Girl Math: What’s Behind the Viral Trend and What Do Marketers Need to Know?

By Michaela VoglApr 18

Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

Published August 18th 2017

Measuring sponsorship ROI has never been an easy task. Brands have long paid heavy sums for high profile sponsorship spots with big dreams but few viable ways to measure their successes.

This week I hosted a webinar with our PR Manager Kellan Terry in which we discussed the new methods marketers can use to measure sponsorship ROI, specifically when it comes to quantifying their impact on social.

In this blog post I’ll run through some of the key points we shared in Tuesday’s webinar, although I’d encourage you to give it a full listen by clicking here to make sure you’re not missing out on any of the tips and insights.

Social media has changed everything when it comes to how consumers interact with their favorite brands.

In what’s come to be known as the experience economy, it’s the tangible, engaging and unique environments that brands provide their audience that ultimately leads to loyalty and success in these times of digital bragging rights and plandids.

People can get anything for a price so it’s about finding a way to create experiences and a connection that really motivates them to want to be part of the brand and to spend money on it. It’s much more challenging than it used to be.

So important are the experiences we create for consumers that they are shaping both the online and physical spaces in which customers are met. From decor to the way menus are planned and food presented, restaurants are being overtaken by the Instagram revolution, with owners starting conversations with designers with briefs like “We want to be Instagrammable”.

The problem with visual experiences is that brands may never see the fruits of their efforts online without the appropriate tools.

Brandwatch Image Insights was designed with the growing importance of visual experiences in mind. It analyzes tweeted images and detects your logo where it’s seen and how it’s used – even if it’s obscured or upside down.

How much is it adding to what marketers can already see and measure?

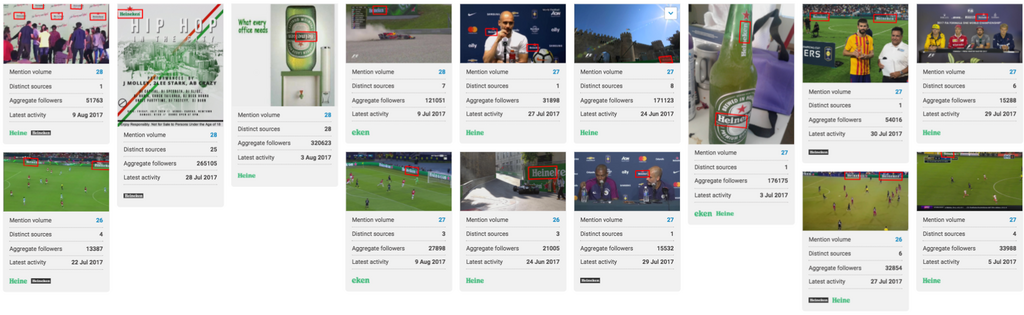

We looked for tweets containing visual mentions of Heineken’s logo, bringing in around 30,000 between 5 June and 9 August 2017.

When we searched within those for mentions that actually mentioned the brand in the accompanying text, only 2,600 did.

Overall, 92% of Heineken’s visual mentions wouldn’t be measured without a logo recognition tool – so that’s plenty of conversation going unseen.

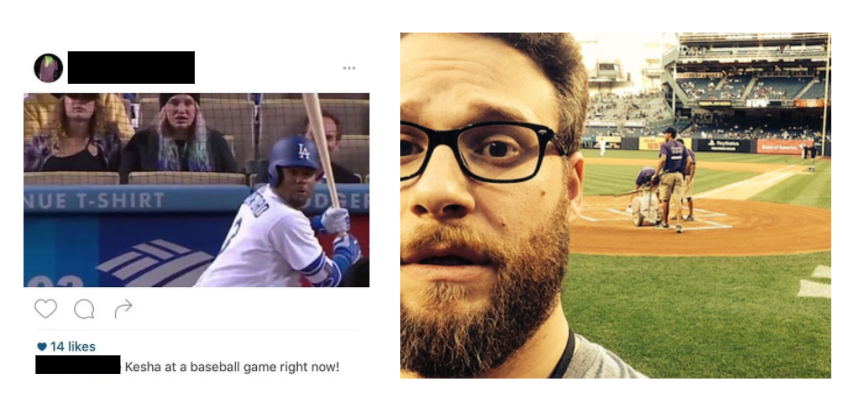

Consider a baseball field and the ads visible in both the shots below.

When the television camera focuses so much on home plate, the ads behind it could be considered the most valuable. But what about when the celebrities sitting there turn around and take a selfie? Suddenly the ads on the outfield could be making more impressions than those shown more on TV.

The different ways we now experience televised events on big and small sceens, especially since 87% of consumers use a second screen device while watching TV, is challenging perceptions on metrics for success when it comes to sponsorships.

Social engagement measurements can provide a lot of extra information where traditional methods are failing or declining.

Take MTV’s VMAs – they’ve seen declining television views of late, but the conversation is enormous on social media – it’s one of the most tweeted-about events of the year. Take those social metrics away and you’re not seeing the potential of the event.

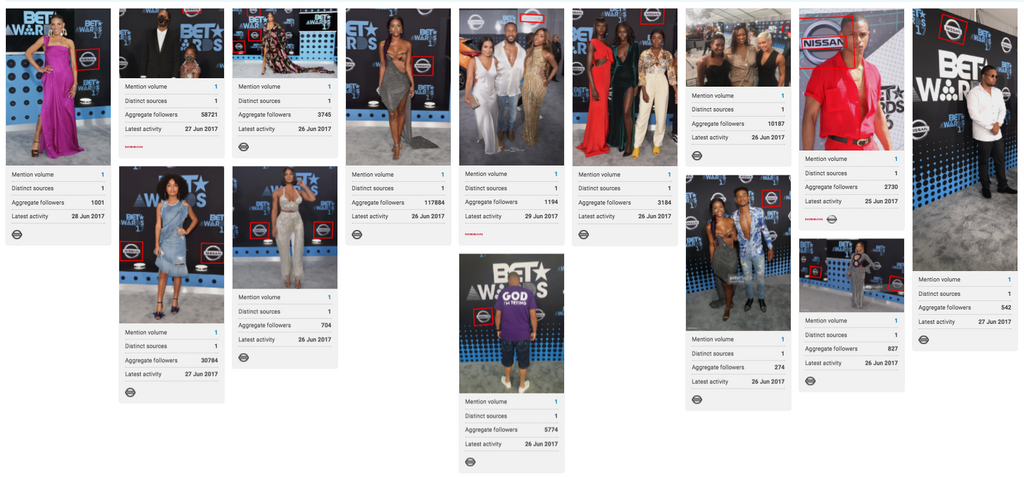

This year, Nissan was the official automotive sponsor of the BET Awards – another enormous awards ceremony on social (in fact, we measured 2 million text-based tweets about the BET Awards on the day itself.)

Within the BET Awards conversation we found a couple of thousand tweets about Nissan in the days surrounding the event and the day itself. Not bad.

But things looked very different when we looked at images containing Nissan’s logo.

We found around 8,000 mentions of Nissan’s logo that were accompanied by BET Awards hashtags or words.

Within those, only a handful of the mentions actually included Nissan’s brand name in the accompanying text. So nearly 80% of all Nissan BET Awards mentions would go unnoticed or at least unmeasured without a logo recognition tool.

@ Mentions and retweets are fine for measuring the success of a sponsorship but when 80% of the mentions are missing, you have to question whether you’re seeing the bigger picture.

Logo recognition tools can give you a more complete view of how your brand is doing visually, and give you extra confidence in comparing the overall value of your sponsorships and endorsements.

Exploring conversations that were previously in the dark, Brandwatch Image Insights is taking these unexplored measures of success and bringing them to light – perhaps challenging perceptions of what had previously been considered successful, and offering a bigger picture for sponsorship stakeholders to look at when evaluating success and looking for their next opportunity.

Want more examples and to find out more about measuring sponsorship ROI?

We’ve got extra insights for Vans, Nike, Adidas and Puma as well as extra commentary on the new KPIs you should be considering when undertaking a new sponsorship, as well as how to work out which of your sponsorships is working harder for you. Check out our webinar by clicking below.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.