10 Social Listening Tools and Who They’re Best for

By BrandwatchJul 14

Join us and boost your social media potential with our data-led event

Published May 22nd 2015

We are pleased to introduce the first in a new Brandwatch blog series, pitting brand against brand in a social presence showdown.

For our inaugural post, what more appropriate place to begin than with the two most heated rivals in the beverage business: Coca-Cola and PepsiCo.

Maintaining a near duopoly on soda products, Coke and Pepsi are natural enemies.

The contention that exists between the two brands is best characterized by the well-known Pepsi Challenge, which asks strangers to sit down blindfolded, try both products, and decide once and for all which is superior.

The general consensus from the taste test was that Pepsi was better. Of course, identifying which product is preferred is not really that simple. Furthermore, as Malcolm Gladwell points out, there are a few qualms with the methodology of the “sip test,” which was put on by PepsiCo.

The general consensus from the taste test was that Pepsi was better. Of course, identifying which product is preferred is not really that simple. Furthermore, as Malcolm Gladwell points out, there are a few qualms with the methodology of the “sip test,” which was put on by PepsiCo.

Yet beyond the interaction of the fizzy soda against our palates there is another reaction affecting our tastes.

As any marketer will point out, a consumer’s experience is also influenced by every exposure to the brand’s messaging along the way.

So if the difference between these sodas is so marginal that it warrants a blindfolded taste test, then it’s likely that it’s the branding that will ultimately play a big role in consumers’ decisions.

The following analysis examines the ancient soda feud using organically occurring Twitter conversations.

This is the Coke vs Pepsi Social Presence Showdown.

Now for the data dump.

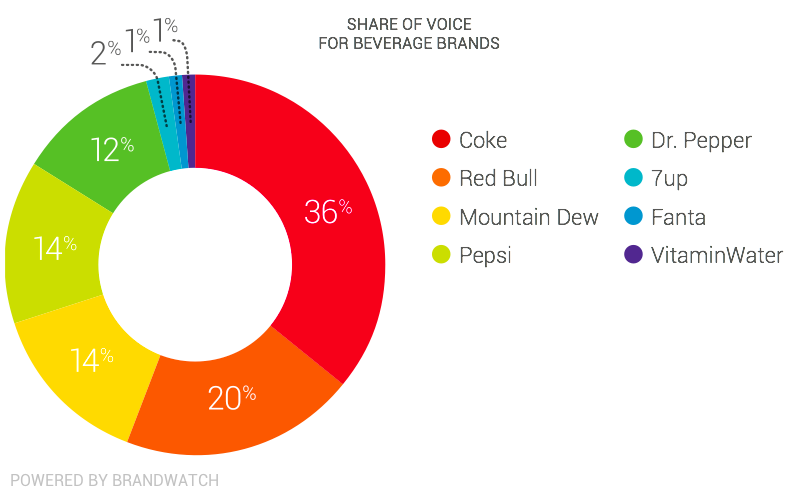

First off, let’s look at the conversation as a whole. In our latest report on the Restaurant, Food & Beverage industry, we examine the total share of voice for several leading soda brands.

Conversation around Coke was over 2.5 times greater than that of Pepsi.

Conversation around Coke was over 2.5 times greater than that of Pepsi.

That is perhaps unsurprising, as Coca-Cola’s market capitalization is over 30% greater than PepsiCo’s, Coca-Cola spends considerably more on advertising, and Coke has 120,000 more Twitter followers than Pepsi.

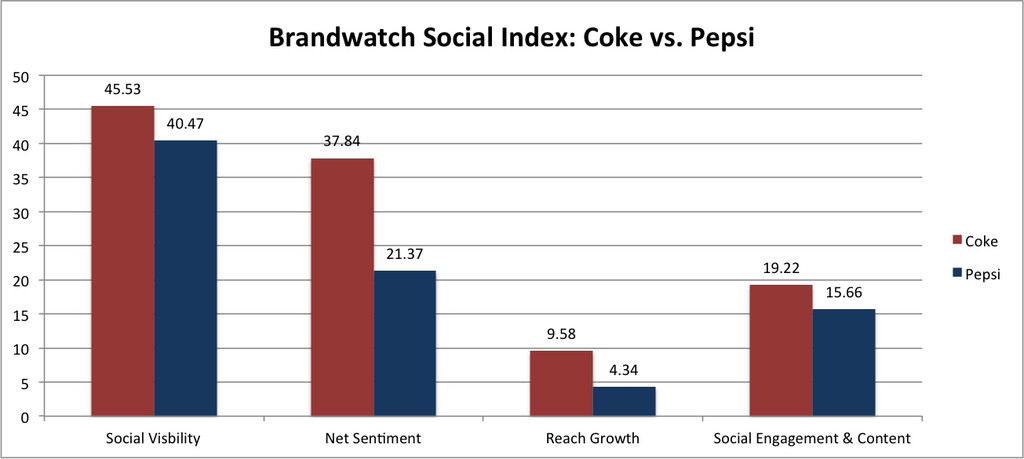

Furthermore, in our proprietary Social Index, Coke scored higher than Pepsi across all four categories.

Compares both Facebook and Twitter conversations directed at the brands for the month of April.

Compares both Facebook and Twitter conversations directed at the brands for the month of April.

The raw numbers are clearly indicative of Coca-Cola’s dominance.

In April, Pepsi’s #outoftheblue sweepstakes campaign led for visibility on Twitter.

While the campaign, which offered fans the chance to travel, hang out with celebrities or enjoy other unique experiences, promoted brand mentions and awareness, the majority of the chatter focused on the prizes and offered little merit to the brand itself.

On the other hand, Coca-Cola’s revitalized #shareacoke campaign garnered more meaningful chatter, which had a specifically significant effect on the brand’s sentiment score.

While the quantitative analysis already depicts Coca-Cola’s product as a clear winner, a qualitative look at the actual tweets helps put some human context to the all the pie charts and bar graphs.

For the sake of the Coke-Pepsi Social Presence Showdown, what we were really interested in is the conversations comparing the two products.

Searching specifically for chatter mentioning both “Coke” and “Pepsi” painted a picture even more partial to Coke.

Scrolling through the conversations, an overwhelming majority of them state a clear preference for Coke (a quick sample estimates around 10 times as many tweets in favor of Coke).

Furthermore, while Pepsi proponents recognize that theirs is an “unpopular opinion,” Coke fans go as far to vehemently deem their Pepsi counterparts as “evil” or say they “don’t trust” them. That is brand loyalty.

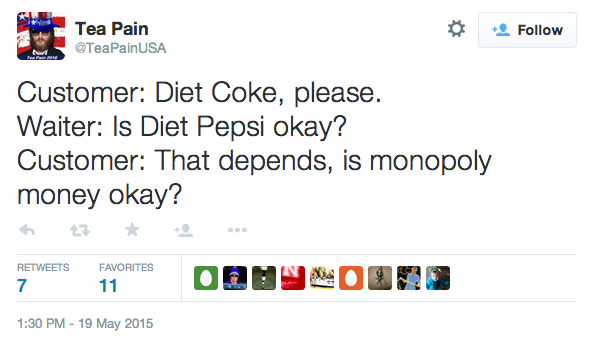

Still, the most common form of tweet comparing the two brands referred to a familiar situation:

The final decision

The final decisionFor the first showdown, the decision seems almost too obvious: Coke is a landslide winner.

Yet perhaps the more important question is: how can Pepsi adapt to gain a stronger social presence? The answers could again be hidden in social data.

Pepsi will have to find creative ways identify and amplify their passionate followers and comparative advantages.

As an example, the analysis below reveals what types of food consumers associate with the two beverages on social media:

While Coca-Cola is more often associated with burgers and french fries, Pepsi leans toward pizza. A similar analysis of alcohol brands revealed that while Coke dominates the Jack Daniels association, Pepsi has a comparative advantage with Appleton’s Rum.

Uncovering and emphasizing these natural associations, brands can begin to carve out and own niche segments of the market.

At the aggregate level, social media data can uncover or inform brand strategies to narrow in on competitors.

Yet at the individual level, a single tweet or Facebook post may inspire the creative campaign that brings a brand into the lead.

Brands that can see both the trees and the forest will ultimately be better suited to leverage the full range of capabilities that social media data offers.

If you have any suggestions for the next Social Presence Showdown, feel free to tweet @Brandwatch.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Consumer Research gives you access to deep consumer insights from 100 million online sources and over 1.4 trillion posts.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.