When searching for new product development advice, there are several frameworks to help you structure the journey. From generating new ideas to releasing the product into the public domain. One of the most popular frameworks for new product development is called ‘the eight stages‘:

- Idea generation – generate a lot of product ideas, using internal and external sources. This includes updating or amending an existing product.

- Idea screening – there is no such thing as a bad idea. Until you reach this stage. Examine and eliminate non-viable ideas.

- Concept development and testing – the idea or concept gets the first external feedback. Up to this point, the idea is purely internal, but bringing in customer opinion can help further develop the idea.

- Marketing strategy/business analysis – establish and describe the target market, projected sales, price, and marketing budget and campaign.

- Product design/development – develop prototypes or beta version to test with a panel of individuals. This will highlight the level of interest and desired product features.

- Test marketing – validate the entire concept, from marketing angle and message to packaging, advertising, and distribution.

- Bring it to market – the grand unveiling. Locations and seasonality may be factored into the decision.

Social data can help in various stages of this framework, providing quicker, detailed feedback at scale and on a cheaper budget than surveys and focus groups. It can help with both feedback on existing products and idea generation for new products.

Traditional methods of new product development

There are several sources of new product ideas and market research available. The R&D department is an obvious place to start, but other employees can also provide valuable input. Market trends and competitor activity are useful but you risk being late to the party.

Surveys and focus groups have traditionally been the most useful for discovering and testing new product ideas. The results of these can form the basis of research for product teams.

One problem is that these methods are time-consuming and costly. If you are looking for feedback on a current product, a survey can only surface answers to the questions you have already thought of.

With social data, the unfiltered nature of organic conversations means there can be insights in the data that you hadn’t thought of asking about, so would have missed.

You can also go back into the data and ask new questions as you are digging and developing. So if you’ve had a new product feature idea you can look at the historical data and see if there is any conversation to support it.

Social listening for new product development

Product satisfaction

Listening to conversations around current products can uncover ideas for the development of those products, as well as new product ideas.

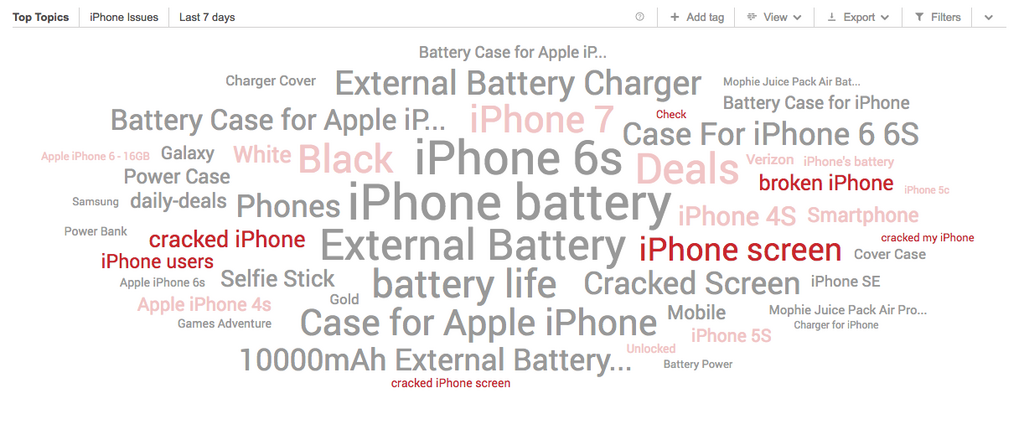

Consumers airing their frustrations is common on social media, and may be one of the richest sources for new product development ideas. Analysing conversation types in conjunction with sentiment analysis can quickly surface common issues with the current product. Once you have discovered repeated themes, you can conduct a deeper analysis of each topic to understand the issue in more detail.

Once you have discovered repeated themes, you can conduct a deeper analysis of each topic to understand the issue in more detail.

Is the problem being mentioned with increasing frequency? Knowing if a topic is becoming more or less common can help you know how long-term the trend is and whether it is worth investing resources in it.

Watching out for repeated emotional responses within the mentions can be fruitful. Noticing anger or frustration around a feature should ring alarm bells.

Frequently repeated product and brand associations can be revealed to deepen your understanding of brand perceptions.

People might be buying your product as they view it as the budget option, in which case your product development path would look very different than if they associate you with innovation and cutting edge technology.

Competitive intelligence

Monitoring conversations around competitors’ products can provide insights into product features that are not part of your offering. Features that regularly see high complaint levels or show repeated frustration can be avoided. Popular features that regularly illicit praise can be researched further and ultimately emulated.

Brand-agnostic research

One of the best ways of conducting social media research is to listen to conversations around product categories. Looking beyond mentions of your own brand or product can be a better way of understanding the marketplace. You can gain an understanding of how people talk about the category. It also gives you a larger dataset to work with.

Begin by gathering the data around your product category. You can then take a representative sample and work through it manually. You should categorize mentions as you read them.

Start with the categories you expect to find, but make sure you add further categories as you discover them. This then allows you to compare different categories, crossing product issues with demographic, emotion, location, and so on.

You can also exclude the most common topics, and go back through the data to find insights that might be obscured by the most popular topics.

Audience segmentation

As we’ve already alluded to, social data allows you to segment the audience in numerous ways. There may be features that only matter to a specific age range, alternatively an issue could be localized to a particular market.

Discovering issues specific to market segments like this can open up new product development opportunities. It can also help with targetted marketing of the product.

Marketing the new product

You will already have an idea of the market from your product research, which will allow you to target your marketing and use the same language customers are using.

You can emphasize the most popular features and highlight how they answer the problem your consumer base is facing. Emphasizing how a product or feature will address the needs of the consumer is much more effective than talking about the feature itself.

Social intelligence can provide detailed feedback at scale. The flexibility means that demographic and location-based insights can be easily uncovered, helping you stay innovative in a competitive space.