking authors more often share their opinions on blogs compared to Twitter and forums.

Gas and energy prices cause online conversations to skyrocket

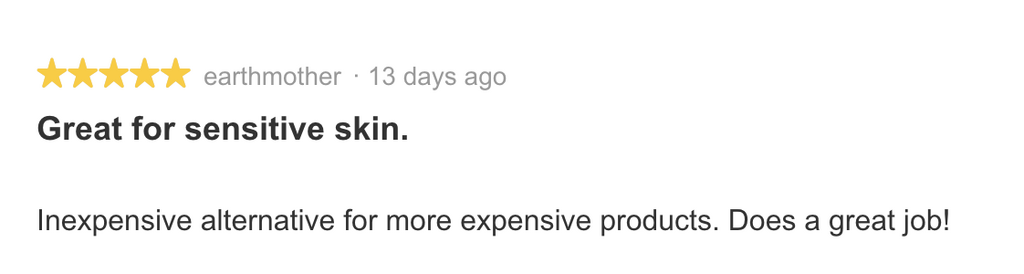

The following chart shows the online consumer discussions around the cost of living over time from January 1 - August 31 2022. Mentions increased steadily over the year with some dominant peaks. With the help of Iris, Brandwatch’s AI analyst, we dived deeper into these conversations to see what caused the peaks.

Rising energy prices, especially for gas and electricity, are a huge topic in consumer conversations and one of the biggest concerns for consumers in 2022. How the soaring gas- and electricity costs lead to higher production costs, lack of supply, and finally higher costs for the consumers is something we see reflected in the conversations online. The two peaks that stand out in the analyzed online consumer conversation both revolve around the rising energy prices and the impact on consumers.

Consumers not only share their opinion on the topic but also their worries and concerns for the coming months. To get an idea of these worries and concerns, we looked deeper into the most expressed sentiments and emotions in these discussions.

Sentiment analysis: Consumers express their worries and concerns online

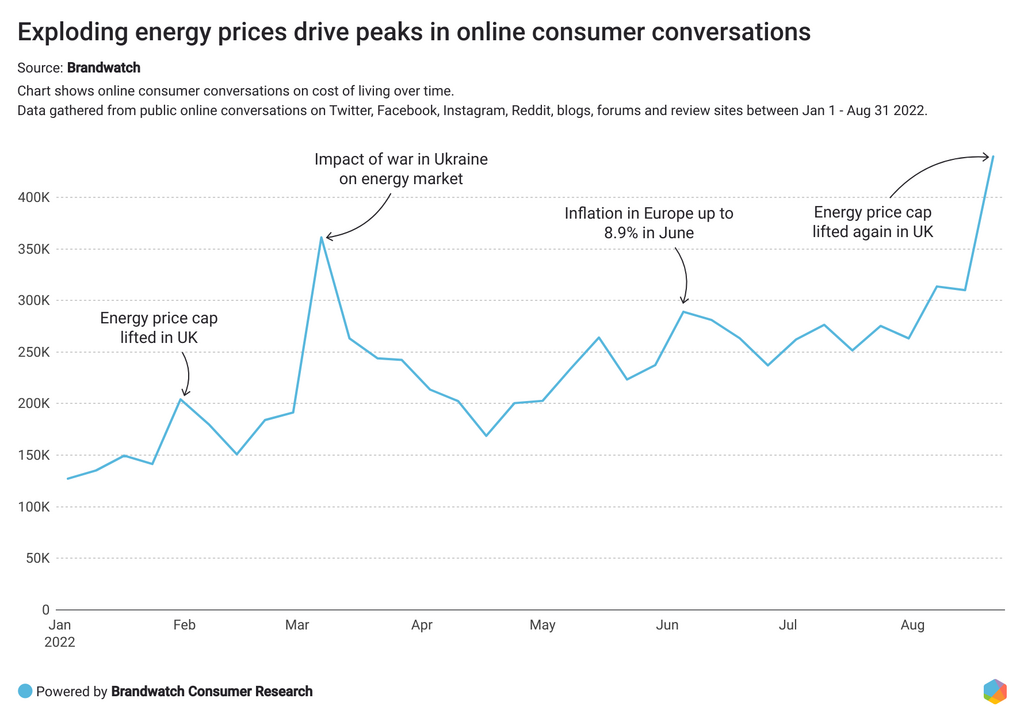

With millions of people influenced negatively by the rising cost of living, inflation, and skyrocketing energy prices, it’s no surprise that online conversations are almost purely negative. A whopping 92% of sentiment-categorized mentions are negative. The most expressed emotion in these negative conversations is sadness, followed by anger. While fear is not the most commonly expressed emotion in this analysis, the fearful mentions increased from July to August 2022 by 22%. This could indicate that consumers worry much more than in the year's first half. To better understand what the fearful online consumer conversations look like, we looked at the topic cloud with the most popular topics and phrases.

A further look into the main topics expressed in these fearful conversations over the last two months shows that consumers express their worries about the cost of living crisis with phrases such as ‘anxiety’, ‘scary’, ‘bad’, ‘fear’, and ‘worried’. Consumers seem to feel more uncertain and scared about the future.

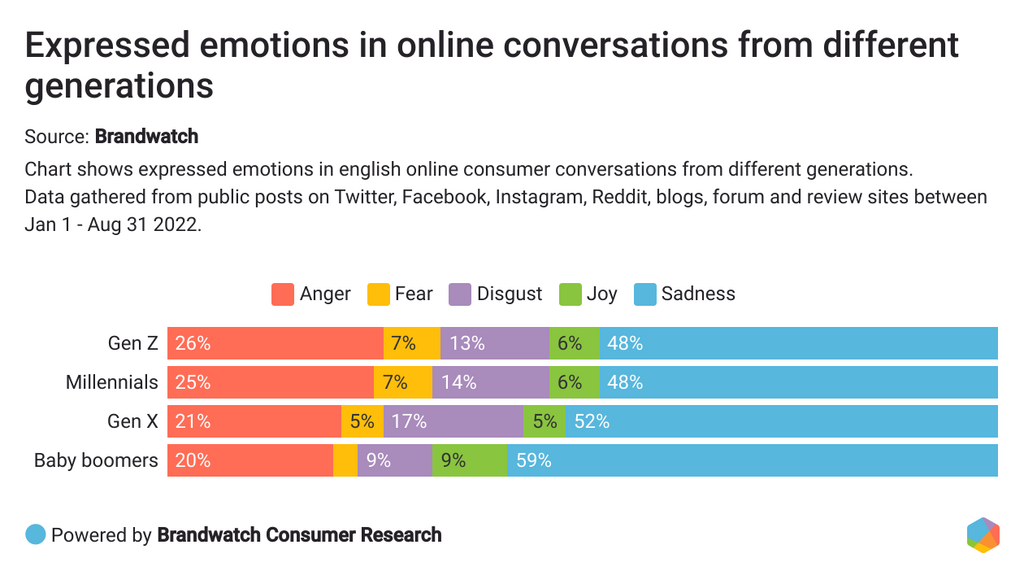

The most expressed emotions in online conversations vary in different generation groups. With Social Panels in Consumer Research, we can match mentions to different generations. Overall, the conversations across all generation groups are mainly negative. Baby boomers are more inclined to express sadness in their discussions than other generations. The younger generations, Gen Z and millennials, are more likely to express angry and fearful emotions when talking about the rising cost of living.

Groceries and rising food prices are the main topics in online consumer discussions

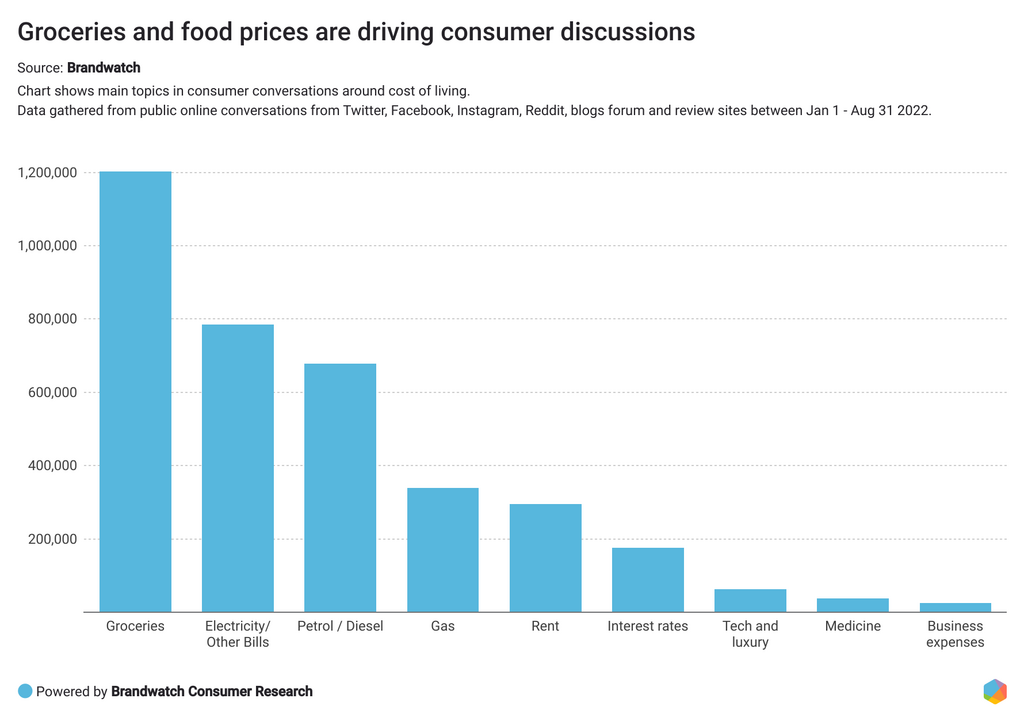

The rising cost of living has undoubtedly influenced many areas in our lives. We categorized online conversations into popular topics to find out which topics are on top of consumers' minds. By far, the most talked about topics are groceries and food prices. Grocery shopping is an ever-present part of people's daily lives, and we’re confronted with rocketing prices every time we reach for the frosted flakes in the cereal aisle. Food shopping is also a financial expense consumers can’t just cut out, so they have to find ways to make adjustments. What we can see is that people go online to seek information and tips or read about the experiences of others.

Popular talking points apart from grocery shopping are electricity/ other bills, petrol/diesel, and gas prices. Especially conversations around gas have increased in the last two months: From July to August 2022 mention volume increased by 45% compared to May to June 2022. The ongoing war in Ukraine and sanctions on Russia led to increasing gas and energy prices in Europe. It’s a topic not only in the top news but also in consumers' conversations. Gas is also the analyzed topic with the highest percentage volume of angry mentions. ‘Winter’ is one of the most mentioned topics when discussing gas prices and electricity bills, with consumers worrying about their heating and power consumption.

While millennials are more likely to talk about rent and grocery shopping, Generation Z would discuss tech and luxury items more often. For Generation X, interest rates are an important talking point, and baby boomers talk more about business expenses when compared to the other generations.

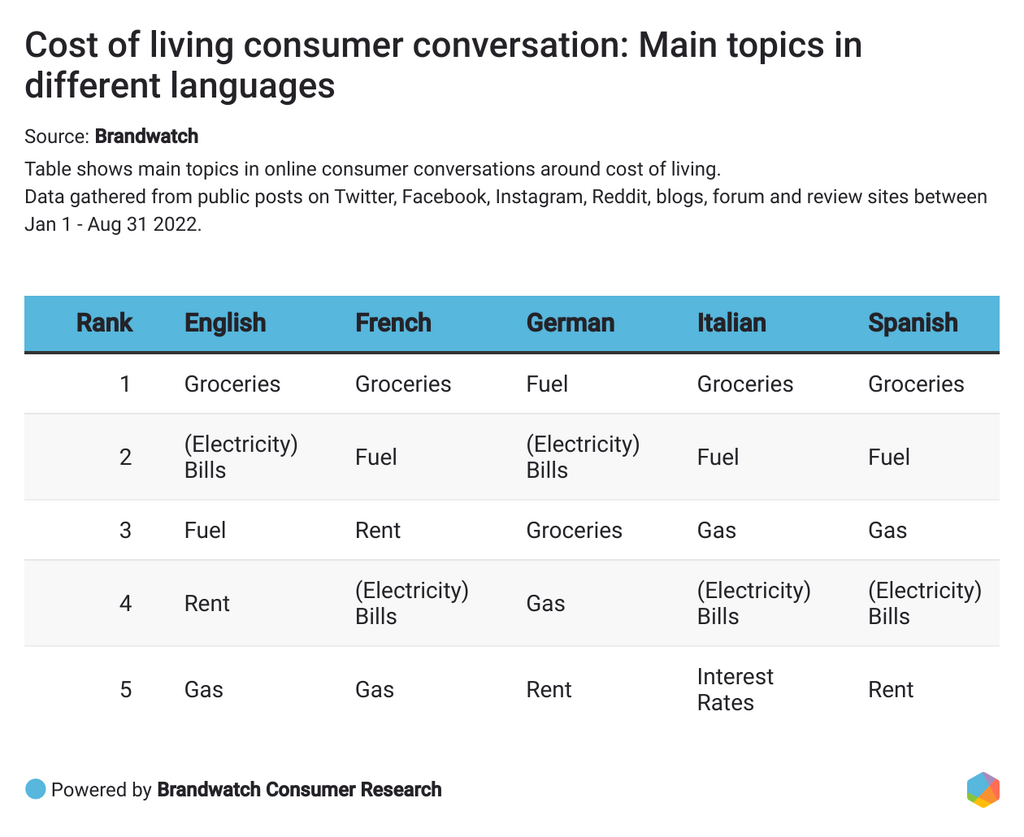

Groceries are the main talking point in all analyzed languages except for German-speaking conversations. Here, fuel and electricity (bills) are more relevant. The main driver in German mentions around fuel is the actions of the German government to reduce the effect of rising fuel prices.

Rent plays a much higher role in French-speaking discussions, while Spanish- and Italian-speaking conversations more often revolve around gas prices.

In terms of sentiment, interest rates are the most negatively talked about topic in English, French, and Spanish, whereas German- and Italian-speaking consumers talk most negatively about gas.

Saving electricity is the most mentioned topic in consumer conversations around changing behavior

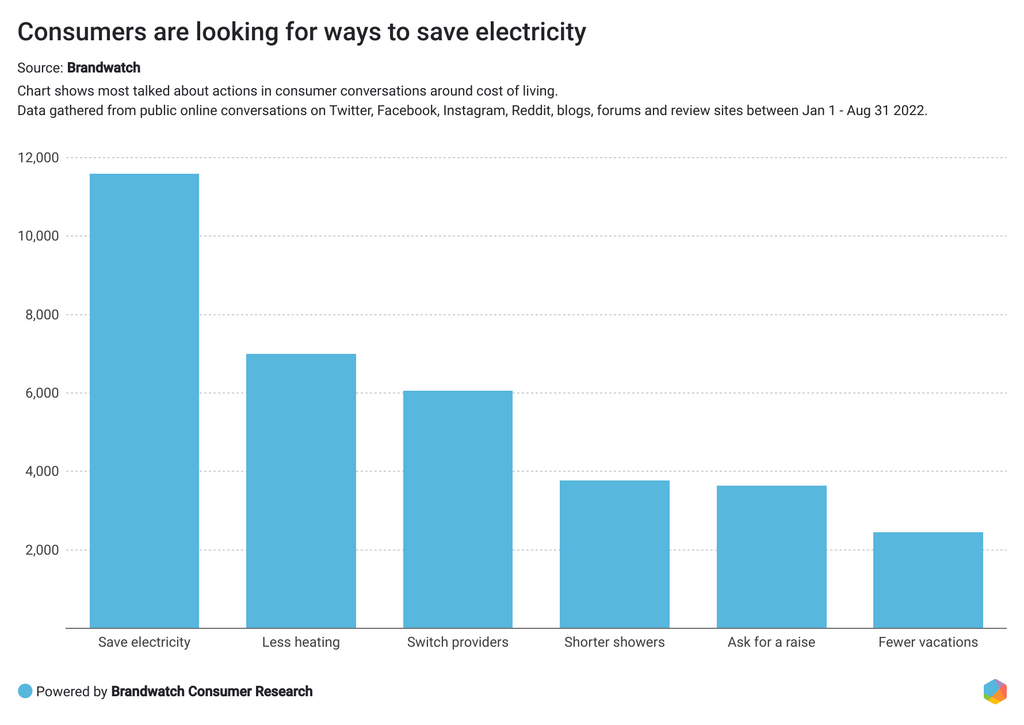

Analyzing consumer conversations not only helps us get an idea of the main topics, pain points, and expressed emotions. It also tells us what consumers are planning or wanting to do. In terms of the cost of living crisis, consumers look for ways to reduce expenses.

Consumers discuss ways to reduce their consumption or switching providers to save money. They want to save on electricity, turn the heat down, or shower less or at lower temperatures. Reduced heating and showering less have become more popular talking points in the last two months.

Saving electricity or switching providers are among the most discussed topics in all analyzed languages. Unique for French-speaking consumers is that they talk more about asking for raises or demanding higher wages. French and Spanish-speaking consumers would also more often talk about taking fewer vacations. In contrast, German-speaking consumers more often post about taking shorter or colder showers. Finally, turning down the heat has a higher relevance in Italian-speaking conversations.

Rising prices and changing shopping habits

Stocking up and issues of high-demand products

In shopping, consumers talk online about how they want to change their shopping behavior. In the shopping consumer conversations, we see that panic buying or stocking up have gotten the highest mention volume between January 1 - August 31 2022. People say they stock up on certain products — especially non-perishable items — because they fear the rising prices or they’re trying to benefit from a discount.

Another influence (apart from fearing higher prices or buying in bulk to get a discount) is shortages. Shortages and empty shelves can lead to people stocking up more to be on the safe side. Since the pandemic's start, stocking up has become much more popular. A dominant talking point back then was toilet paper running out of stock. And people still talk about toilet paper. They use it, for example, to describe the strange shopping experience in the years 2020 and 2021. Others are worried people could start hoarding again and that we would relive the empty shelves experience.

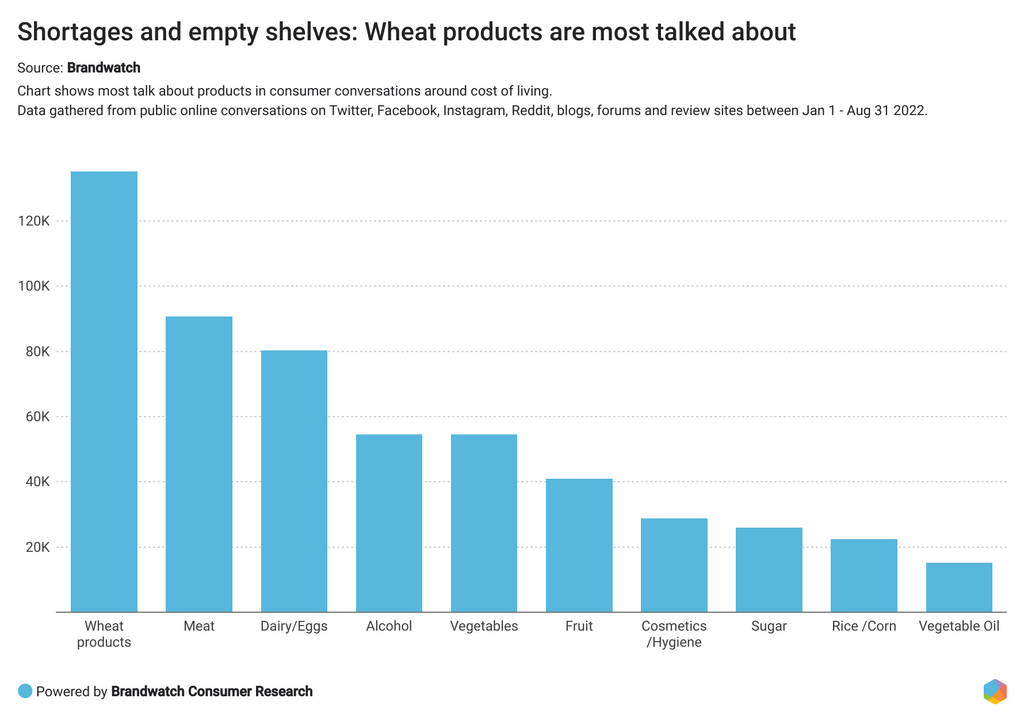

Next, we structured the online conversations around supermarket shopping into different product groups. Two main talking points in the discussions are rising prices and supply issues of wheat products. Meat and dairy products, as well as eggs, also lead to many mentions. Consumers discuss higher prices not only in supermarkets, but also higher prices in fast food places and restaurants. Rising energy prices and the higher cost of cooking oil have led to higher prices and even meals being taken off the menu.

Expensive cosmetics and hygiene products make customers frustrated

But the higher prices of wheat, animal products, and vegetable oil were not what made consumers particularly unhappy. Diving into the sentiment of those conversations, we can see that consumers are particularly angry about the soaring prices of cosmetics and hygiene products. Apart from mentioning everyday products like soap and shampoo, there are a lot of mentions about skincare and female hygiene products being too expensive. Consumers are looking into cheaper alternatives or hoping for sales. However, some post about not wanting to cut back on their favorite products. Affordability was one of the biggest consumer pain points in conversations around skincare. You can read more about cosmetics trends in our latest CPG report here.

Collaborating with beauty influencers is one way for cosmetic brands to reach more price-sensitive consumers. Influencers have high credibility in their community, and by working with the right influencers, brands can reach a wider audience and deepen brand loyalty. Influencers can promote the brand’s products on their channels and offer exclusive discounts. In this way, brands not only reach more price-sensitive consumers but can also track the outcome of the influencer campaign more efficiently. Brandwatch Influence makes it easy for brands and agencies to find the perfect influencers, nurture the relationships, and measure the campaign’s success from beginning to end.

There are some interesting regional differences in consumer conversations worth pointing out:

- English-speaking consumers talk more about meat products than any other analyzed language.

- German-speaking consumers talk less negatively about shopping and products and post more about dairy and egg products.

- French-, Italian- and Spanish-speaking consumers mention wheat products more than any other product category.

- Italian-speaking consumers talk more about cosmetics and hygiene products.

Consumers shop more often at budget-friendly stores and think about eating less meat

In the online conversations around buying behavior, consumers also post about choosing discounters more often than regular supermarkets or eat fewer meat products to save money. The conversations around buying bulk, eating less meat, and shopping more at discounters increased the most from July to August 2022. Shopping in discounters is particularly popular in French-, German-, and Spanish-speaking conversations, as the following table shows.

‘Cheap(er)’ and ‘budget’ are the most used words in the online consumer conversation around the cost of living and shopping at discounters or buying more off-brand products. These customers are especially price-sensitive, and exchange saving tips or give updates on sales at different stores to save money. It’s no surprise that the primary platform for these discussions is forums.

Cutting back on meat products

Food and diet can be emotional topics. It gives us fuel to function in our daily lives, and many diet tips articles are online. Google search shows über 2.6 million search results for ‘diet tips’ (August 2022). Food is also often tied to pleasant childhood memories, used as a popular group bonding activity, and no festivity happens without food. So it’s no wonder consumers get emotional if the rising cost of living crisis significantly impacts their eating routine.

In terms of volume, eating less meat is the second-most talked about topic in consumer conversations around changing shopping habits. Consumers seem to feel more forced to stop buying meat than in other areas. Discussions about eating less meat have the highest percentage of disgusted mentions compared to other analyzed topics. People express their dislike about rising meat prices and of meat becoming unaffordable to them. This issue became much more relevant in the last two months: From July to August 2022, mentions increased by 20%.

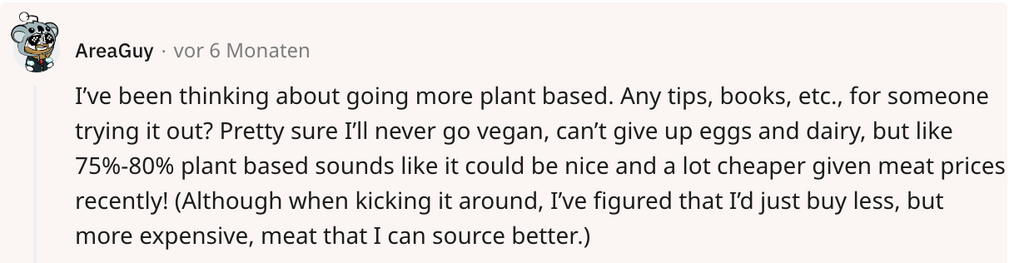

Not all conversations around a more plant-based diet are negative. In the positive conversations, people highlight the benefits of eating less meat for the wallet, health, and planet. They ask for tips and inspiration to cook with less meat.

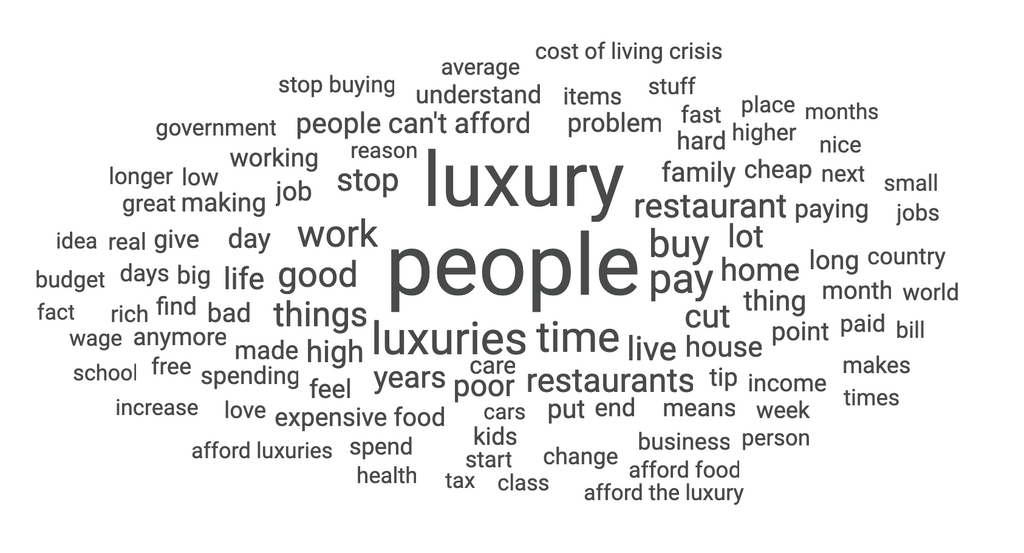

Consumers plan to treat themselves less

The conversations around buying less expensive products and going out less mainly express sadness. As high as 71% of emotion-categorized mentions around ‘buying less expensive products’ and 64% of emotion-categorized mentions around ‘going out less’ express sadness. Consumers plan to go out less, to order less takeaway, and to cook more meals at home. In the conversations around buying less expensive products, ‘luxury’ is the word people most often use.

As prices skyrocket, there seems to be a shift from people seeing expensive products as unaffordable and unnecessary luxuries.

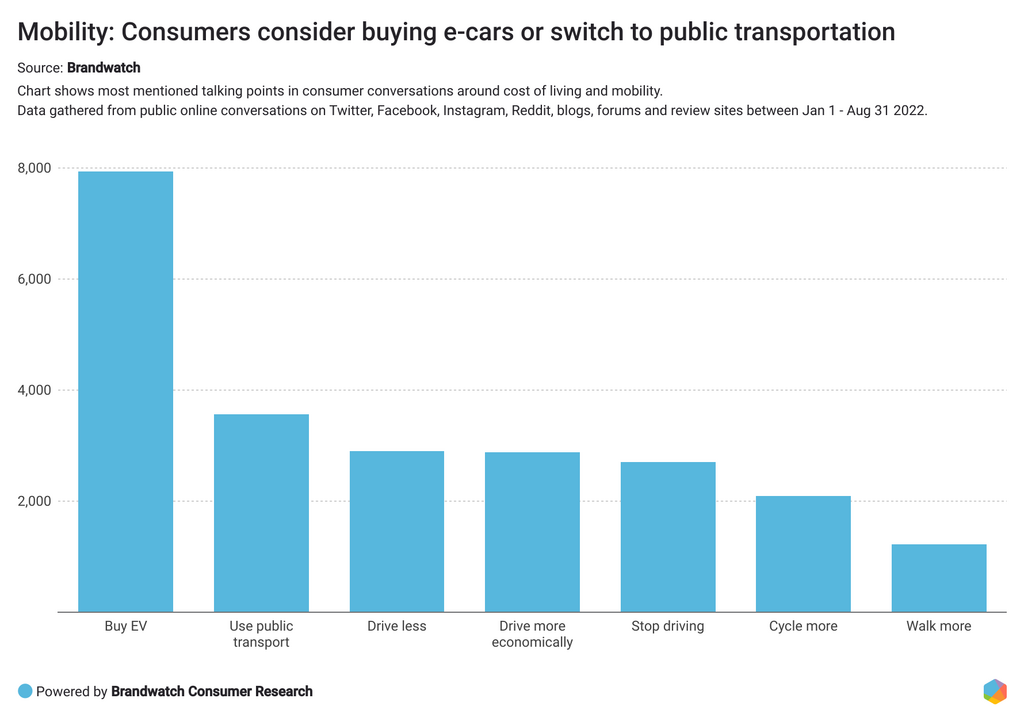

The rising cost of living raises discussions about mobility

Rising petrol and diesel prices are the third most-discussed topics in consumer discussions around the cost of living. What do these conversations look like? Car drivers facing higher expenses question whether they can maintain their mobility lifestyle. The mentions around mobility and rising costs increased by 137% from January 1 - August 31 2022.

The main topic in the mobility discussions are e-cars. Some talk about switching to an electric car. Others are worried about whether they can keep their petrol- or diesel car or if they have to switch to an electric one. In these discussions, car drivers talk about the affordability of electric vehicles, rising fuel prices, and higher costs for charging e-cars.

Buying e-cars has the highest percentage of mentions expressing sadness in consumer mobility discussions. The affordability of e-cars mainly drives these mentions. Some consumers say they want to buy an e-car but can’t afford one.

While electric cars are a key topic in the conversations around mobility, there are also other aspects consumers consider facing rising cost of living. Consumers want to use more public transportation, drive less, and find ways to drive more fuel-efficiently.

Comparing the different language data sets showcases some interesting differences in the conversations:

- English-speaking consumers talk way more about e-cars than the other analyzed consumer groups. As high as 43% of all English consumer conversations around mobility discuss e-cars.

- The main topic in German- and French-speaking conversations is public transportation.

- Spanish- and French-speaking consumers talk more about driving more economically than the other analyzed consumer groups.French-speaking consumers talk less about switching to electric cars.

- Out of all analyzed consumer groups, German-speaking consumers talk most negatively about driving more economically.

Final thoughts

The consumer landscape has radically changed over the last few years which means that it has never been more important for brands to understand their customers and how their behavior changes. Companies need to adjust their campaigns and communication strategies to stay ahead.

The rising cost of living and inflation forces many customers to adjust their buying decisions, making it harder for brands to keep loyal customers. No matter which industry brands operate in or if they offer branded or off-brand products, it’s important to understand the worries and struggles of consumers. Brands should remember that these are challenging times and consider whether certain campaigns are still appropriate for their target audiences.

Our analysis showed that consumers are willing to pay a higher price if the services and customer experience are excellent and so, companies need to make sure they can meet (or exceed) consumer expectations. With the rising cost of living and consumers becoming more price sensitive, it's more important than ever to provide excellent customer service. With consumer intelligence platforms like Brandwatch Consumer Research, brands can monitor the main customer pain points and use those insights to make more informed, data-driven decisions.