Do you know what your competitors are doing?

Five-Minute Guide to Competitive Intelligence

We take you through how to get started with competitive intelligence.

In all industries, brands are constantly trying to one-up their competitors.

Companies seeking a better understanding of the competitive landscape, industry trends, product feedback, and how they stack up against their rivals can tune in to online conversations to find those insights.

So how do you get started with competitive intelligence?

Right here.

In this guide, we analyze online conversations to show brands how to evaluate their competition by:

- Seeing who is dominating the conversation

- Measuring share of voice across different audience groups

- Understanding how audience affinities affect product choices

- Monitoring new entrants into the market

The lion’s share

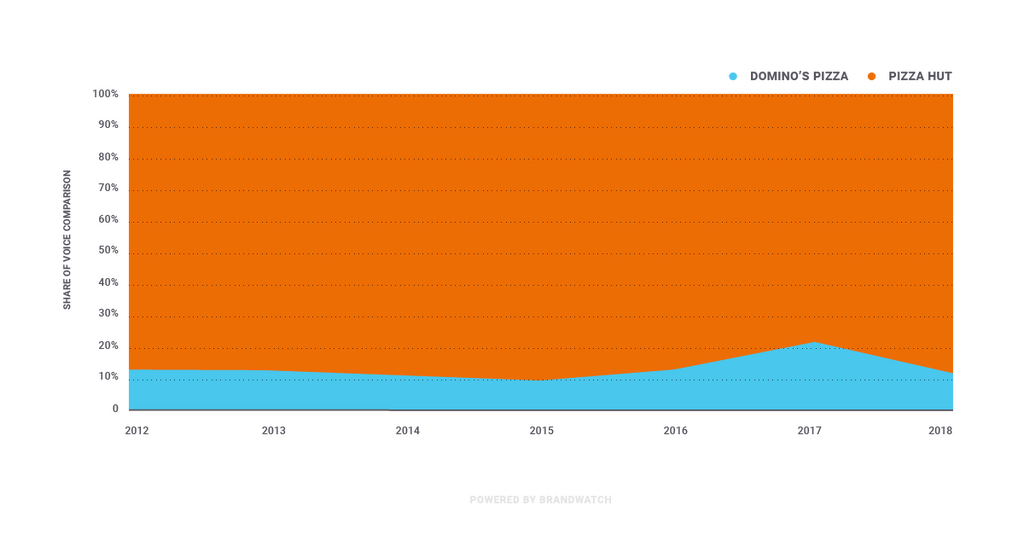

Monitoring share of voice over time is a useful metric for brands looking to determine how much of the online conversation they occupy relative to their competitors.

It can be a good measure for comparing brand recognition, too.

When it comes to fast food pizza chains, there are only so many that are household names.

Among the biggest brands are Domino’s Pizza and Pizza Hut, who are both known for cheap and easy eats.

As you can see, Pizza Hut dominates the online conversation, meaning Domino’s has some way to go to catch up. But looking at this over time, rather than as an overall comparison, we can spot a key moment.

Domino’s saw a spike in conversation in 2017 after they dethroned Pizza Hut as the top global seller. These kinds of achievements mean brands can start to claw back share of voice from competitors.

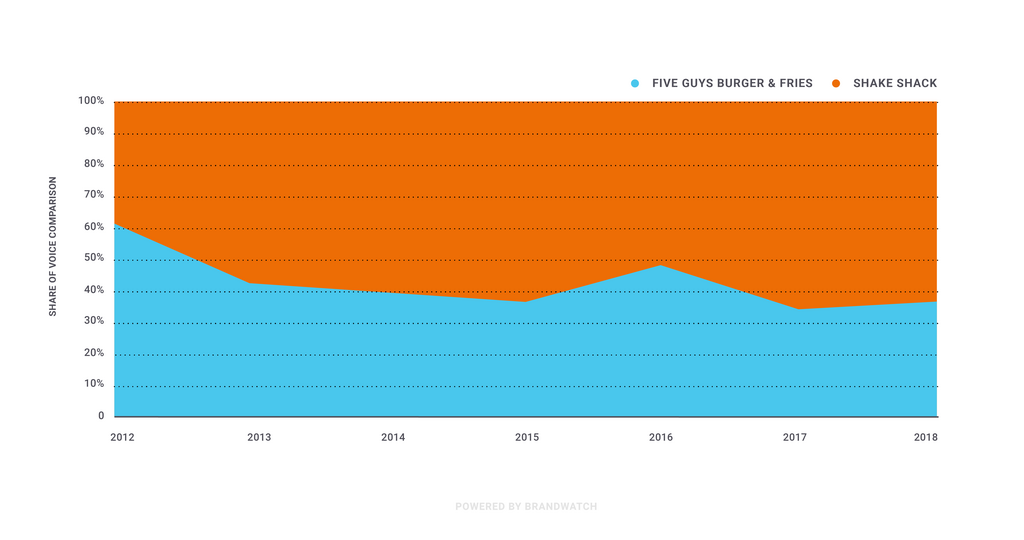

We also looked at another example from the fast food world: burgers.

Universally loved fast food chains like Five Guys and Shake Shack are offering higher quality burgers at a relatively low price point. So how are their respective share of voices looking?

In 2012, Five Guys had a larger share of voice than Shake Shack, with over 60 percent of the share of voice. This was likely due to Five Guys’ longer history, while Shake Shack love was more localised (primarily in New York).

But since then, Five Guys has seen their dominance challenged.

By 2013, Shake Shack had broken the 50% share of voice mark and has held onto it ever since (even with a temporary surge after the restaurant was mentioned in a 2016 Spider-Man comic).

One reason for Shake Shack’s takeover could be their willingness to experiment and make improvements to their product line. From vegetarian-friendly offerings like their Shroom Burger to creative custards, they’ve become a cult favorite.

Clearly, their customer-focused activities have been filtering through into social conversations.

More than a feeling

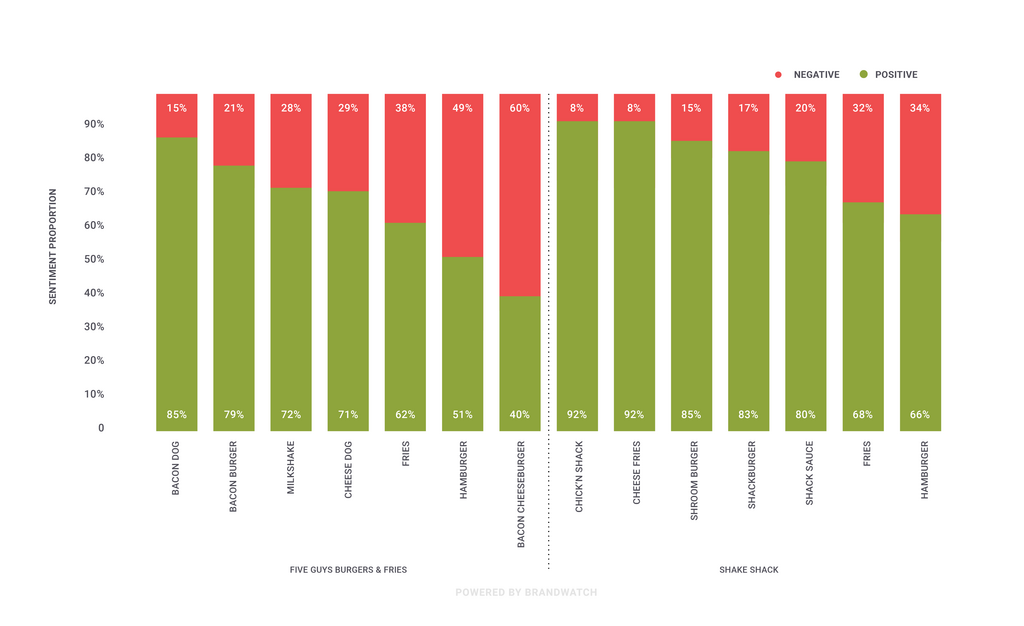

Of course, share of voice or volume of mentions only shows us one side of the conversation.

Being talked about more than your competitors is only good if people are being positive. That’s where sentiment analysis comes in.

We decided to take a closer look at the products Five Guys and Shake Shack have on offer, comparing sentiment around some of their menu items.

Being two fast food burger companies, there are similarities between the menu items, but each brand is unique in its own way.

For Five Guys, menu items with bacon generally perform well, like the Bacon Dog and Bacon Burger (the Bacon Cheeseburger being an exception).

For Shake Shack, the Chik’n Shack is more beloved than the burgers. Cheese Fries and the Shroom Burger are also popular.

This gives brands some nice insight into their products without the effort of running expensive focus groups. From here they can start the process of improving the least-liked items, and promoting the customer favorites. By digging into these conversations, they can find out exactly what consumers love (and hate) about each product.

Who’s driving the conversation?

Competitive intelligence is also about understanding who is driving the conversation around a brand and its products.

Demographics

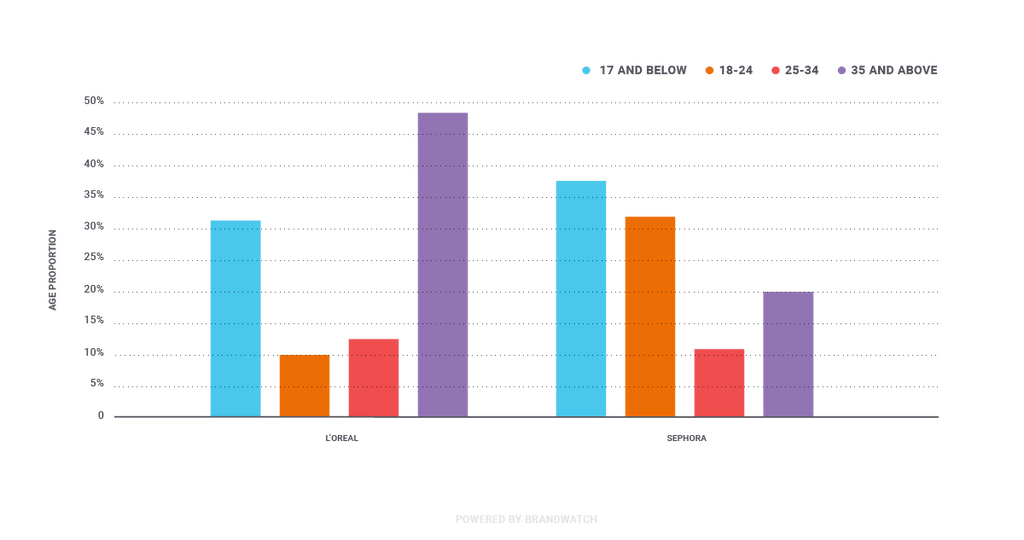

Moving into the beauty industry, we took a look at two big names: L’Oreal and Sephora. We wanted to find out if there was a difference in the groups that discussed each.

Looking at age demographics, there are stark differences.

L’Oreal appeals to an older crowd, with 47 percent of the conversation coming from those 35 and above. However, those 17 and below also make up a sizable chunk of the discussion, occupying 31 percent of share of voice.

Sephora is popular among millennials and Gen Z. Those 17 and below make up the largest share of the conversation with 37 percent share of voice, followed by those 18-24 with 32 percent share of voice.

These kinds of takeaways can play a big role in steering a company’s marketing and promotional activities, particularly in who they target and how they talk to them.

Affinities

Audience also hinges upon affinities, which shows consumers’ interests and preferences. Getting back to burgers, we compared the audiences for Five Guys and Shake Shack.

The former has attracted a crowd enthusiastic about country music, church, and gaming. They’re also sports fans, given their affinities for Sportscenter, NCAA, and wrestling.

The latter seems to have a more cosmopolitan taste, with interests in Dubai and New York City. Shake Shack also attracts a business-driven crowd, indicated by interests in economics, entrepreneurship, and finance. They’re also foodies, with affinities like chefs, wine, and dining.

Five Guys Burgers & Fries Affinities

| Interest | Affinity Score |

|---|---|

| Country Music | 4.23 |

| Xbox | 3.09 |

| Gaming | 3.04 |

| Homework | 3.00 |

| Sportscenter | 2.36 |

| NCAA | 2.23 |

| Games | 2.02 |

| Canada | 1.99 |

| Wrestling | 1.98 |

| College | 1.96 |

| Astrology | 1.88 |

| Shoes | 1.88 |

| Church | 1.86 |

| Math | 1.86 |

| Soul Music | 1.84 |

| Christianity | 1.82 |

| Hip Hop | 1.79 |

| NHL | 1.74 |

| Video Games | 1.72 |

| Hockey | 1.71 |

Shake Shack Affinities

| Interest | Affinity Score |

|---|---|

| Dubai | 26.55 |

| New York City | 17.34 |

| Chefs | 10.36 |

| Brooklyn | 7.36 |

| Economics | 5.14 |

| Entrepreneurship | 3.44 |

| Food and Drink | 3.42 |

| Wine | 3.38 |

| Recipes | 3.36 |

| Cooking | 3.34 |

| Dining | 2.88 |

| Blogging | 2.80 |

| Advertising | 2.03 |

| Finance | 1.92 |

| Management | 1.90 |

| Healthcare | 1.88 |

| News and Media | 1.69 |

| Writing | 1.67 |

| Fashion | 1.59 |

| Design | 1.59 |

Just like with the age demographics, we can see a stark difference in the two groups. Clearly differing marketing opportunities are available for each company.

Tracking new entrants in the market

Monitoring online conversations about an industry or market can help brands gain insight about the players they are up against.

Smart homes have undoubtedly exploded in popularity in recent years and it’s not just major Fortune 50 companies that are manufacturing smart home devices.

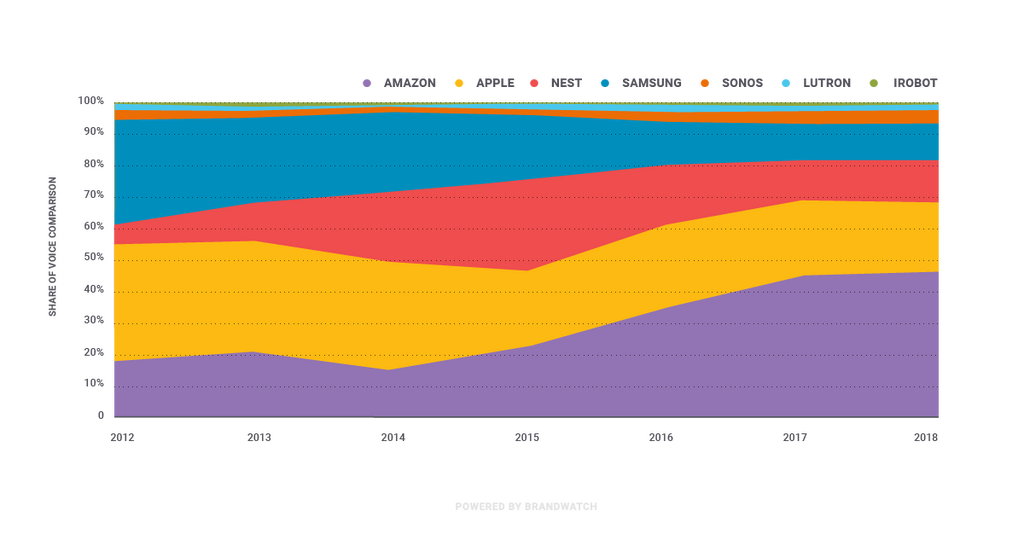

Looking at the brands in the smart home specific conversation, Amazon has usurped Apple and other brands, with the rising popularity of versatile home assistant Amazon Echo.

Nest had a moment in 2015, when smart thermostats were becoming popular. Meanwhile Samsung has lost a lot of its share of voice since 2012. Smaller brands like Sonos and Lutron have steadily made their social conversation presence known in the smart home discussion.

Keeping a regular eye on this kind of data can limit the chance of competitor surprises. If a newcomer is making gains, it’s time to dedicate more resources to working out what their angle is and what’s making them successful.

Conclusion

The data shows that online conversations offer a range of insights for competitive intelligence. By delving into the data, brands can better understand their position in their industry and market, how consumers feel about them and their products, who their audiences are, and the ever-changing players in the field they are competing in.

This is by no means an extensive look, either. There’s way more to be done with competitive intelligence and our AI-powered listening and analysis tools can help.

Get in touch to book a demo and speak to our team to see how you can start tracking your competition and use the data to get ahead.