Historically, brands have often performed market research with the aim that their strategic decisions could be based off more than just instinct. They’ve commissioned focus groups, consumer surveys or psychology experiments to answer a specific question that will help inform their choices.

Each research technique bears its own benefits and misgivings. Some are expensive, timely or rigid. Others are qualitative, making the information organic but difficult to base concrete decisions off.

Increasingly, brands are realizing that social media monitoring is an effective tool for market research.

The benefits of social media research:

- Data comes from naturally occurring public statements and is organic

- Analysis can be undertaken faster and requires little labor

- Sample sizes can be quite large

- Less expensive than many traditional forms of research

The cons of social media research:

- Data is unstructured and imperfect

- Certain types of information are difficult to identify

As leaders in social analytics, our goal is to leverage the benefits of social data and to find creative and effective ways to tackle some of its challenges.

To understand just how that is done, let’s take a look at two interesting market research insights.

1. Language associations research

What adjectives do people use to describe your products? What other products, ideas or songs do they associate it with?

Examining Coke and Pepsi, a classic product showdown, we can see how the associated language for the two beverages differs.

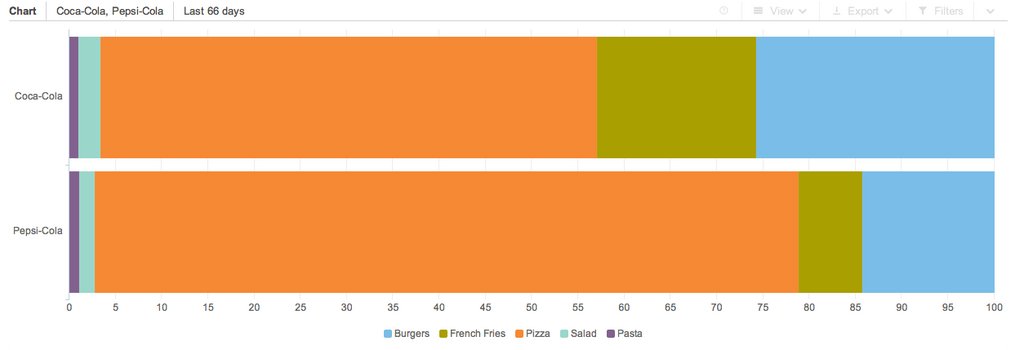

The analysis below looks at mentions of Coke or Pepsi in relation to burgers, french fries, pizza, salad and pasta.

For Coke, burgers and french fries make up a larger fraction of the conversation related to foods. For Pepsi, pizza makes up over 75% of the food conversation in this analysis.

For Coke, burgers and french fries make up a larger fraction of the conversation related to foods. For Pepsi, pizza makes up over 75% of the food conversation in this analysis.

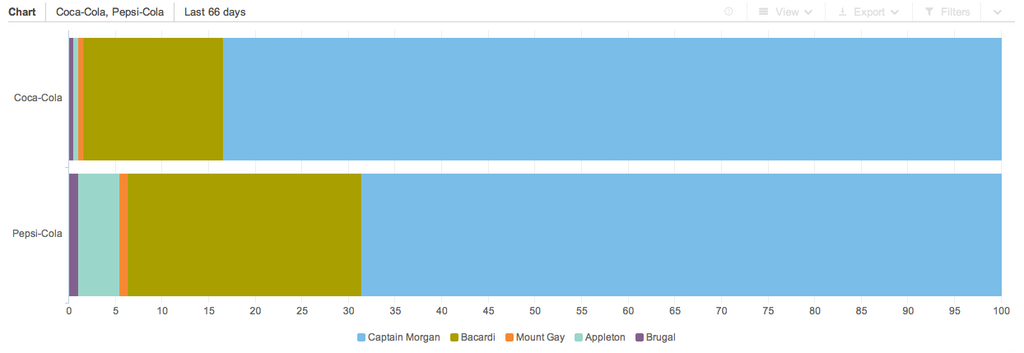

Again, if we examine different types of rum associated with Coke and Pepsi, we see that Appleton consists of a larger percentage of Pepsi conversation.

Such analyses help brands understand what products are most closely linked to their own – that may inform everything from sales strategy to marketing or advertising creatives.

Such analyses help brands understand what products are most closely linked to their own – that may inform everything from sales strategy to marketing or advertising creatives.

2. Concert behaviors in the UK market

Let’s say we want to get a better understanding of conversations around shows and ticket purchasing behaviors in the UK.

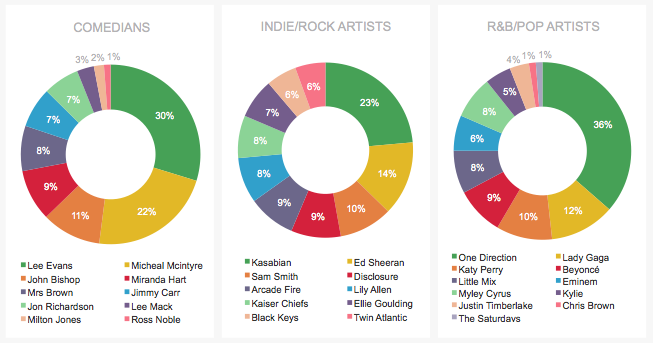

The analysis below examines the most discussed acts for three genres: Comedy, Indie / Rock and R&B / Pop.

Analyzing these conversations further, we can identify key phrases or words indicating that actually parents were purchasing the tickets for their children. For the data we looked at, that amount to around 18% of total purchase mentions.

Analyzing these conversations further, we can identify key phrases or words indicating that actually parents were purchasing the tickets for their children. For the data we looked at, that amount to around 18% of total purchase mentions.

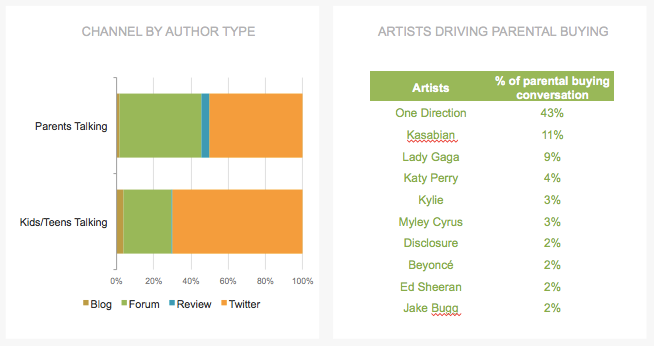

The figure below helps shed further light on what websites and for which shows parents are most likely to be buying tickets for their children according to social media.

The consensus is that the highest percentage of parents talking about buying tickets for their children is centered around One Direction. Also, parents are generally more active on forums and review sites whereas their children are most active on Twitter.

The consensus is that the highest percentage of parents talking about buying tickets for their children is centered around One Direction. Also, parents are generally more active on forums and review sites whereas their children are most active on Twitter.

With this information, we can more precisely uncover how, where and for which events to connect with parents or children – that is an actionable insight.

These two examples are by no means an exhaustive list of the kinds of social media research you can do but hopefully give you some idea of its capabilities.

Now you know.