20 Social Media Holidays to Celebrate This May

By Yasmin PierreApr 10

Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

Published August 28th 2015

Welcome to the fourth in our monthly social presence showdown series, where age-old disputes between industry titans are settled through the analysis of social media data.

Today we take a look at two major organizations in the American healthcare industry: Blue Cross Blue Shield and Kaiser Permanente.

To say the least, the healthcare system in the US is incredibly complex. Kaiser Permanente defines itself as an integrated managed care consortium, while Blue Cross Blue Shield is actually a federation of health insurance organizations.

While Kaiser provides insurance, manages hospitals and employs healthcare providers, Blue Cross Blue Shield is the parent brand for 38 separate insurance organizations.

That introduces some complex considerations into this analysis.

Yet comparing these two brands could provide insight into the way the public perceives each structure.

Still, despite the distinct structures of these two healthcare organizations, it’s possible to compare these brands using social media conversations as the common denominator.

Now, for the data dump.

Let’s start with a basic overview of the two brands.

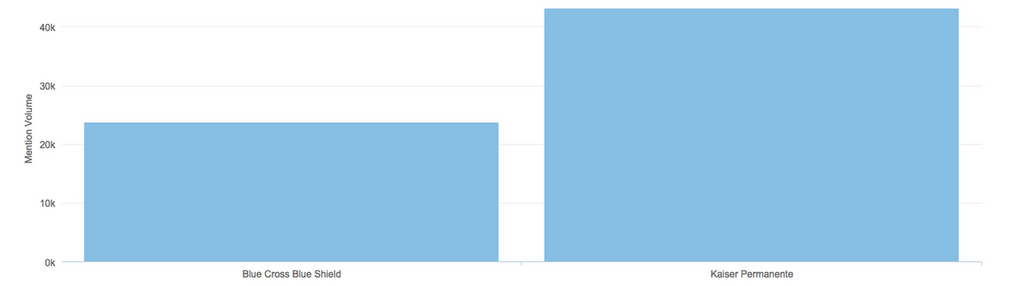

In terms of overall conversation, Kaiser Permanente received far more conversation on both Twitter and Facebook.

(Jan 1st, 2015 – August 24th, 2015)

Kaiser’s dominance in volume of conversation may be unsurprising given that @KPShare has four times as many followers as @BCBSAssociation and Kaiser’s Facebook page has 2.85 times as many likes as Blue Cross Blue Shields’ page.

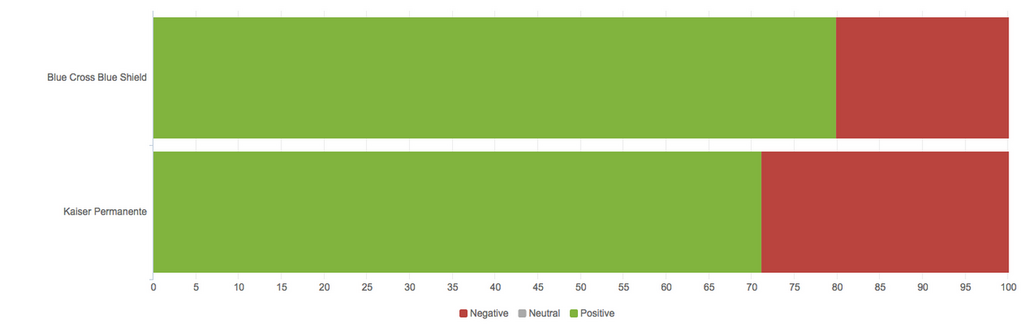

An automated sentiment analysis reveals that Blue Cross Blue Shield is perceived slightly more positively than Kaiser Permanente is.

(Jan 1st, 2015 – August 24th, 2015)

The volume and sentiment analyses provide a basic overview of the way brands are discussed, alerting us of any dramatic differences. However, they do not provide enough context to genuinely understand the dialogue surrounding the two brands.

At the most basic level, Blue Cross Blue Shield and Kaiser Permanente function to provide citizens with healthcare services, an objectively positive mission. However, there is still an enormous number of Americans disgruntled with the way our healthcare system is run.

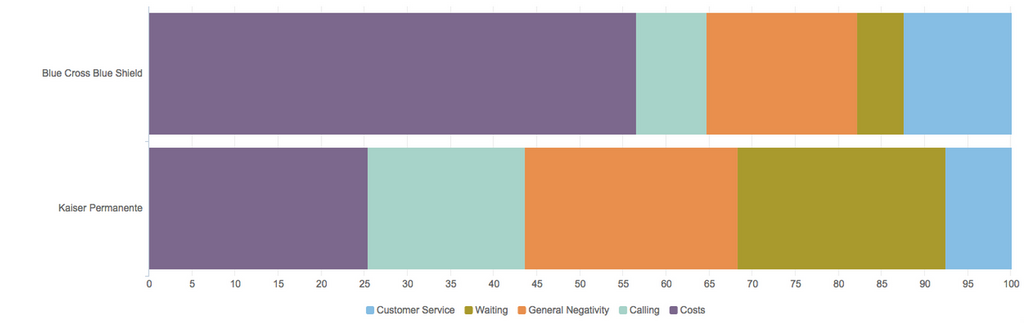

A quick analysis of the negative conversations directed at these brands reveals some of the central issues surrounding healthcare.

(Jan 1st, 2015 – August 24th, 2015)

Cost stands out as an overwhelming proportion (51.1%) of the overall complaints in this analysis. 69.6% of the complaints directed at Blue Cross Blue Shield were regarding Cost.

Specifically, an article covering BCBS’s request to raise rates for Affordable Care Act plans in North Carolina incited strong concerns.

Calling was a much larger issue for Kaiser (23.7%) than it was for BCBS (9.6%). Looking at the specific complaints revealed that consumers were dissatisfied with how difficult it was to make an appointment and how much time the phone process took.

Waiting comprised 31.9% of Kaiser’s complaints in this analysis. Patients cited computer malfunctions, pharmacy wait times and appointment wait times as specific issues.

Customer Service is a bigger issue for BCBS (14.3%) than it was for Kaiser (9.9%). One specific concern was customer service agents that put callers on hold or rerouted them through their system.

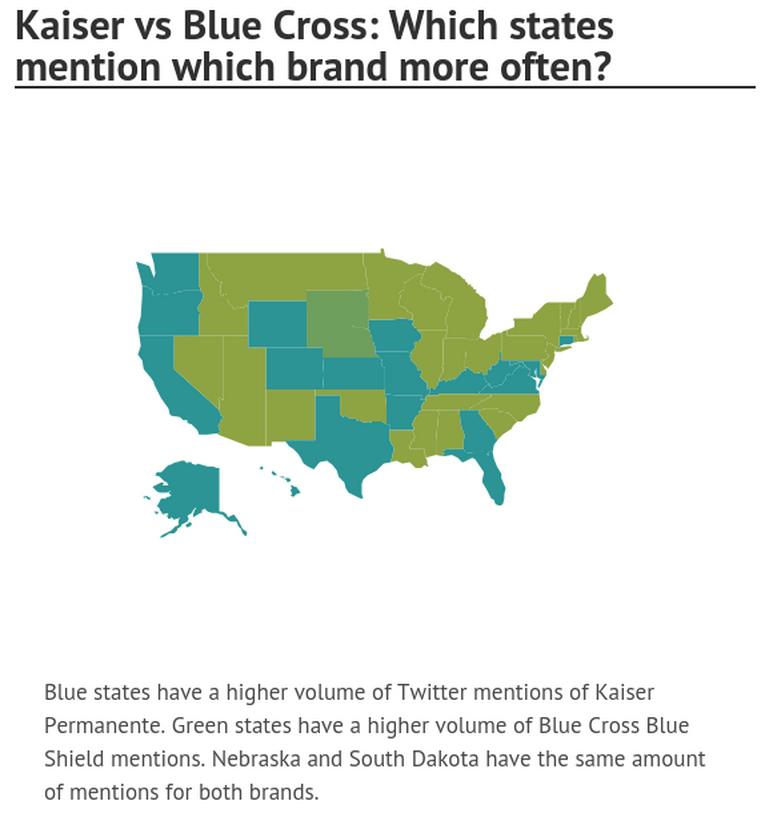

As aforementioned, Blue Cross Blue Shield is a federation of 38 separate health insurance providers across the United States. As such, their reputation may vary across states.

The below analysis reveals which states mention which brand more often on Twitter.

(Jan 1st, 2015 – August 24th, 2015)

In total, Kaiser is mentioned 1.8 times as often as BCBS is in the United States despite maintaining fewer locations. Kaiser’s presence is stronger in the Mid-Atlantic, Colorado, Florida, Texas and along the West coast. Predominantly a California-based organization, they receive over 18 times as many mentions in the “golden state.”

Blue Cross Blue Shield seems to receive more mentions only in the places where Kaiser’s physical presence is lowest. However, they do have a stronger online presence in New England, maintaining 1.4 times as many mentions in Massachusetts despite Kaiser’s offices there.

This analysis sheds some insight into the ways patients perceive Kaiser Permanente and Blue Cross Blue Shield. There are significant concerns surrounding both regarding the cost and the way healthcare services are provided.

While the healthcare system in America is highly complex, for the sake of the showdown, a winner must be decided. Reviewing the social analysis, a few things stood out:

First, Kaiser, despite being a smaller organization, has generated considerably more chatter, specifically surrounding their @KPThrive campaign.

Second, Blue Cross Blue Shield’s online reputation is disjointed. While they generated strong chatter around their value-based care model in Illinois, their proposal to raise rates for the Affordable Care Act plans in North Carolina was largely unpopular.

For those reasons, Kaiser Permanente is the winner of this month’s social presence showdown. Perhaps Obama was right to advocate for Kaiser’s integrated model.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.