Swap buzz for purchase intent

The great measurement myth. More buzz equals more potential sales.

Unfortunately, buzz is sometimes just buzz. While something may capture our attention online, it doesn’t always translate into capturing the pennies in our wallets.

Instead of using buzz as a proxy for interest in your brand, measure purchase intent and find out what’s driving people to purchase (or not purchase) your products.

Two of my favourite case studies I use as examples with my clients are purchase intent studies from Brandwatch (I know, gush for Brandwatch on the Brandwatch blog, but it’s true).

The studies clearly demonstrate that buzz does not equate to purchase intent and actual purchase. In this first study, Brandwatch analyzed H&M social conversations around four major celebrity endorsement campaigns.

The study found that while David Beckham drove highest overall buzz, it was Beyoncè who drove most purchase consideration.

https://twitter.com/hokagebeyonce/status/596751830803185664

The second study correlated buzz to purchase intent and finally sales of computer games, with purchase intent being a stronger indication of sales than buzz.

The moral of the buzz story – go deeper in the analysis. Buzz is a metric, one that doesn’t tell you very much. You need to then analyze buzz using another analytical method, purchase intent is one of these methods, and lifecasting is another.

Swap buzz for lifecasting

There’s been many a research focus on showing how social media has changed the customer decision-making journey.

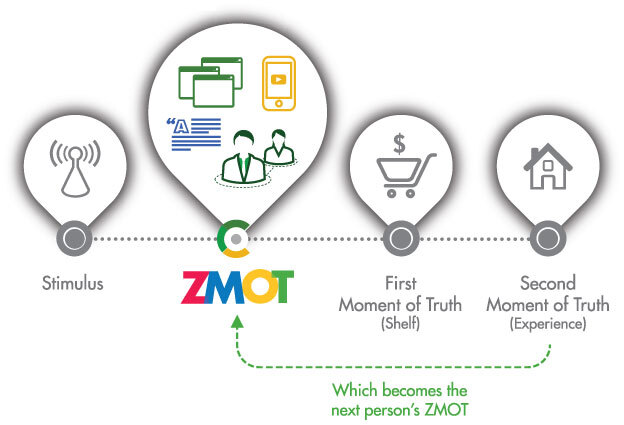

Think about Google’s ZMOT theory too. I still think there is work to be done on these models (but that’s another blog post) and this shows in the rise of social media conversations about the consumption of brands, products are services.

The consumption stage of the decision-making cycle is largely missing from the theoretical models on the topic but when we analyze social media data, experience (or Lifecasting) is one of the highest topics of conversation.

In a recent study on the whisky industry, I found that 16% of all conversations were about drinking whisky.

This included the brand, the type of glassware, how the whisky was being drunk, the occasion, who was there and the feelings surrounding drinking whisky.

Measuring buzz isn’t going to give you this type of insight. By changing up the way you think of buzz, the way you measure buzz, you can gain insights that can be used in future communications and campaigns.

Swap wordclouds for advanced segmentation

I see a lot of wordclouds in social insights reports, but let’s be honest – they don’t really tell you that much.

There is no context to what’s going on behind the keywords and in many cases, you have multiple keywords for the one topic.

I remember analyzing the conversations around the London Marathon and there were about 20 words talking about Mo Farah, many of them talking about exactly the same thing.

https://twitter.com/benbland19/status/716423601562513408

What I had been looking for in that study was to understand the customer journey and it was being masked by Mo Farah conversations.

Put straight, a wordcloud can’t give you strategic insight.

I know people like wordclouds, so I decided to test how useful they were in a recent workshop with PwC’s Academy.

This workshop was dedicated to ‘Social Media Intelligence for Campaign Management’ and after going through different analytical approaches delegates were given social insights and asked to develop a marketing campaign with them.

After experiencing rich customer insights, the delegates didn’t find the wordclouds useful during the process because they lacked context.

The moral of the wordcloud story is to swap them for advanced segmentation.

You need to think about what questions you are trying to answer and segment the data appropriately. You have to dig deep and use different analytical approaches that are not readily available through automation. You can’t get strategic insight at the click of a button.

Swap demographics for psychographics

Marketers are used to segmenting consumers into demographic variables but segmenting audiences through demographics alone is a dangerous business.

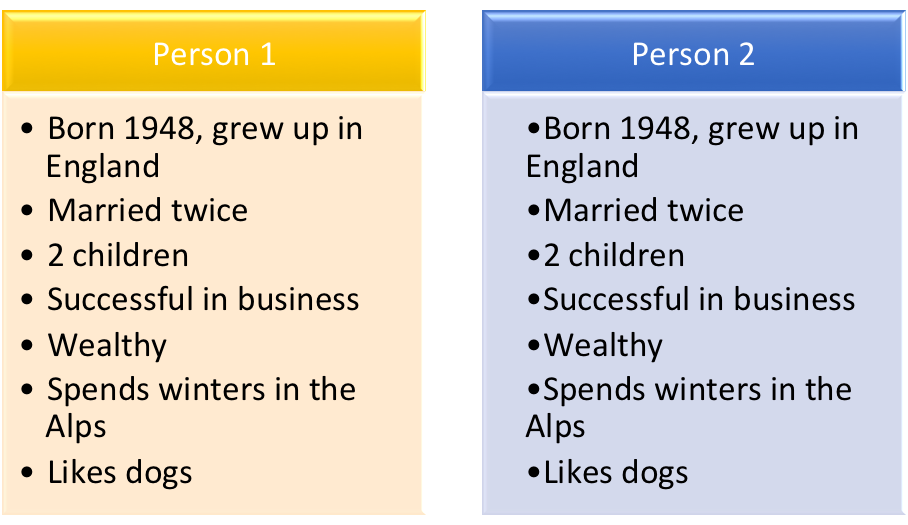

I found this example some years ago, it’s quite comical but succinctly communicates the need for psychographic variables in persona modelling (thanks to Dr Gentsch).

Demographically speaking, these two people appear similar. They are famous people; do you have any idea who they may be?

What if I told you they are Prince Charles and Ozzy Osbourne, would you believe me?

They are indeed Prince Charles and Ozzy Osbourne. The glaring omission from demographics is context. The solution is to compliment demographics with psychographics, in a recent HBR article, Alexandra Samuel, eloquently discusses the power of psychographics.

The best part is that social media conversations hold the key to unlocking psychographic insights about your audience.

I mentioned before that there are hidden ‘sub-segments’ in your social audiences, psychographics can be used to gain insights on these sub-segments.

By analyzing your brand differentiated engagement drivers you can find out what parts of your brand and your content speak to these sub-segments.

Final thoughts

It’s really easy to be taken in by the automation of social tools, their pretty visuals and easy to use dashboards but there is a price to pay for this level of automation – lack of proper insight.

Social media and social tools have the potential to help businesses get closer to their customers and find out what’s driving customer behavior but we need to dig for this insight.

Like with traditional research, there are analytical approaches you can take to analyse the data, and we have covered some of them here.

Get smart with your social data and build up your capability to know what analytical approach is best to use, don’t settle for the pre-set metrics that don’t tell you anything.

Dr Jillian Ney is the UK’s first Dr of Social Media and a Digital Behavioral Scientist. She helps companies to understand what’s driving customer behaviour by applying people science to digital data.

If you like this content you can subscribe to her personal blog for more insight and updates on people science for your digital data.