10 Social Listening Tools and Who They’re Best for

By BrandwatchJul 14

Join us and boost your social media potential with our data-led event

Published April 29th 2016

Welcome to another social presence showdown.

This time, we’re focusing on two giants of the small package delivery market: FedEx and UPS. For years, these two companies have led the way in delivering bundles of joy to consumers across the globe. Between them, they deliver nearly 6.5 billion packages a year.

UPS, founded in 1907, is the older of the two companies, with FedEx starting in 1971. That headstart might be what makes UPS the larger company, with $53 billion in revenue compared to FedEx’s $42 billion. While FedEx has a larger fleet of airplanes, UPS has more ground vehicles.

Perhaps the best way to sort out the rivalry is to find out what their customers think. We’ve analyzed the social conversations around both brands to determine which company is the leading deliverer of small packages, according to the online world.

This is the FedEx vs UPS social presence showdown.

When it comes to followers and fans, FedEx is leading the way on Twitter with 247K followers to UPS’s 189K. On Facebook, UPS is a clear winner with 1.59M fans compared to its rivals 1.07M fans.

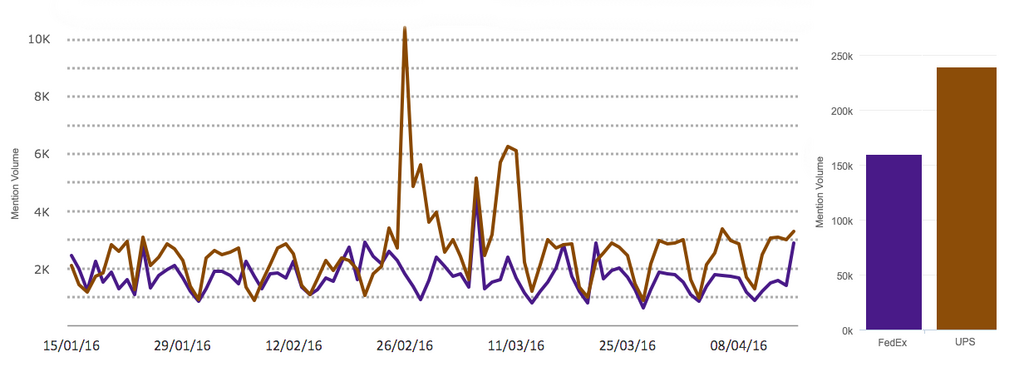

Looking beyond these two social networks to gain an overview of all mentions across the web, we found a total of 397,110 mentions in the last 3 months.

As the follower numbers would predict, UPS easily gains more of the conversation, with 60% of the mentions.

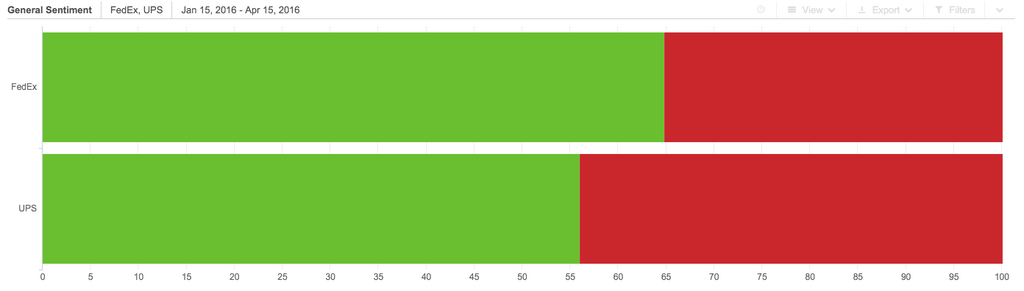

An overview of the automated sentiment analysis reveals that as a percentage of total brand mentions, FedEx gained more positive mentions over the three month period.

While sentiment analysis isn’t perfect, it can give us an indication of any major issues to investigate, and a general overview of the feeling around a brand.

In this case, there was a higher percentage of negative conversation around both brands compared to the other rivalries we have previously covered.

One way to understand the topics of complaint and the higher rate of negative mentions is to dive into the data for a qualitative analysis. We can also discover how people are comparing the two services by evaluating the mentions that feature both brands.

@FedExHelp just pick a date a stick to it. I’m sticking with my guys @UPS they got my back. ✌️

— William (@_justhatguy) April 8, 2016

Mentions of both brands can highlight why somebody is thinking of switching from one company to another…

@UPS @UPSHelp may have the worst customer service in the business. Time to start using fedex

— Pavluchuk & Assoc (@Jpavllc) April 11, 2016

As these examples show, for all the benefits e-commerce brings, a late delivery or poor customer service when something goes wrong can be hugely frustrating.

The growing use of Twitter for customer service is largely improving customer experience, but it leaves the frustrated few complaining in public view.

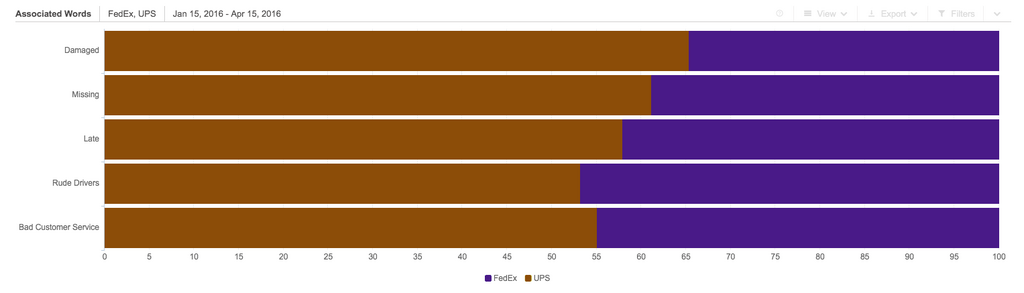

If we are going to get to the bottom of this social showdown we will need to undertake a quantitative analysis. To do that, we picked some of the most common annoyances of package delivery, as mentioned in the dataset.

We created rules in Brandwatch Analytics to categorize the mentions and find how much negative conversation fell into several categories.

We searched for mentions of late deliveries, missed deliveries, damaged deliveries, rude drivers, and poor customer service.

Clearly UPS receives more mentions in all five negative topics. At first, it appears that FedEx is the clear winner.

However, if we account for the fact that UPS took 60% of the overall conversation, a different story emerges.

If the two brands delivered an equally good level of service we would expect the 60/40 conversation split to be repeated in each of the complaints categories.

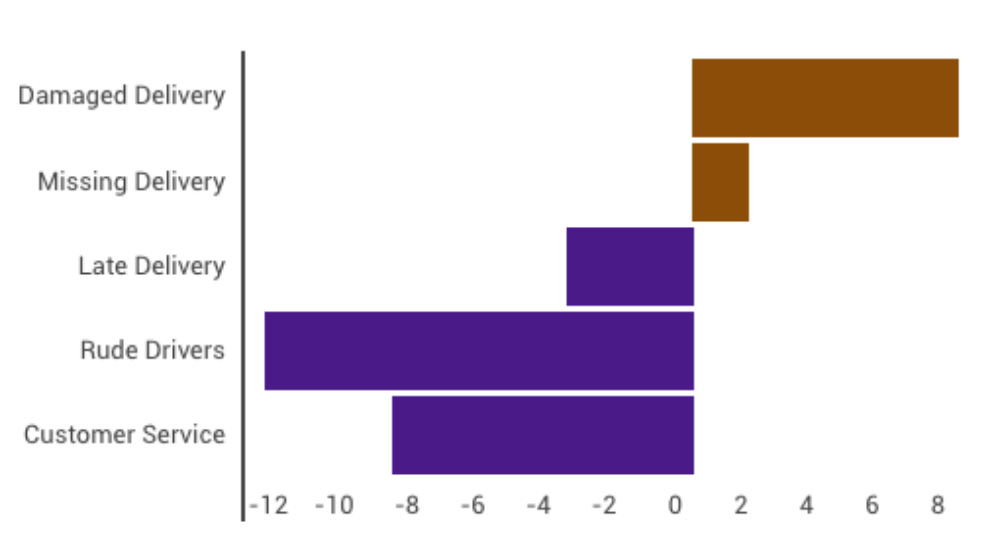

By weighting the complaints against the benchmark we can see the increase or decrease in complaints compared to the average.

Now we can see that there are more UPS mentions around damaged and missing deliveries. More people reference FedEx when complaining of poor customer service, rude delivery drivers, or late deliveries.

This implies that FedEx is better at the delivery side of the business, whereas UPS has a better consumer facing service than it’s rival.

It’s a close call, with both brands succeeding in some categories and falling behind in others.

UPS has more followers and fans and gains a higher share of voice between the two brands, taking 60% of the conversation.

FedEx is the winner when it comes to general sentiment, with 64.8% positive compared to UPS with 56%.

Finally, looking at common grievances with parcel delivery firms, UPs has more mentions in two categories and FedEx has three. However, the swing towards FedEx is more pronounced in the three it loses, so we’re calling this one a win for UPS.

For now, UPS narrowly delivers the win. With a race this close the momentum could easily swing back the other way.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.