20 Social Media Holidays to Celebrate This May

By Yasmin PierreApr 10

Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

Published February 22nd 2018

How many times do you change your mind a day?

If you’re standing in the grocery store staring at 35 different types of shampoo and conditioner, how many do you actually consider before making the final decision?

Have you ever wondered why you only consider 3-5 brands? What makes those brands so special?

No? Well, we have.

Today we published a guide that looks at the evolution of the customer journey and how brands can do a better job at understanding where their customers are in this process.

As consumers, we’ve become more informed and ultimately less trustworthy of brands. From advertising to family and friends, the number of influences which affect our decisions is growing day on day.

So what can brands do in order to put up a fight against these growing influences and depleting attention spans?

Well, it starts with taking a long, hard look in the mirror.

No matter what market you’re in, I’m almost certain in saying there’s fierce competition. Standing out is getting harder and harder, but brands are looking to new ways of reinventing themselves that align more closely with the modern customer journey. Chieu Cao, CMO at Perkbox, explains;

“Today you also need to factor in the B2B2C approach, where you’re not directly targeting the customer but rather the end user. This can sometimes turn into a very powerful tool to differentiate yourself from the competition.

In fact, it’s what we do here at Perkbox. Employee engagement is a very well-established industry. We’ve come in and created a different way of looking at it. We create pull from employees where they request employers to launch Perkbox. By focusing on keeping employees engaged, we ensure employers win.

In that way, we’re B2B as we look to partner with business owners, HR departments and decision makers, but through our B2C brand because we want to connect directly with users. This has helped us create an exciting brand, one that employees look forward to using, and has been really important to our growth.”

Think about Trader Joe’s. For anyone that has not been to Trader Joe’s, let me assure you it is the nicest grocery shopping experience you will ever have. They dedicate themselves to making sure every shopper has a positive experience. This ranges from always being on hand to answer questions to handing out treats when the queues get a little long.

Even though it’s just another grocery store, the brand have created space in the market by being better than anyone else at one thing in particular.

If customers are the ones buying our products or services, then surely we should try to understand more about these people? Seems simple, but big brands still fail to get this stage of the process right.

Investing in persona-based marketing is not something you will regret. Don’t just focus on demographics, look the shared values and shared objectives of each group. What are the common threads that your can use to reach them more effectively?

There are a few ways to discern this information. Firstly, talk to them. Next do some research, look at your existing database, use social intelligence tools like Brandwatch Analytics to get a better (unbiased) view of your target and current customers.

Brands have little control over this stage, as it is directed predominantly but the customer. When a need or want is determined by the customer, they will almost automatically have an initial set of brands that they will consider.

This initial consideration set can be influenced by any number of factors; previous exposure, friends and family, price, accessibility. However, if your brand is confident in the previous two steps, then the chances of entering this set are far greater.

Woo! You’ve progressed onto the next stage. You, and some other lucky brands are the chosen few. Don’t panic, you’ve prepared for this.

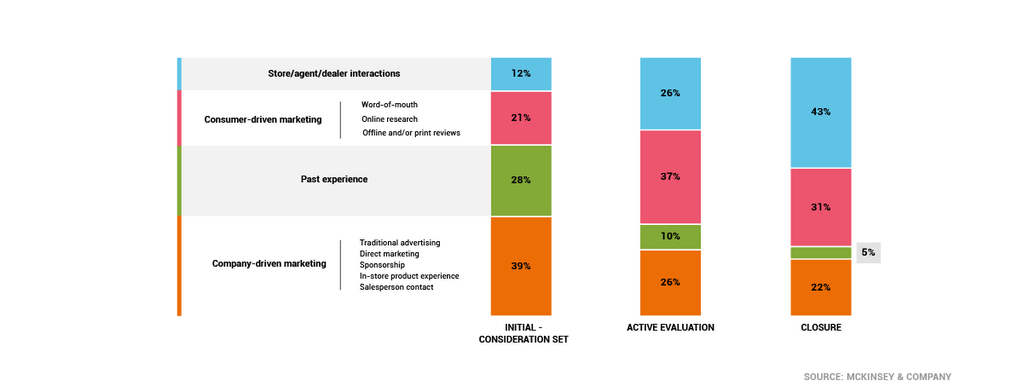

McKinsey reports that two-thirds of marketing touch points at this stage are customer-driven.

There are few ways to combat this:

Be conscious of your brand online

Having a real-time view of what your customers, and everyone else, is saying about your brand will allow you to spot opportunities or identify possible risks before they happen. Products like Brandwatch Vizia enable you to maintain an always-on approach to your customers and marketing.

Look after your website

You website could be the turning point for turing a prospective customer into a actual customers. That said, be sure you’re putting your best foot forward. Make sure everything is up to date and ensure it’s as easy as possible for people to find what they’re looking for.

Invest in influencer marketing

In order to succeed with influencer marketing, brands must ensure that they are getting return on their investment.

While this is tricky to measure, there’s no point in investing crazy budget on influencers that have no actual influence on the desired target groups.

Congratulations!

You have won another customer, but some may argue that this is when the hard work begins. Drive the customer experience in order to foster long-term relationships, and hopefully create brand advocates.

For this strategy to be successful, it must have buy-in across the organization. The sooner there is alignment on customer-centric strategies and decision-making, the sooner your brand will reap the rewards.

The more you get to know about your customers, the easier it will be to drive the customer experience by reaching them in the right place, at the right time.

Read our guide for in-depth details on how your brand can start to leverage customer journey marketing.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Consumer Research gives you access to deep consumer insights from 100 million online sources and over 1.4 trillion posts.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.